On the subject of utilizing cryptocurrencies, transaction charges play a vital function in figuring out how briskly and cost-effective your transfers are. Bitcoin and Ethereum, the 2 largest blockchain networks, each cost charges, however the best way these prices are structured, why they fluctuate, and the way they influence customers are vastly completely different.

Bitcoin’s charges are largely influenced by community congestion and block area demand, whereas Ethereum introduces a extra complicated charge construction with gasoline charges, which fluctuate based mostly on computational effort and community exercise. However why do Bitcoin and Ethereum charges differ a lot? What drives these prices, and the way can customers optimize their spending?

On this article, we’ll break down the transaction prices on each networks, discover the important thing components that affect charges, and supply sensible ideas that can assist you decrease bills when sending BTC or ETH.

How Charges Work on Bitcoin and Ethereum

Bitcoin and Ethereum networks have distinct mechanisms influencing transaction charges, formed by their distinctive architectures and operational dynamics.

On Bitcoin

Bitcoin’s transaction charges are primarily influenced by block dimension limits and the state of the mempool. Every Bitcoin block has a most dimension of 1 megabyte and this restricts the variety of transactions it may well retailer. This limitation signifies that during times of excessive transaction quantity, not all transactions could be processed instantly.

The mempool serves as a holding space for unconfirmed transactions. When the variety of transactions exceeds the block capability, the mempool turns into congested, resulting in delays and elevated charges. Customers usually supply greater charges to prioritize their transactions, incentivizing miners to incorporate them within the subsequent block.

A 3rd issue comes into play in instances of congestion: miners prioritize transactions with greater charges. Customers can select to pay extra to expedite their transactions or wait longer throughout peak intervals to learn from decrease charges.

On Ethereum

Ethereum’s charge system is centered round gasoline charges. Each operation on the Ethereum community requires a specific amount of computational effort, measured in “gasoline.” Customers pay charges based mostly on the gasoline required for his or her transactions and this value fluctuates based mostly on community demand. Ethereum can course of about 30 transactions per second.

The Ethereum Enchancment Protocol (EIP) 1559, applied in August 2021 restructured the blockchain’s charge mannequin by introducing a base charge that adjusts in keeping with community congestion. This base charge is burned, completely eradicating it from circulation. The modifications additionally permits customers so as to add a precedence charge (tip) to incentivize miners to course of their transactions quicker.

Excessive demand for Ethereum’s assets, particularly throughout well-liked dApp launches or token gross sales, can result in elevated base charges. The dynamic adjustment mechanism of EIP-1559 goals to stabilize charges by increasing block sizes throughout peak instances, however customers should still expertise greater prices throughout vital community exercise.

Different Components That Affect Transaction Prices

Past community congestion, a number of different components affect transaction charges on Bitcoin and Ethereum. One essential one is transaction complexity as we see within the case of good contracts with Ethereum and Layer 2 options for each Ethereum and bitcoin.

Impression of Sensible Contracts on Ethereum Charges

In contrast to Bitcoin’s easy transactions, Ethereum helps smart contracts—self-executing code facilitating complicated operations. Executing good contracts consumes extra gasoline, limiting the variety of transactions a block can deal with and contributing to congestion. In style dApps and DeFi platforms usually trigger gasoline value spikes attributable to sudden community exercise surges.

The Impression of Layer 2 Scaling Options

Layer 2 (L2) scaling options cut back transaction complexity on the mainnet and thus they’re able to improve blockchain scalability and cut back charges. They basically course of transactions off-chain or bundle them earlier than submission to the principle chain, which reduces the quantity of computation that must be executed to validate them.

Ethereum’s transaction charges have dropped considerably attributable to rollups, a sort of Layer 2 scaling implementation. Platforms like Optimism, Base, and Scroll have lowered common transaction charges by greater than 24% in comparison with the Ethereum mainnet whereas additionally considerably enhancing the transaction velocity.

Ethereum’s Optimistic Rollups allow a possible throughput of over 5,200 TPS, whereas Zero-Information (ZK) Rollups attain speeds of as much as 2,000 transactions per second (TPS).

RELATED: Scaling the Ethereum Blockchain: A Complete Information on Layer 2 Options

The identical could be mentioned for Bitcoin although it doesn’t actually have a big ecosystem of Layer 2 networks. Bitcoin Lightning has been very efficient, transaction charges on the community are 90% decrease than the principle community.

Which Community Is Extra Value-Efficient for Customers?

The selection between Bitcoin and Ethereum will depend on the precise use case and the person’s priorities concerning price, performance, and community exercise. Customers fascinated by DeFi, NFTs, or different decentralized purposes could choose Ethereum regardless of its greater charges attributable to its in depth ecosystem and functionalities.

Nonetheless, in a really broader means, we will make common price comparisons that can assist you have an thought of methods to use each Bitcoin and Ethereum networks to your transactions.

For Small Transactions, Ethereum is preferable

Ethereum’s gasoline charges fluctuate based mostly on computational complexity. Easy token transfers sometimes price lower than Bitcoin transactions throughout community congestion.

Bitcoin’s charges rely on transaction dimension and community demand. When site visitors is excessive, small transactions can develop into costly.

For Giant Transactions: Bitcoin is preferable

Bitcoin transactions typically have mounted base charges, making bigger transfers comparatively cheaper when congestion is low.

Ethereum’s gasoline charges for giant transfers are decrease than charges for good contract interactions however can nonetheless rise considerably throughout peak exercise.

Finally, the choice between Bitcoin and Ethereum will depend on the person’s particular transaction wants, price sensitivity, and community preferences.

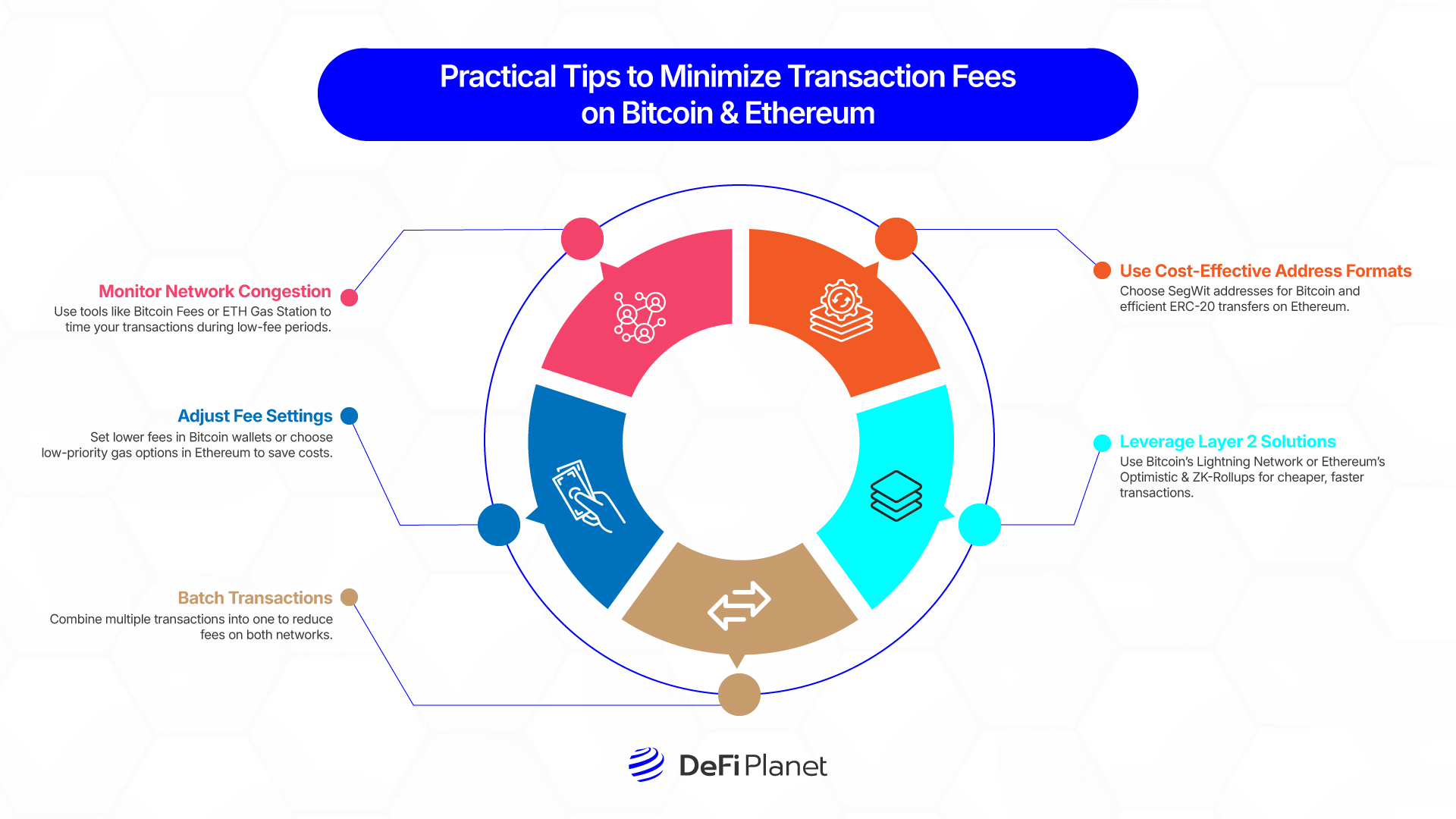

Sensible Tricks to Reduce Transaction Charges on Bitcoin and Ethereum

Transaction charges can add up rapidly, however with good methods, you possibly can cut back prices on each Bitcoin and Ethereum. Right here’s how:

Monitor Community Congestion and Time Your Transactions

Use instruments like Bitcoin Charges to trace community congestion. Charges rise throughout peak utilization, so sending transactions throughout off-peak hours might help you get monetary savings.

On Ethereum, gasoline charges additionally spike throughout excessive community exercise, comparable to NFT drops, DeFi launches, or token gross sales. Use instruments like ETH Gasoline Station or Gasoline Now to determine low-fee intervals earlier than transacting.

Modify Price Settings for Value Effectivity

Many Bitcoin wallets enable customers to manually set charges. In case your transaction isn’t pressing, you possibly can go for a decrease charge, although this may increasingly delay affirmation throughout congestion.

On Ethereum, if velocity isn’t essential, set a decrease gasoline value or choose the “low-priority” choice in your pockets. Whereas your transaction could take longer, it’ll price considerably much less.

Ethereum wallets mechanically estimate gasoline limits, however reviewing and adjusting them can stop overpayment. Be cautious—setting a restrict too low might trigger the transaction to fail, resulting in wasted gasoline charges.

Batch Transactions to Save on Charges

As a substitute of sending a number of transactions individually, batch them right into a single transaction. This reduces the whole quantity of block area used and lowers charges per transaction. This tip additionally applies to Ethereum.

If interacting with a number of dApps, strive bundling a number of good contract interactions right into a single transaction to cut back gasoline charges. Some platforms supply gas-saving mechanisms for batch processing.

Use Value-Efficient Handle and Transaction Codecs

On bitcoin, transactions despatched through SegWit addresses (beginning with “3” or “bc1”) are typically cheaper as they use much less block area. In case your pockets helps SegWit, all the time go for it.

Whereas Ethereum doesn’t have a direct equal to SegWit, selecting ERC-20 over ERC-721 (NFT) transactions when doable might help decrease charges, as NFTs require extra computational energy.

Leverage Layer 2 Options for Cheaper Transactions

Bitcoin’s Lightning Community and Ethereum’s Layer 2 scaling options like Optimistic Rollups (Optimism, Base) and ZK-Rollups (Arbitrum, Scroll, StarkNet) enable for quicker and cheaper transactions. So if you’re coping with frequent, small-value transactions, these options are your greatest wager.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”