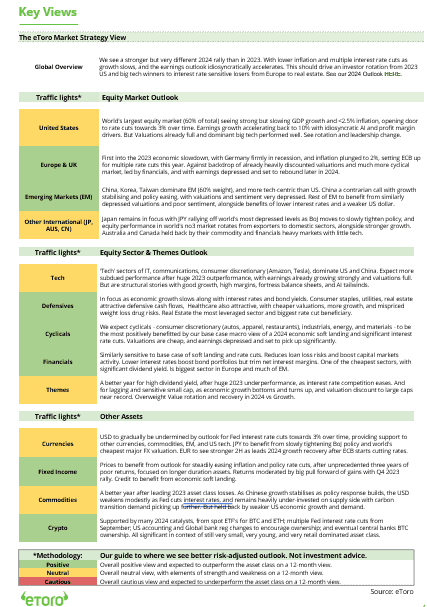

President Trump’s ‘America First’ strategy is shaking up world markets, however the UK inventory market isn’t flinching. Certain, there have been a couple of wobbles previously ten days however the FTSE 100 and FTSE All-Share have stayed resilient. So, what’s driving the latest efficiency, and may it sustain? Let’s dig in.

The UK market is defying sceptics:

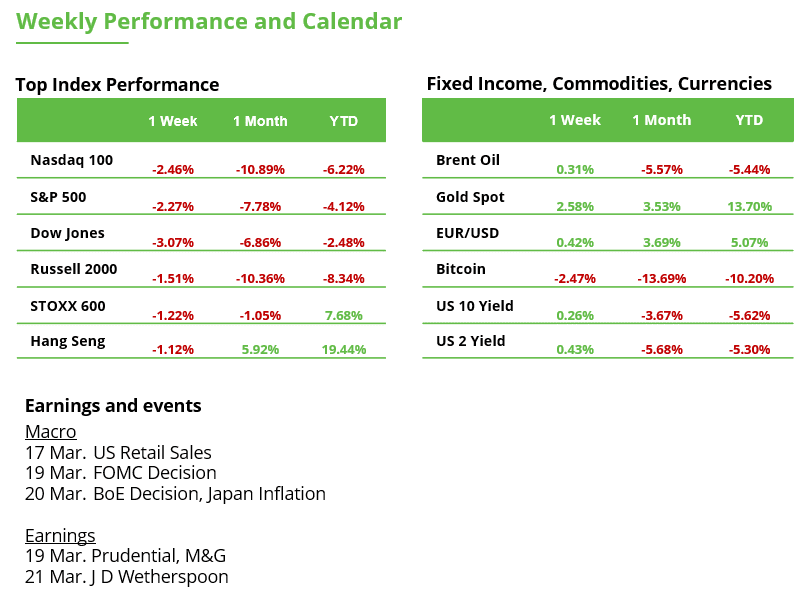

The FTSE 100 is up 6.6% YTD, beating the S&P 500 (-3.9%) and defying years of underperformance.

The Euro Stoxx 50 (+10.7%) is even stronger, as world buyers rotate into worth shares and away from overpriced US mega-cap tech.

In the meantime, the FTSE 250 (UK-focused shares) isn’t enjoying alongside, caught in mid-cap limbo because the UK financial system struggles. However in case you’re a long-term investor, a few of its unloved shares is likely to be hidden gems ready to shine.

FTSE 100 loves its “outdated financial system” shares:

Banks, oil, and mining shares are holding agency – due to excessive charges, expensive crude, and value-hunting buyers.

Lloyds and Normal Chartered popped as buyers piled into financials, whereas BP and Shell stayed sturdy, shrugging off vitality worth swings.

Not-so-hot sectors, now:

Client shares are struggling. Price-of-living pressures imply UK customers aren’t splurging on luxurious sneakers.

Actual property took a success. Greater-for-longer charges = robust instances for property shares. Savills a notable case and not too long ago dropped after failing to current a transparent turnaround plan.

Shares within the highlight:

NatWest fell because the UK authorities offered extra shares. Buyers don’t love “pressured” promoting, however this can be a step towards full privatization.

Assura (healthcare property enterprise) jumped on takeover buzz. Non-public fairness loves low-cost UK belongings – anticipate extra M&A strikes.

Gold miners shined as gold hit an all-time excessive. Tariff fears + safe-haven demand = buyers speeding into valuable metals.

The macro setup is vital – watch the BoE.

The Financial institution of England meets on March 20. Will they maintain charges at 4.5% or trace at cuts? Inflation ticked as much as 3%, which might delay charge cuts.

If the BoE eases later in 2025, rate-sensitive shares (actual property, shopper) might rebound.

Bottomline: Worth Play or Worth Entice?

Low-cost, however for a way lengthy?

The FTSE 100 trades at ~12x ahead earnings – beneath its long-term common (14x) and cheaper than each the S&P 500 (21x) and Europe (15x). Whereas it will not be a deep discount, its relative low cost suggests room for a re-rating as world buyers take discover.

Non-public fairness and overseas buyers are already snapping up undervalued UK belongings.

Dividends nonetheless rule.

The FTSE 100’s 3.8% dividend yield dwarfs the S&P 500’s 1.4% – providing regular revenue even when progress takes time.

Persistence pays.

Warren Buffett’s warning: Markets wrestle after they neglect the basics—earnings have traditionally grown ~7% per 12 months, on common. When markets overshoot this tempo, they’re basically borrowing returns from the long run. The US has front-loaded years of positive factors, whereas the UK has quietly caught to its long-term tempo. Which will make UK a greater risk-reward guess for long-term buyers.

Tariffs as a Boomerang? Trump’s Commerce Warfare Weighs on U.S. Company Income

Issues are rising, however panic stays absent: Extra S&P 500 firms are mentioning “tariffs” of their earnings calls than at any time within the final 10 years. This highlights how a lot commerce uncertainties threaten company earnings and market stability. On the identical time, the variety of firms mentioning “recession” has dropped to its lowest stage in over 5 years, signaling that fears of an financial downturn stay low.

Tariff uncertainty clouds the outlook: S&P 500 firms are anticipated to report 7.3% YoY earnings progress in Q1 2025 (see chart), a pointy revision down from 11.6% projected on the finish of 2024. Income progress is estimated at 4.3% YoY. Trump and uncertainty over new tariffs are weighing on expectations, however the market has already partially priced in these dangers. Tariffs alone received’t crash the financial system, however they may speed up the slowdown within the U.S.

4 sectors hit hardest: The 4 sectors with the best mentions of “tariffs” in This autumn earnings calls—Supplies, Industrials, Client Discretionary, and Client Staples—are additionally those which have seen the biggest cuts in earnings expectations for Q1 2025. This means that tariffs usually are not only a speaking level however are straight impacting company earnings.

Earnings progress doesn’t at all times imply inventory positive factors: Eight of the eleven S&P 500 sectors are anticipated to report earnings progress in Q1 2025, led by Well being Care and Info Expertise. Nevertheless, greater earnings don’t robotically translate to rising inventory costs—valuations and market tendencies play a vital position. Whereas Well being Care has gained 4.5% YTD, Info Expertise is down 10.0%, reflecting a market shift towards defensive and cyclical sectors. Well being Care, Vitality, Utilities and Actual Property have been the strongest performers this 12 months.

Bottomline: Whether or not the four-week dropping streak is an overreaction or if the correction continues will grow to be clear within the coming days. Traditionally, corrections happen virtually yearly, typically creating new alternatives. Nevertheless, buyers stay in the dead of night concerning Trump’s commerce insurance policies and are looking for readability. Let’s see whether or not the Fed can calm the markets considerably on Wednesday – or set off new turbulence.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.