Hyperliquid is a decentralized derivatives buying and selling platform (DEX derivatives) that has been gaining traction within the DeFi ecosystem because of its distinctive operational mannequin, clear governance, and deep integration of safety and danger administration mechanisms.

Hyperliquid Liquidity Mannequin (HLP)

Hyperliquidity Supplier (HLP) is the shared liquidity vault of Hyperliquid, funded by the group to execute market-making and liquidation methods on the platform. Anybody can deposit USDC into HLP and earn income or bear losses proportional to their contribution. HLP serves as the first buying and selling counterparty for many orders on the platform, just like how GLP operates on GMX, however with a extra energetic and adaptive strategy.

HLP doesn’t cost any administration charges; all income and losses are absolutely distributed to depositors, because the vault is solely community-owned.

In follow, HLP is structured into a number of sub-vaults, every implementing totally different methods. Particularly, there are two vaults targeted on market-making (known as Vault A and Vault B) and one vault designated for liquidations (the Liquidator vault). Vaults A and B constantly place purchase/promote orders to offer liquidity to the order ebook, whereas the Liquidator vault handles positions which can be being liquidated.

Study extra: What’s Hyperliquid?

HLP shows the web place aggregated throughout all three sub-vaults. For instance, if Vault A is lengthy 100 million USD price of ETH, Vault B is lengthy 200 million USD, and Liquidator is brief 300 million USD, the general web place of HLP could be zero because the lengthy and brief positions offset each other.

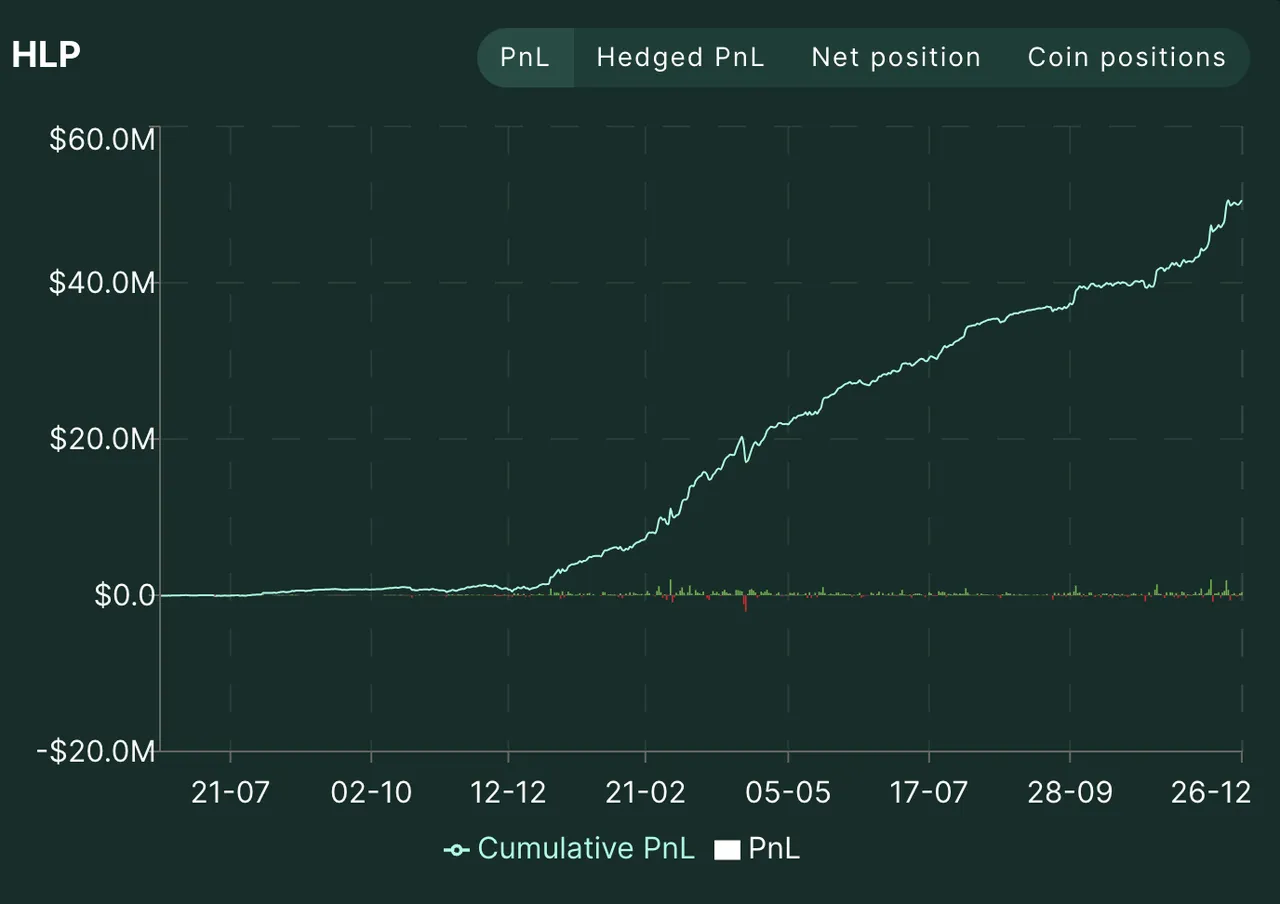

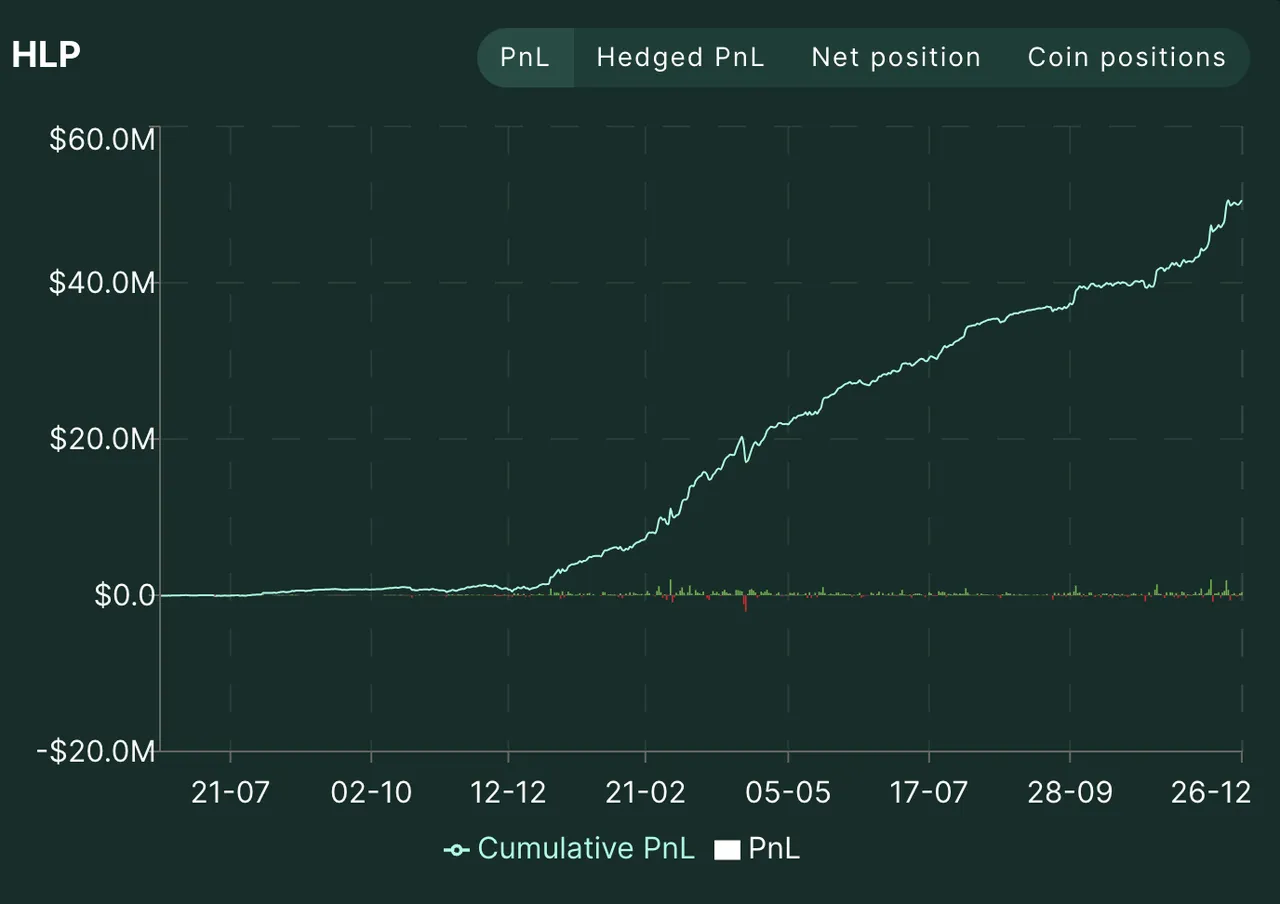

HLP Efficiency

Since its launch, HLP has usually remained worthwhile – because of its market-making technique and buying and selling payment income. By the tip of 2024, the HLP vault had reached a complete worth locked (TVL) of roughly 350 million USDC and had gathered round 50 million USDC in revenue, reflecting a constantly optimistic APR.

HLP’s tendency to take care of a web brief place all through the 2023–2024 bull market allowed it to ship regular returns, whilst asset costs have been trending upward.

HLP efficiency remained worthwhile since launched – Supply: HyperLiquid

Nonetheless, HLP is just not with out danger. On a number of events, the vault recorded important losses as a result of sudden market volatility.

Jelly and a Laborious-learned Lesson for Hyperliquid

Some of the notable incidents occurred in late March 2025, involving a brief squeeze on the token JELLY. A dealer opened a brief place price roughly 8 million USDC on JELLY, then proceeded to purchase up the token on decentralized exchanges (DEXs), inflicting the worth to surge dramatically. In consequence, the brief place was liquidated and absolutely transferred to the HLP vault.

Learn extra: Recap of the Worth Manipulation in Hyperliquid

The worth of JELLY on DEXs skyrocketed by a number of hundred %, pushing HLP into an unrealized lack of over 10 million USD.

Going through the chance {that a} 230 million USD vault might lose every thing to a small memecoin, the crew acted shortly: they delisted JELLY and set a compulsory liquidation value at 0.0095 USD – precisely the extent the place the attacker had initially opened the brief.

Nonetheless, this transfer sparked widespread controversy relating to Hyperliquid’s decentralization and transparency. Many argued that this was successfully a “validator bailout” (or “validator put”)—a” state of affairs the place the community steps in to cap losses when the vault is hit too arduous. This raised issues that Hyperliquid could also be keen to override market mechanisms to guard HLP’s capital, probably on the expense of different customers.

In response, Hyperliquid upgraded its blockchain to incorporate on-chain validator voting for future asset delistings – a step towards deterring manipulation. Nonetheless, questions stay in regards to the platform’s dedication to true decentralization.

Hyperliquid’s Threat Administration Measures

Following the JELLY incident, Hyperliquid applied a collection of danger administration upgrades to forestall comparable situations from occurring sooner or later. One main change concerned decreasing the portion of HLP capital used for liquidation methods. The crew set this allocation at a hard and fast, clearly outlined quantity and in addition decreased the rebalancing frequency for the Liquidator vault to assist restrict potential losses throughout main liquidation occasions.

As well as, Hyperliquid launched a mechanism for loss thresholds and Auto-Deleveraging (ADL). This technique robotically triggers deleveraging when losses from liquidation methods exceed a selected threshold. As soon as the losses hit that restrict, the protocol prompts ADL, which attracts on unrealized income from different merchants inside the similar asset pair to cowl the deficit.

To additional improve stability, the platform additionally adopted dynamic Open Curiosity (OI) caps. The platform adjusts these caps primarily based on every asset’s liquidity and market capitalization, implementing a lot stricter limits on low-cap tokens. This measure helps forestall a small variety of merchants from opening outsized positions that would distort market depth and introduce systemic danger.

Supply: ASXN

These latest enhancements mirror Hyperliquid’s recognition of the vulnerabilities uncovered by the JELLY episode and its dedication to constructing a extra resilient system. HLP shares income with customers however wants robust danger controls throughout risky market circumstances.

One latest instance that highlights Hyperliquid’s evolving governance and danger administration practices is the delisting of MYRO perpetuals. On March 29, 2025, validators 2-5 voted to delist MYRO as a result of low liquidity and manipulation dangers.

ASXN backed delisting as a result of low quantity, poor liquidity, and skinny order books throughout CEXs, DEXs, and Hyperliquid. These circumstances made MYRO extremely vulnerable to cost manipulation and posed pointless danger to HLP

Exchanges Supporting HYPE and Liquidity

Following its token launch, Hyperliquid shortly drew important consideration from the crypto group. HYPE jumped 60% in half a day, hitting 6 USD and nearing 2B USD in market cap.

Supply: CoinGecko

Customers swapped USDC for HYPE straight on Hyperliquid DEX after connecting their pockets.

Within the weeks following the airdrop, a number of mid-tier centralized exchanges started itemizing HYPE, additional increasing its liquidity. KuCoin was the primary CEX to allow HYPE deposits, withdrawals, and buying and selling (beginning December 7, 2024). In the present day, exchanges akin to KuCoin, Gate.io, Bitget, LBank, and CoinW account for the best buying and selling volumes of HYPE.

Study extra: Why Hyperliquid Doesn’t Have to Record on Binance

Regardless of no Binance itemizing, HYPE trades actively, pushed by robust group curiosity after the key airdrop. In its early days, HYPE noticed robust volatility from profit-taking and fallout after the JELLY incident. Nonetheless, in latest weeks, the worth has proven indicators of stabilization.

Conclusion

Hyperliquid good points traction in DeFi with community-backed liquidity and powerful, proactive danger controls. HLP vaults generate yield, however the JELLY incident uncovered robust trade-offs between person security and decentralization.

The Layer 1 Perpetual DEX’s swift upgrades and HYPE’s robust debut present rising belief within the protocol’s long-term potential.

Learn extra: Hyperliquid Airdrop Season 2 Information