Polygon is beginning the week with some contemporary vitality as Giottus, a serious Indian crypto change, now affords QuickSwap’s QUICK token in INR and USDT buying and selling pairs. The itemizing is opening the door for much more customers within the Indian market, as we all know how huge the Indian crypto scene is. POL, the Polygon crypto token, is testing its $0.38 help degree because the market dips.

The hum round Polygon can be doubtless because of its latest authorities boosts. The US Division of Commerce posted GDP knowledge on the blockchain, which was a giant transfer.

(Indian crypto market, supply – Statista)

In the meantime, the Philippines has notarized public funds by way of BayaniChain, a platform on Polygon. One of many senators, Bam Aquino, has been pushing for nationwide finances monitoring utilizing Polygon, citing the necessity to stop falsification as his motive.

These knowledge present Polygon crypto energy, particularly in regulated finance.

(POLUSD, supply – TradingView)

Polygon Catalysts and The International Crypto Sentiment

Right this moment, Polygon noticed a ten% month-to-month acquire, a bump to $0.25. The soar is pushed by Courtyard NFTs, which stand on the #1 spot in 24-hour gross sales, with a quantity of 826 million POL crypto tokens. Bull is considering the potential 53% rally to $0.90 as soon as the $0.58 resistance degree is breached, though it’s removed from its Polygon Matic all-time excessive. Polygon crypto POL was MATIC earlier than being rebranded as POL.

Grayscale is one other catalyst as the corporate determined so as to add Polygon to its spot ETFs.

Grayscale up to date S-1 filings for spot $ADA and $POL ETFs, transferring nearer to providing regulated funding merchandise for Cardano and Polygon. This signifies rising institutional curiosity past $BTC and $ETH, aiming to offer broader entry and diversification for traders.

— Yeti Fi (@YetiFAi) August 30, 2025

Nonetheless, the crypto market is experiencing a giant decline this week, with the whole market cap falling from $4 trillion to $3.77 trillion after a giant $900 million in liquidations.

BTC ▼-1.93% dropped beneath $110,000 for the primary time since July, whereas

ETH ▼-0.80% remained regular round $4,300, a notable huge dip after it reached ATH near $5,000. Altcoins, significantly

SOL ▼-5.65% and Hyperliquid, managed to rebound, with above $200 SOL, and near $45 HYPE.

Cronos noticed a giant spike to multi-year highs, though it cooled down afterward. Trump’s DJT certainly was the catalyst.

DISCOVER: High Solana Meme Cash to Purchase in 2025

Pig Butchering: Crypto’s Darker Aspect

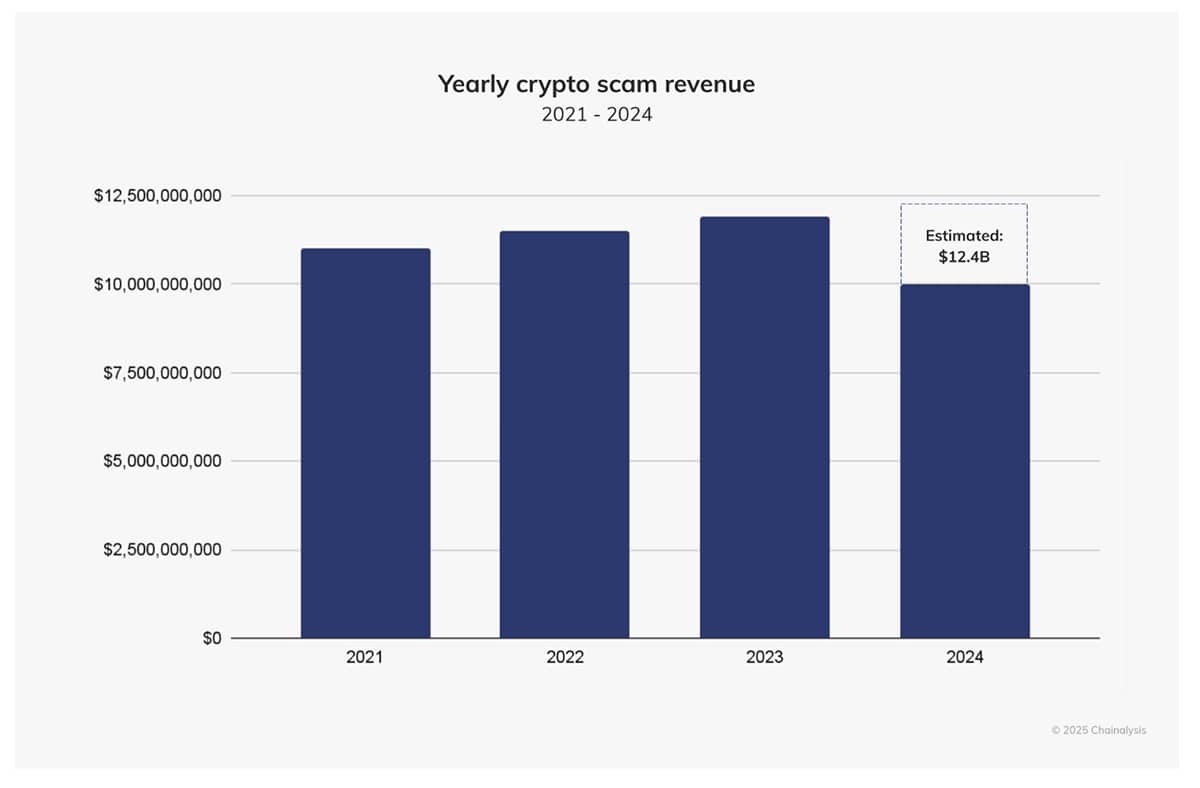

On the darker facet of issues, pig butchering scams wreaked havoc this week, with authorities within the APAC area freezing $47 million in USDT linked to fraudulent schemes. Victims is lossing hundreds of thousands by pretend romance scams and farudulent crypto funding. One of many sufferer is girl from Virginia, which ultimately misplaced her $1.3 million.

(Crypto rip-off income, supply – Chainalysis)

The US Division of Justice has additionally seized $225 million from a stablecoin funding fraud scheme, half of a bigger $5.8 billion in losses projected for 2024. Scammers are persevering with their playbook by refunding small quantities to construct belief earlier than disappearing. Together with these scams, ransomware and “wrench” assaults are additionally on the rise. It contributed to a bootleg market quantity that ranged between $45 billion and $51 billion final yr.

Crypto crime might have dipped to a smaller share of complete transactions. It was recorded at round 0.14% to 0.4% of the $10.6 trillion in crypto transactions quantity. Nonetheless, absolute numbers are nonetheless climbing because the market grows.

Will crypto get well? Observe us stay right here.

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Crypto Regulation Replace: U.S. CFTC, Europe’s MiCA, Japan’s Help, and What It Means for Memecoins

Crypto is seeing some regulation modifications which can be opening up new alternatives. In USA, the CFTC simply dropped a serious advisory, paving the best way for worldwide exchanges to legally serve Individuals. That is doubtless the tip of the period that was focusing solely on enforcement which is a extra balanced strategy in the direction of crypto.

Europe, with its MiCA framework, is including to bullish momentum with Japan’s latest help for crypto. These modifications come on the excellent time, as crypto funding surged to $1.8 billion in August alone.

(CTFC FBOT, supply – CTFC)

Whereas there are nonetheless challenges, like what’s coming from South Korea, which can be halting some lending actions. Crypto regulation, as reported within the information, is beginning to deliver extra stability to the house. Right this moment we see fewer limitations and smoother entry to cryptos.

Within the US, the CFTC’s FBOT program will doubtless permit platforms like Binance to return. This has the potential to deliver extra liquidity again, estimated at 15-20% over the following two years. On the opposite information, Nasdaq’s surveillance know-how has additionally now screens crypto derivatives as a part of the regulation.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Full story right here.

The submit Right this moment Crypto Information, August 30 – Polygon Crypto High Indian Change Itemizing: Pig Butchering Crypto Crime Wreck Thousands and thousands In a single day appeared first on 99Bitcoins.