If you’re searching for the most effective Bitcoin ETF, you’re not alone. Many traders need a easy technique to achieve Bitcoin publicity with out dealing with wallets or exchanges, and a dependable crypto ETF could make that course of a lot simpler. With a number of new funds competing for consideration this 12 months, understanding which one stands out may also help you make a better, safer funding selection.

On this information, we take you thru what a Bitcoin ETF is, why traders are paying consideration, the most effective spot Bitcoin ETFs for 2025, how to decide on the suitable one, the right way to purchase them, the advantages and dangers, Bitcoin technique ETFs, and the long run outlook for these funds. If you would like a transparent, pleasant breakdown that helps you make a assured selection, maintain studying.

Greatest Bitcoin ETFs for 2025: A Detailed Comparability of High Picks

TickerETF NameIssuerExpense RatioAssets Beneath Administration (AUM)IBITiShares Bitcoin BeliefBlackRock0.25%~$87.3BFBTCConstancy Smart Origin Bitcoin FundConstancy0.25%~$24.2BBTCGrayscale Bitcoin Mini BeliefGrayscale0.15%~$5.4BEZBCFranklin Bitcoin ETFFranklin Templeton0.29%~$627.4MBITBBitwise Bitcoin ETFBitwise0.20%~$4.8BARKBARK 21Shares Bitcoin ETFARK Make investments / 21Shares0.21%~$5.8BHODLVanEck Bitcoin BeliefVanEck~0.20%~$1.9BBTCWWisdomTree Bitcoin FundWisdomTree0.25%~$186.3M

Greatest Spot Bitcoin ETFs to Purchase for 2025: Our Skilled Picks

Spot Bitcoin ETFs provide you with direct entry to Bitcoin and the way it works by common brokerage accounts. You get the worth motion of Bitcoin with no need a pockets or non-public keys. These funds proceed to develop quick as traders look for easy and controlled methods so as to add the most effective bitcoin ETF to purchase to their portfolios. Earlier than you select one, it helps to check measurement, liquidity, charges, and the way every fund operates. Under are our skilled picks for 2025, backed by clear figures and simple to know particulars.

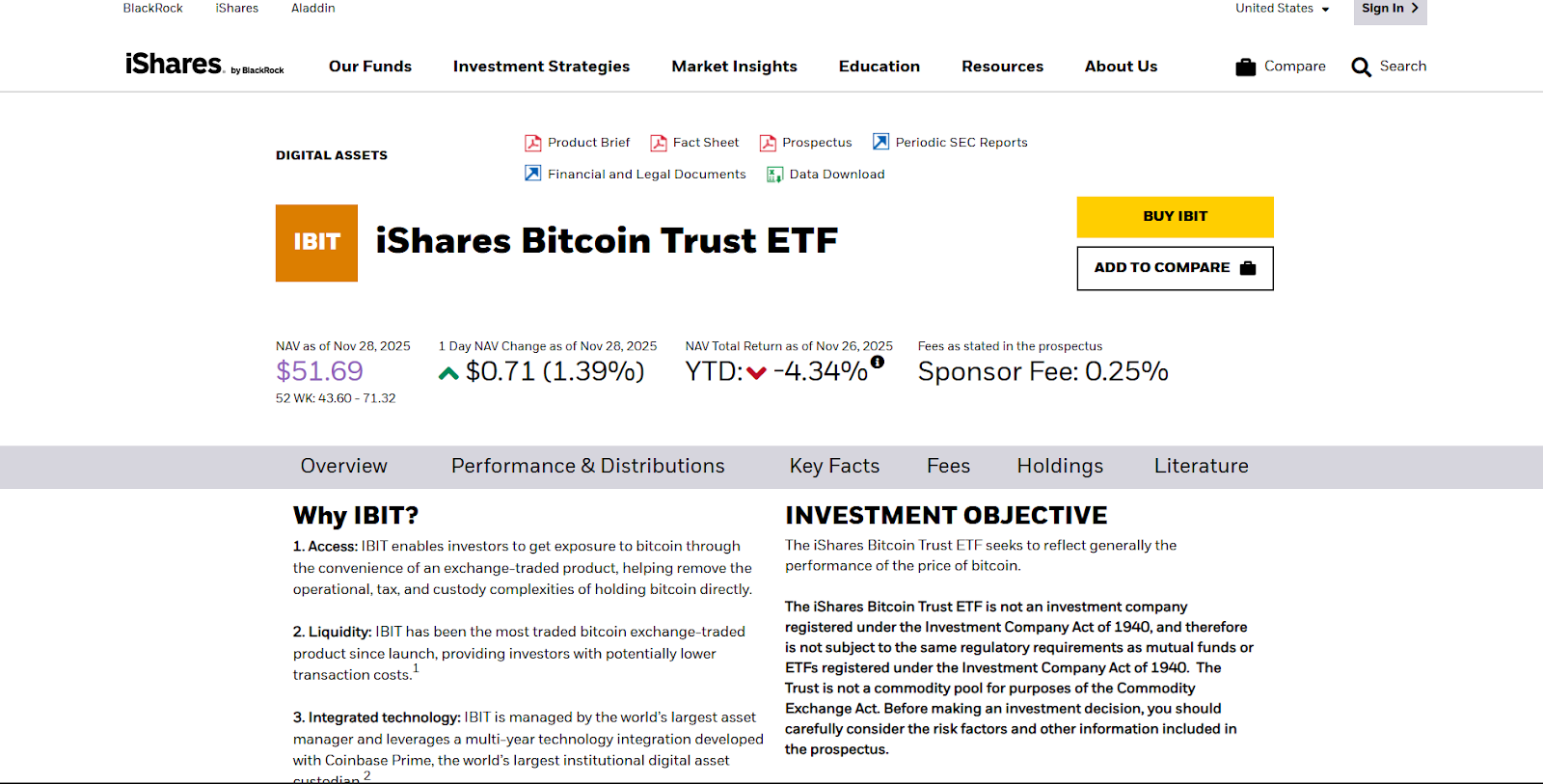

1. iShares Bitcoin Belief (IBIT)

IBIT is the most important spot Bitcoin ETF available in the market and some of the trusted choices obtainable at the moment. It manages round US$80 billion in belongings beneath administration, which supplies you robust liquidity and easy buying and selling. The fund fees a easy 0.25 % expense ratio and tracks the spot value of Bitcoin. Many traders select IBIT as a result of its measurement helps cut back value slippage and creates a extra steady buying and selling expertise. If you would like a high-volume crypto ETF from a well-known issuer, IBIT sits on the high of the checklist.

2. Constancy Smart Origin Bitcoin Fund (FBTC)

FBTC is backed by a big asset supervisor with lengthy expertise in custody and analysis. This issues if you need safe storage of your Bitcoin publicity. The fund holds about US $23.27 billion in belongings and fees a 0.25 % price. Custody is dealt with by Constancy Digital Belongings, which can entice these searching for robust safety and stable operational controls. If you happen to favor a good conventional issuer in your spot Bitcoin ETF, FBTC offers you confidence and clear monitoring efficiency.

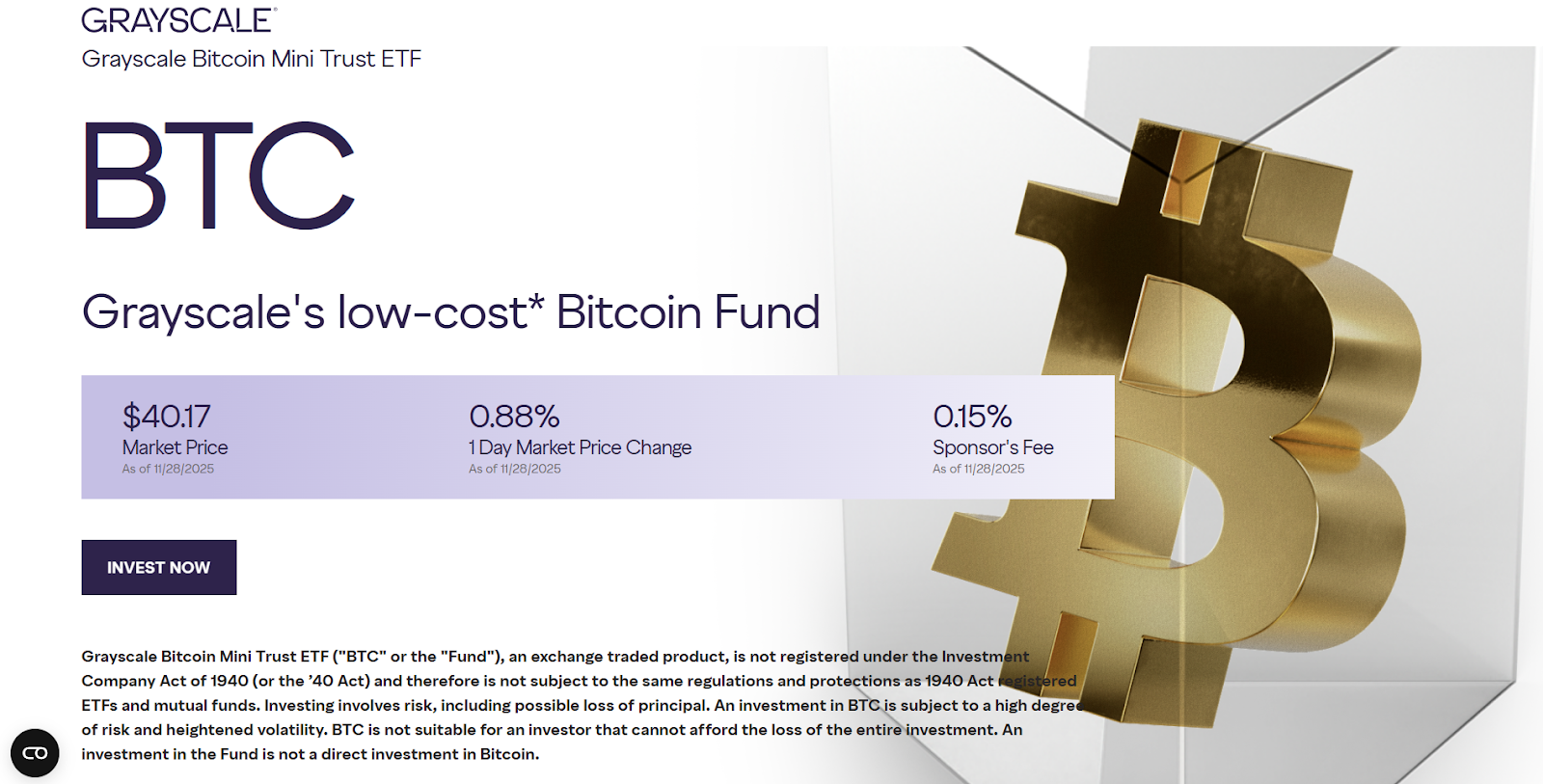

3. Grayscale Bitcoin Mini Belief (BTC)

BTC is one in every of Grayscale’s newer choices and was created to offer a decrease price possibility, 0.15%, in comparison with older belief buildings. It holds about US$4 billion in belongings and offers you direct Bitcoin publicity with out the premium points seen in earlier funds. Grayscale has been lively in Bitcoin merchandise for years, so BTC advantages from that have. If you would like publicity by a model that has been a part of Bitcoin investing for the reason that early days of institutional curiosity, this Bitcoin fund is a sensible selection.

4. Franklin Bitcoin ETF (EZBC)

EZBC stands out for its low prices and easy operation. The fund fees one of many lowest expense ratios, 0.19% yearly, amongst spot Bitcoin ETFs. The fund has reported internet belongings of about US $661.1 million within the latest months. This appeals to traders who’re delicate to charges and need long run worth. EZBC focuses on easy monitoring and ease of use. If you would like a finances pleasant possibility that also offers you clear publicity to Bitcoin, EZBC is value critical consideration.

5. Bitwise Bitcoin ETF (BITB)

BITB is thought for transparency. The fund publishes its Bitcoin holdings repeatedly so you may see precisely what it owns. It fees about 0.20 %, which makes it one of many decrease price decisions within the group. BITB holds about US$3.97 billion in belongings and goals to trace Bitcoin precisely. It holds precise Bitcoin in chilly storage and delivers direct spot-crypto publicity by way of a standard ETF construction. If you would like the most effective performing bitcoin ETF that values openness and clear reporting, BITB is a powerful match.

6. ARK 21Shares Bitcoin ETF (ARKB)

ARKB brings collectively ARK Make investments’s development targeted technique and 21Shares’ expertise with crypto merchandise. This partnership creates a contemporary and aggressive spot ETF that has gathered round US$4 billion in belongings beneath administration (AUM). Charges sit round 0.21 %, and the fund holds actual Bitcoin in regulated custody. ARKB is fashionable amongst traders who observe ARK’s broader innovation themes and need Bitcoin included in that long run imaginative and prescient. If you would like a ahead pondering crypto ETF, ARKB is a pure decide.

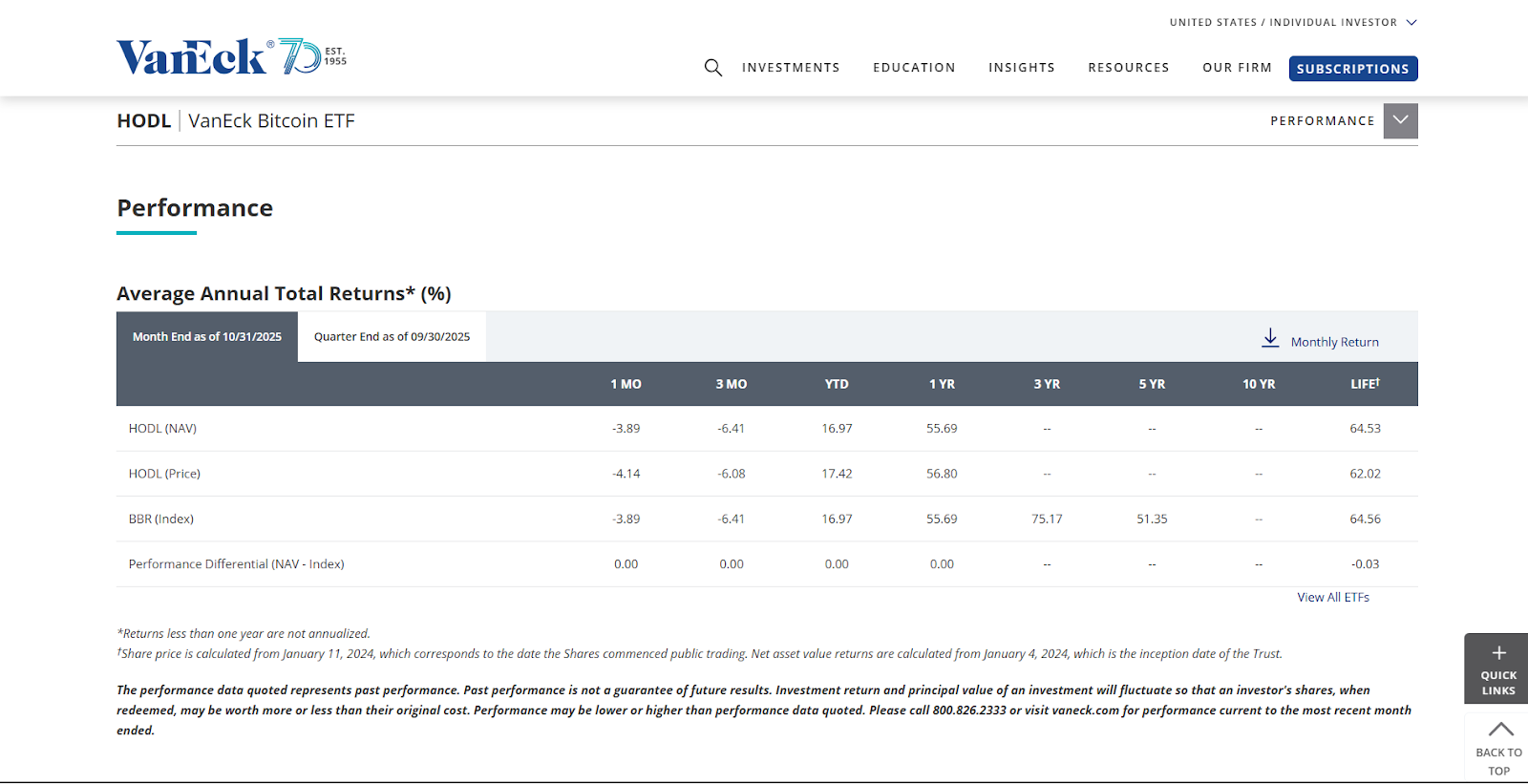

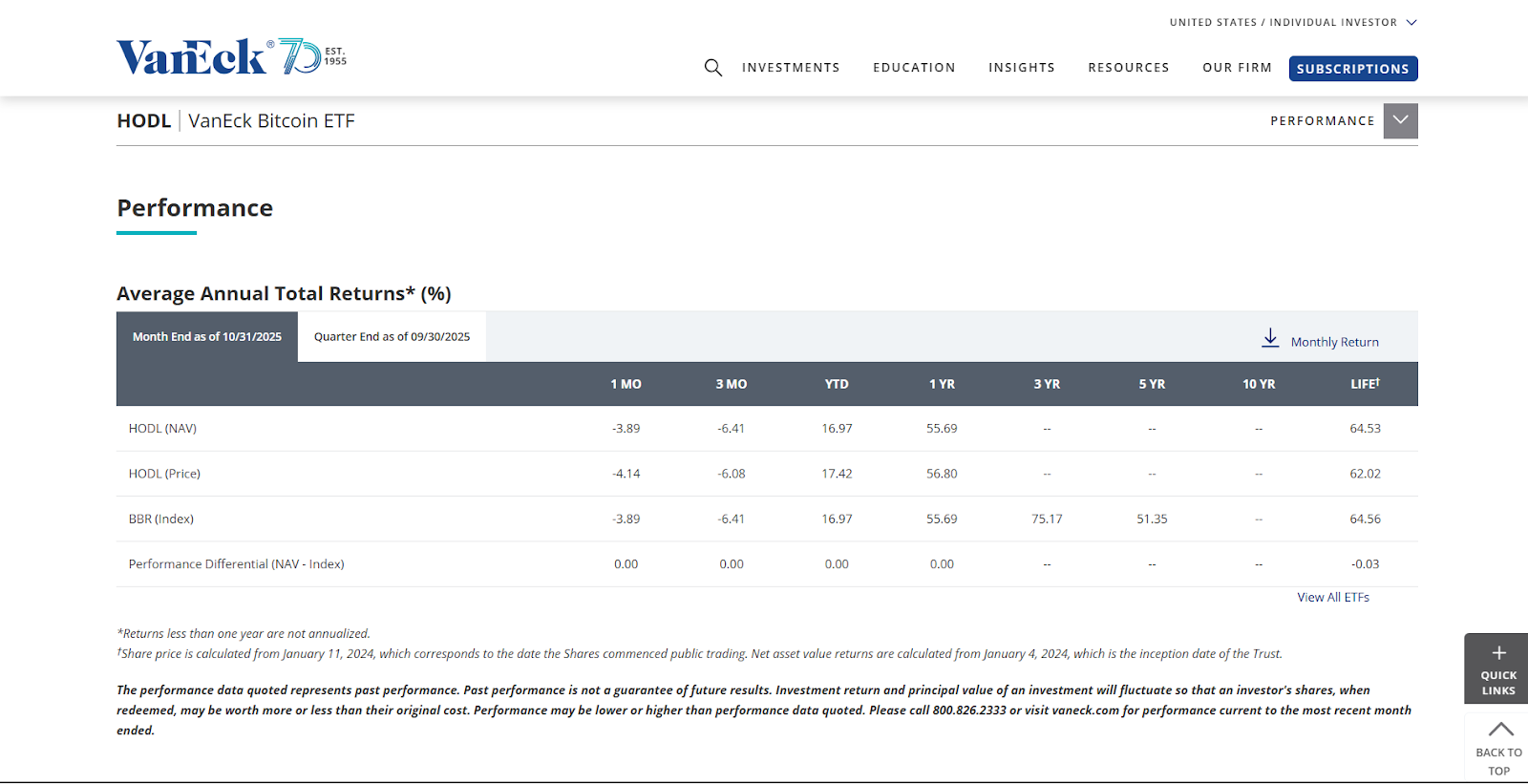

7. VanEck Bitcoin Belief (HODL)

HODL affords easy, cost-efficient Bitcoin publicity by a trusted issuer. The fund holds about US$1.52 billion in whole internet belongings and retains charges decrease than many opponents. It invests 100% in Bitcoin, with the Belief proudly owning roughly 17,485 BTC beneath custody. It focuses on direct spot holdings and simple commerce execution by common brokers. HODL works effectively for traders who need a clear, dependable possibility with out extras they don’t want. If you would like a conservative and effectively structured Bitcoin fund, HODL is a stable selection.

8. WisdomTree Bitcoin Fund (BTCW)

BTCW is designed for traders who need a steady, regulated construction backed by a revered issuer. It carries a 0.25% expense ratio, making it a competitively-priced selection for easy Bitcoin publicity. Whereas BTCW’s belongings beneath administration stay modest (within the low tons of of hundreds of thousands), it stays a reliable possibility if you would like regular publicity with out complexity. It suits effectively for cautious traders evaluating a number of crypto ETF decisions for 2025.

What’s a Bitcoin ETF?

A Bitcoin ETF is a fund that allows you to purchase Bitcoin publicity by a regulated fund as an alternative of utilizing a crypto change. You get the worth motion of Bitcoin, however you by no means must retailer cash, handle non-public keys, or cope with wallets.

A Bitcoin ETF works by holding Bitcoin or Bitcoin-related belongings in your behalf. Whenever you purchase shares of the ETF, you’re shopping for a small piece of these holdings. This setup makes Bitcoin simpler to entry, particularly for individuals who favor regulated funding merchandise. In accordance with the CFTC (Commodity Futures Buying and selling Fee), ETFs provide you with a extra acquainted construction whereas nonetheless monitoring Bitcoin’s value.

The right way to Select the Greatest Bitcoin ETF

Whenever you examine Bitcoin ETFs, you wish to deal with elements that have an effect on price, security, and long run efficiency. The suitable selection is dependent upon the way you make investments and the way a lot threat you may deal with. Listed below are the important thing issues to have a look at earlier than you determine.

Charges: Expense ratios cut back your returns over time. Decrease charges make a giant distinction if you happen to plan to carry your ETF for years. All the time examine the prices aspect by aspect.Liquidity: Excessive buying and selling quantity helps you purchase and promote with out huge value gaps. Giant funds with billions in belongings often supply smoother commerce execution.Monitoring Accuracy: A superb ETF ought to observe the worth of Bitcoin intently. Sturdy monitoring means your returns match the true motion of Bitcoin with out giant deviations.Issuer Repute: Trusted issuers use robust safety, dependable custody, and clear reporting. This helps defend the underlying Bitcoin and offers you confidence within the product.Custody and Safety: Spot ETFs retailer actual Bitcoin in regulated custody. You need a fund that makes use of confirmed safety practices to maintain these holdings secure.

The right way to Purchase Spot Bitcoin ETFs?

Shopping for a spot Bitcoin ETF is easy as a result of the method is just like shopping for a standard inventory or conventional ETF. You don’t want a crypto change or a digital pockets. Listed below are the steps to observe.

Step 1. Open a brokerage account: That you must open a web-based brokerage account with a regulated brokerage that gives spot Bitcoin ETFs. This contains most main platforms. Be sure your account is verified and funded earlier than you start.Step 2. Seek for the ETF ticker: Each Bitcoin ETF has a novel ticker. Examples embrace IBIT, FBTC, or BITB. Kind the ticker into your dealer’s search bar to tug up the fund’s particulars and present value.Step 3. Evaluation the ETF info: Verify the expense ratio, belongings beneath administration, buying and selling quantity, and up to date value efficiency. This helps you perceive how the fund behaves and whether or not it suits your objectives.Step 4. Resolve what number of shares to purchase: Select the variety of shares based mostly in your finances and threat degree. You should buy a single share or construct your place over time. Many brokers help fractional investing.Step 5. Place your purchase order: Submit a market order if you wish to purchase instantly, or use a restrict order if you happen to favor a particular value. As soon as the order fills, the ETF seems in your portfolio and tracks the worth of Bitcoin in actual time.

Take a look at checklist of the most effective crypto exchanges and apps

Advantages and Dangers of Investing in Bitcoin ETFs

Advantages

Handy entry. You should buy a Bitcoin ETF by an everyday brokerage account. You don’t want a crypto pockets, non-public keys, or a crypto change. This makes it simpler for newbies and long run traders.Regulated construction and custody. Spot Bitcoin ETFs maintain actual Bitcoin in regulated, institutional grade custody. This reduces safety dangers you usually face when storing Bitcoin your self.Easy tax reporting. You purchase and promote shares the identical method you commerce shares. This retains your tax reporting easy and avoids the advanced guidelines that include direct Bitcoin possession.Liquidity and simple buying and selling. Most main Bitcoin ETFs commerce with robust quantity. Excessive liquidity helps you enter and exit your place with out huge value gaps.Direct Bitcoin publicity with out complexity. A spot Bitcoin ETF tracks the worth of Bitcoin intently. You get the total value motion with out the stress of managing digital wallets or blockchain transfers.

Dangers

Bitcoin value volatility. Bitcoin can rise and fall shortly. As a result of the ETF tracks the worth instantly, your funding can transfer up or down in brief intervals.Administration charges. Each ETF fees an expense ratio. Over time, charges cut back your whole returns. Decrease price funds are often higher for long run traders.You don’t personal precise Bitcoin. Whenever you purchase the ETF, you personal shares in a fund, not the Bitcoin itself. You can not use the underlying Bitcoin for funds or transfers.Doable monitoring variations. Typically the ETF doesn’t observe the precise value of Bitcoin. Custody prices and fund operations can create small variations in efficiency.Custodian and regulatory issues. Bitcoin ETFs rely upon custodians to retailer the Bitcoin safely. Adjustments in rules or points on the custodian degree can have an effect on the fund.

What’s a Bitcoin technique ETF?

A Bitcoin technique ETF is a sort of crypto ETF that makes use of futures contracts as an alternative of holding actual Bitcoin. In contrast to a spot Bitcoin ETF, which owns precise Bitcoin in custody, a method ETF will get publicity by regulated Bitcoin futures traded on exchanges. This implies the fund tracks the final route of Bitcoin however might not match the worth completely, particularly when you think about the distinction between futures publicity and bodily backed Bitcoin ETFs.

These ETFs deal with brief time period market developments and often swimsuit traders who need lively buying and selling instruments moderately than long run holdings. The construction can create further prices as a result of futures contracts expire and have to be changed. This course of can have an effect on efficiency, particularly when in comparison with the most effective performing Bitcoin ETF that holds actual Bitcoin.

A Bitcoin technique ETF can nonetheless match into your checklist of Bitcoin funds if you would like a product that works inside conventional brokerage accounts and follows Bitcoin’s motion with out direct possession. It affords a less complicated path for individuals who favor futures publicity whereas staying in a regulated atmosphere.

High Bitcoin Technique ETFs for 2025

ProShares Bitcoin Technique ETF (BITO). BITO is probably the most widely known Bitcoin futures ETF. It makes use of regulated Bitcoin futures to trace the final route of the Bitcoin market. Its measurement and robust buying and selling quantity make it a standard selection for traders who need futures based mostly publicity inside a standard account.Valkyrie Bitcoin Technique ETF (BTF). BTF invests in Bitcoin futures contracts and offers you short-term publicity to market developments. It appeals to traders who need tactical instruments moderately than long-term spot holdings. It’s a sensible addition for individuals who favor strategy-style Bitcoin funds.VanEck Bitcoin Technique ETF (XBTF). XBTF focuses on effectivity and futures based mostly publicity. It makes use of a construction designed to handle prices and ship smoother efficiency throughout contract roll intervals. It really works effectively if you would like a futures-based possibility that matches inside your broader checklist of bitcoin funds.

Future Outlook for Bitcoin ETFs

The outlook for Bitcoin ETFs stays robust as extra traders look for easy and controlled methods to realize Bitcoin publicity. Spot Bitcoin ETFs proceed to draw regular inflows as a result of they provide a better path to the most effective bitcoin etf with out the challenges of storing digital belongings. This shift exhibits that many individuals favor a construction they already perceive.

Institutional curiosity can be rising. Giant corporations are finding out how a crypto ETF can match into long-term methods, particularly for diversification. As extra establishments make investments, the market features deeper liquidity, which helps anybody looking for the most effective Bitcoin ETF to purchase for long-term development. Stronger liquidity usually helps a smoother buying and selling expertise and extra steady pricing.

Regulation is anticipated to information the following section of growth. Clear guidelines round custody and reporting may also help traders belief bitcoin funds much more. If the regulatory atmosphere continues to develop, we may even see extra product innovation, together with funds that intention to turn into the best-performing bitcoin ETF for various threat ranges.

Conclusion

Selecting the most effective Bitcoin ETF is dependent upon your objectives, threat degree, and the way you favor to take a position. Spot funds supply easy, direct publicity to Bitcoin, whereas strategy-based ETFs use futures for a special kind of market entry. Every possibility has its strengths, whether or not it’s decrease charges, deeper liquidity, or stronger transparency. The suitable selection comes from evaluating prices, issuer popularity, custody practices, and the way intently the fund tracks Bitcoin. Whenever you perceive these elements, you may decide a crypto ETF that matches your long-term plan and really feel assured figuring out you made a well-informed determination about including bitcoin funds to your portfolio.

FAQs

What’s the greatest Bitcoin ETF to put money into?

The very best Bitcoin ETF to put money into is dependent upon what you need. If you happen to favor measurement and liquidity, IBIT is a standard selection. If you would like robust custody and a trusted issuer, FBTC is fashionable. You must examine charges, monitoring accuracy, and fund measurement to seek out the most effective match in your objectives.

Are Bitcoin ETFs a very good funding?

Whether or not Bitcoin ETFs are a very good funding is dependent upon your threat tolerance and time horizon. A Bitcoin ETF offers you Bitcoin publicity in a regulated construction, however you continue to face the worth volatility of Bitcoin. They are often helpful for long run diversification in case you are snug with these actions.

How does a Bitcoin ETF work?

A Bitcoin ETF works by holding Bitcoin or Bitcoin futures and turning that publicity into shares you should purchase by your brokerage account. When the worth of Bitcoin strikes, the worth of the ETF shares strikes in the identical route. This provides you Bitcoin publicity with no need a pockets or non-public keys.

What’s the distinction between Spot Bitcoin ETF and Bitcoin Futures ETF?

The distinction between a Spot Bitcoin ETF and a Bitcoin Futures ETF is how they achieve publicity. A spot Bitcoin ETF holds actual Bitcoin, whereas a futures ETF makes use of regulated futures contracts. Spot funds observe Bitcoin extra intently, whereas futures funds can behave otherwise throughout contract roll intervals.

Can I maintain Bitcoin in an ETF?

You can not maintain precise Bitcoin in an ETF, however you may maintain ETF shares that characterize Bitcoin publicity. The fund owns the Bitcoin or futures contracts, and also you personal shares of the fund. This provides you the worth motion with no need your individual pockets.

Are Bitcoin ETFs obtainable within the USA?

Sure, Bitcoin ETFs can be found within the USA. A number of spot Bitcoin ETFs and futures ETFs commerce on main exchanges. You should buy these funds by most brokerage accounts with no need a crypto change.

Which is healthier: Bitcoin ETFs vs. Direct Bitcoin Funding?

Whether or not Bitcoin ETFs or direct Bitcoin funding is healthier is dependent upon your wants. Bitcoin ETFs are simpler and controlled, whereas direct Bitcoin offers you full management of the asset. If you would like comfort, ETFs assist. If you would like full possession, direct Bitcoin works higher. The suitable selection is dependent upon your consolation with wallets, safety and long run objectives.