You’ve most likely heard time and again that you just want a crypto pockets—however nobody’s truly defined why. Possibly to procure some cash on an change and now you’re questioning how one can hold them secure. So on this information, we’ll cowl the whole lot you have to know. You’ll be taught what a crypto pockets is, the way it works, what varieties exist, and how one can decide one that matches you greatest, whereas avoiding widespread errors and scams.

What Is a Crypto Pockets?

A crypto pockets is a instrument for holding and controlling cryptocurrency. It doesn’t retailer cash inside—it shops your personal keys. These are the cryptographic codes that show possession of your digital property on the blockchain.

A crypto pockets works like a password supervisor on your cash. If you ship or obtain crypto, it indicators every cryptocurrency transaction together with your personal key whereas your public key (aka your pockets deal with) tells the community the place it’s going.

Each cryptocurrency pockets—whether or not it’s a {hardware} pockets or software program pockets—exists to do one factor: hold your keys secure and allow seamless transactions. Many wallets reside in your telephone or pc. Others are bodily units you plug in when wanted. However all share one job: defending entry to your crypto in order that solely you’re in management.

Core Ideas of Wallets

Earlier than we dive deeper into wallets, you’ll want to determine the fundamentals. When you perceive these core elements of crypto wallets, the whole lot else will begin to click on.

Public and Non-public Keys

Your personal secret’s your grasp password. The proof that your cash are yours. Lose it, and also you lose entry solely. It appears to be like like an extended string of characters that permits you to signal crypto transactions and transfer funds.

In the meantime, your public secret’s what others see. It’s mathematically linked to your personal key however secure to share. Consider it like your electronic mail deal with: Your public key lets individuals ship you messages, however your personal key makes certain they’ll’t open your inbox.

Collectively, these two are known as your cryptographic keys, and so they’re what make blockchain safety doable, whereas guaranteeing crypto can transfer all through the ecosystem.

Pockets Addresses

A pockets deal with is the brief, readable model of your public key. It’s how the community is aware of the place to ship your funds. You’ll be able to examine it to a checking account quantity. It identifies you for funds however reveals nothing else.

When somebody sends crypto, they paste your receiving deal with or scan a QR code linked to it. Every blockchain has its personal format. Addresses might be case-sensitive, so at all times double-check earlier than hitting “ship.”

Transaction Signing

If you ship crypto, your crypto pockets makes use of your personal key to create a digital signature, which is a cryptographic proof that the transaction got here from you. Others confirm it utilizing your public key, which mathematically matches your personal one with out revealing it. If the signature checks out, the blockchain accepts the switch. This manner, you by no means expose your personal key, but everybody can verify it’s legit. This method retains crypto safe and verifiable inside wallets.

Restoration and Backup Necessities

The reality is, wallets can break, telephones can vanish, and computer systems can die. However each crypto pockets provides you instruments to get better entry if one thing goes flawed.

The Seed Phrase

A seed phrase (or restoration phrase, or seed) is a listing of 12–24 phrases generated by your pockets below the BIP39 normal. These phrases recreate your personal key and restore your pockets if it’s misplaced or broken. Write it down as soon as, retailer it offline, and by no means share it with anybody, wherever. Keep in mind that anybody who finds your seed can entry your digital property, so deal with it like a vault key.

Passphrase (BIP39 “twenty fifth Phrase”)

A passphrase is an optionally available, further “twenty fifth phrase” that encrypts your seed phrase. It provides one other wall between you and potential thieves. Even when somebody steals your seed, they’ll’t entry funds with out your passphrase. It’s highly effective, however dangerous. Overlook it, and nobody, not even your pockets supplier, might help you get better your crypto property.

Restoration Process

In case your gadget fails, restoration is an easy course of: reinstall your crypto pockets app, choose Restore, and enter your seed (and passphrase, if used). The crypto pockets regenerates your personal keys and syncs your stability from the blockchain community. However backups solely work for those who hold them safe and correct. For those who overlook even one phrase of your seed, your funds are gone.

Metallic Seed Backup

Paper burns and exhausting drives fail, which is why severe holders use steel seed backups, that are engraved plates that may survive hearth, water, and time. They’re good for long-term chilly pockets safety. Even when it’s a bit old-school, it really works—and it’s one much less means on your restoration seed to be destroyed.

Sorts of Crypto Wallets

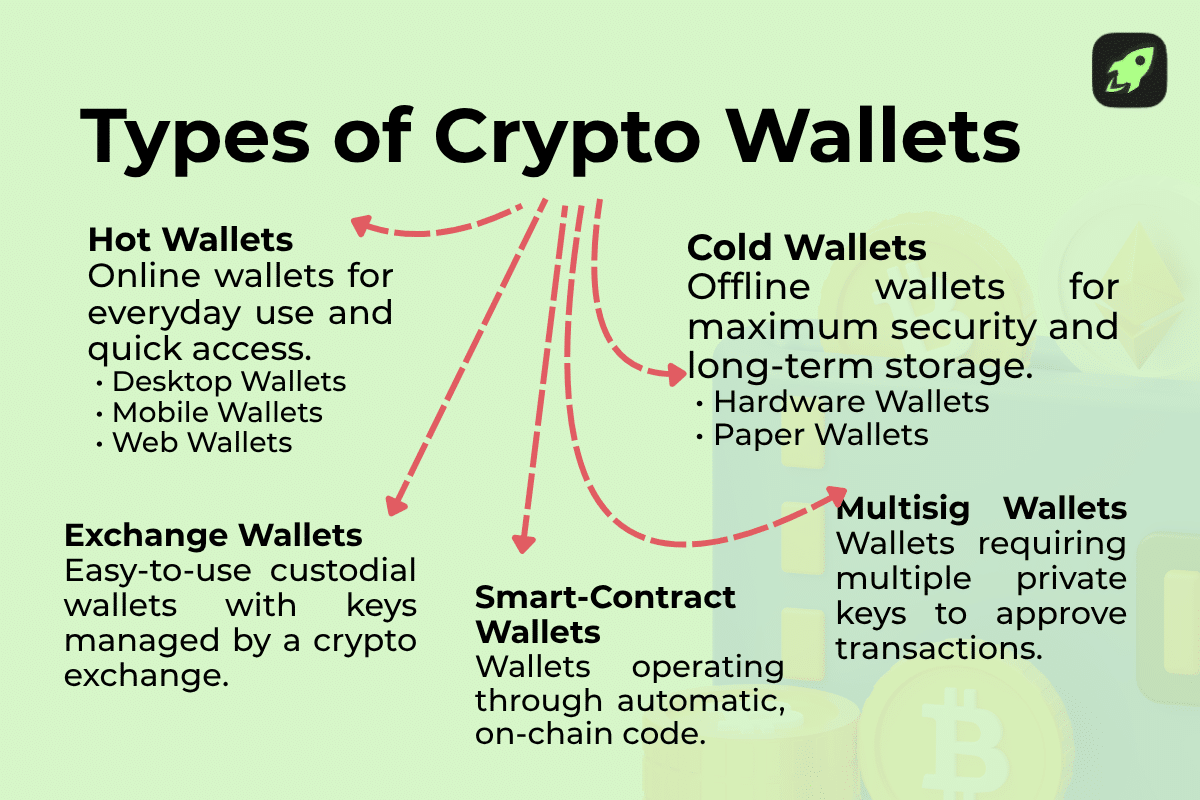

Cryptocurrency wallets differ by how they join and who controls them. You’ll see many forms of crypto pockets, from scorching, chilly, multisignature, smart-contract, to change wallets. Beneath is a breakdown of every.

Scorching Wallets (Software program, Cellular, Internet)

Scorching wallets are also referred to as on-line wallets. Being solely on-line makes them quicker to make use of every day. They embody software program wallets put in in your pc or cell phone, net wallets in your browser, and plenty of cellular wallets. You’ll be able to simply ship or obtain crypto with scorching wallets. However as a result of they’re at all times related to the web, they’re extra weak to hacks. Use them for smaller, lively balances, not your full stash.

Chilly Wallets ({Hardware}, Paper)

Chilly wallets are solely offline. This slashes your publicity to dangers like hacks and downtime. There are two principal sorts of chilly wallets: {hardware} wallets (small units) and paper wallets (printed keys).

{Hardware} wallets sometimes price between $50 and $200. They signal transactions internally so your personal keys are offline, and by no means leak. Paper wallets are much more easy: they’re simply your keys printed out. However they’ve a better danger of harm or loss.

Most individuals favor to make use of chilly wallets for long-term safe storage of their holdings in massive quantities.

Multisignature Wallets

A multisignature pockets (or multisig) wants a number of personal keys to maneuver funds, for instance, 2 of three or 3 of 5. Every signer has their very own key, and the transaction solely goes via when sufficient of them approve. This setup protects in opposition to theft or errors, since no single key can drain the crypto pockets. It’s splendid for groups, DAOs, or joint accounts that need an additional layer of shared management and prioritized safety.

Sensible-Contract Wallets

Sensible-contract wallets run code on the blockchain. They will have guidelines built-in: each day limits, guardians who approve strikes, or automated actions. These wallets allow you to work together with decentralized functions (dApps), DeFi, and NFTs with out exposing uncooked keys. The pockets’s logic protects your property in line with outlined guidelines.

Crypto Alternate Wallets

If you create an account on a cryptocurrency change, you mechanically obtain an change pockets. Any such crypto pockets is a custodial pockets. On this setup, the change holds your personal keys. That makes it a lot simpler so that you can commerce, but in addition a lot riskier. If the change is hacked, you might lose all of your funds. Nonetheless, many inexperienced persons begin right here since these wallets are the best to open and function.

Custody Fashions

Who holds the keys—you or another person—defines your pockets’s custody mannequin. Figuring out the distinction decides how a lot management (and danger) you tackle.

Custodial Wallets

A custodial pockets implies that a 3rd get together, often a cryptocurrency change, holds your personal keys. You log in with a password, and the corporate manages the tech behind the scenes. The upside is evident: comfort. You’ll be able to get better entry simply and commerce quicker. However there’s an equally apparent draw back—you don’t have full management. And if the service is hacked or freezes accounts, your crypto property are in severe hazard.

General, custodial wallets go well with inexperienced persons or short-term merchants who desire a fast, managed expertise. Simply keep in mind that for those who don’t maintain the keys, you don’t really personal the cash.

Non-Custodial Wallets

A non-custodial pockets provides you full management. You maintain the personal keys, not an organization. Meaning nobody can block transactions, get better your password, or take your funds with out your say-so. It’s pure self-custody, which is each empowering and demanding. For those who lose your seed, you’re locked out without end. Nonetheless, many favor it for higher safety and extra freedom.

Non-custodial wallets work nice for long-term holders and DeFi customers who wish to keep impartial.

How Wallets Work Beneath the Hood

A crypto pockets may appear easy, however below the floor, it’s doing severe math. If you hit “ship,” the pockets builds a transaction and indicators it together with your personal key. That signature is exclusive, and anybody can confirm it utilizing your public key, however nobody can faux it. The blockchain community checks the mathematics, confirms it’s actually you, and provides the transaction to its everlasting document.

Learn extra: Blockchain Know-how Defined for Rookies

To remain constant and safe, Bitcoin cryptocurrency wallets observe a set of open guidelines known as Bitcoin Enchancment Proposals (BIPs). These requirements outline how these wallets create and handle your keys safely:

BIP39 (Seed Phrases): explains how wallets flip random information right into a 12–24-word restoration phrase that recreates the consumer’s personal keys if wanted.

BIP32 (HD Wallets & Derivation Paths): reveals how a single grasp key can generate a vast variety of baby addresses via a “derivation path,” so one backup restores the whole lot.

Most fashionable crypto wallets additionally connect with decentralized apps via protocols like WalletConnect, which allow you to approve transactions out of your telephone with out exposing your personal keys.

Lastly, various kinds of blockchains document balances in numerous methods:

UTXO Mannequin (Bitcoin): treats every transaction like money. You spend particular chunks known as unspent transaction outputs (UTXOs), and your pockets provides them as much as present your stability.

Account Mannequin (Ethereum): works extra like a financial institution ledger. Every deal with shops its stability straight, and each motion—sending cryptocurrency tokens, minting NFTs, or interacting with sensible contracts—prices a little bit of gasoline.

Collectively, these methods make each pockets a cryptographic engine, signing, verifying, and syncing your crypto securely throughout the blockchain.

How you can Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero price

Why Wallets Matter

Wallets provide you with direct management over your property, whether or not you’re investing for the lengthy haul, spending each day, or diving into Web3 apps. They’re the bridge between proudly owning crypto and truly utilizing it. Let’s go over simply a number of the methods you should utilize your crypto pockets.

Lengthy-Time period Holding (HODLing)

For those who plan to carry crypto for years, chilly wallets (similar to {hardware} wallets) are your greatest wager. They hold your personal keys offline, secure from hacks and phishing. Gadgets just like the Ledger Nano X or Trezor Mannequin T retailer your restoration phrase internally and by no means expose it on the web.

Learn extra: What’s ‘HODL’?

Offline storage, usually known as chilly storage, is how long-term traders can sleep at night time. It’s slower to entry however far safer, which is a small trade-off for shielding your future beneficial properties.

On a regular basis Spending

For fast funds and on-the-go use, scorching wallets shine. You put in them in your telephone, scan a QR code, and might ship crypto in seconds. Apps like Exodus or Belief Pockets make this as straightforward as paying with a bank card.

Scorching wallets require an web connection, in order that they’re nice for comfort—simply keep on with small balances on there, and use sturdy safety (like two-factor authentication and tough passwords) to remain secure.

Utilizing Wallets with dApps

Your cryptocurrency pockets can be your means into Web3. By way of connectors like WalletConnect or MetaMask, you possibly can entry dApps straight, with no usernames or passwords. That’s as a result of, while you register, your public key verifies your id, whereas your personal key stays hidden. You’ll be able to lend, borrow, commerce, or play, all out of your pockets. It’s your passport to the decentralized net.

Wallets in DeFi

In DeFi, your non-custodial pockets acts like your financial institution. You join, approve a transaction, and work together with sensible contracts that deal with lending, swaps, and staking. No middlemen. Each motion you are taking is recorded on the blockchain and paid for in gasoline. DeFi rewards independence, however it additionally calls for you retain your seed and personal keys safe, since there’s no reset button for those who mess up.

Wallets and NFTs

NFTs reside in crypto wallets too. They’re tokens tied to your public deal with, proving possession on-chain.

If you mint or purchase an NFT, it’s saved in your pockets alongside your crypto. You’ll be able to show it in a market or transfer it between wallets similar to another asset. Whether or not it’s artwork, collectibles, or in-game gadgets, your pockets is what proves they’re really yours.

How you can Select Your First Pockets

Your first crypto pockets ought to match the way you truly use crypto. The proper decide balances safety, ease of use, and management. There are not any one-size-fits-all solutions right here.

Safety Options

Begin with security. Search for wallets that help two-factor authentication (2FA), sturdy passwords, and common firmware updates. Many additionally allow you to whitelist addresses, so your pockets solely sends crypto to accepted accounts.

{Hardware} wallets supply the strongest protection, since your personal keys by no means contact the web. Software program wallets ought to at the very least encrypt your keys domestically. As a normal rule, the extra steps it takes to get entry to your crypto, the more durable it’s for hackers to achieve it.

Ease of Use (UX)

If a crypto pockets appears like a puzzle, you received’t use it. Rookies ought to decide one thing easy, with clear menus, straightforward restoration, and fast swaps. Cellular choices are nice for this—utilizing a pockets in your telephone, you possibly can ship or obtain cryptocurrency in seconds.

Supported Blockchains / Cryptocurrencies

Some wallets deal with only one blockchain, whereas others help a whole lot. For those who plan to handle a number of property, ensure that your pockets lists all of your cryptocurrencies and networks, similar to Bitcoin, Ethereum, and Solana.

Backup & Restoration Choices

Your backup is your lifeline. Select a cryptocurrency pockets that generates a seed and lets you add a passphrase for further safety. Be sure restoration is straightforward and well-documented, too. For those who worth self-custody, that is the place it issues most. Shedding your seed means dropping your property without end. Preserve it offline, on paper, or higher but, in a steel backup.

Price and Charges

Software program wallets are often free. {Hardware} wallets price cash, often between $50 and $200, however that’s low cost insurance coverage in case you have massive holdings.

Additionally, don’t overlook transaction prices. On networks like Ethereum, you’ll pay gasoline charges each time you progress crypto. Some wallets estimate these for you, serving to you propose transfers prematurely.

Popularity & Open Supply / Audits

Lastly, decide a crypto pockets you possibly can belief. Stick to names which have public code, impartial audits, and lively growth. Open-source wallets are simpler to confirm, since anybody can examine they’re not hiding undesirable surprises.

An excellent status means years of updates, not flashy adverts. On the subject of crypto security, transparency at all times beats hype.

Frequent Dangers & How you can Keep away from Them

Errors or scams can price you the whole lot, regardless of how good your crypto pockets is. However the excellent news is that the majority pockets disasters are preventable if you already know what to be careful for.

Shedding a Non-public Key or Seed Phrase

Your personal key and seed are the one solution to entry your crypto. Lose them, and no help staff can convey your funds again. Write your restoration phrase down as soon as, retailer it offline, and by no means add it to cloud storage. Make a backup copy if wanted, however retailer it in a unique, safe means. Deal with your seed like a grasp key—as a result of that’s precisely what it’s.

Phishing / Malware / Faux Apps

Phishing is the oldest trick within the crypto e-book. Scammers can ship you faux emails, construct clone web sites, or make counterfeit pockets apps that steal your personal info. Double-check each URL earlier than logging in. Obtain wallets solely from official hyperlinks. By no means enter your seed into an internet kind, even when the web page appears to be like legit. When doubtful, at all times assume it’s a entice.

Alternate / Custodial Danger

For those who hold your funds on a custodial pockets or change pockets, you’re placing your belief (and your cash) into another person’s safety. Crypto historical past is filled with instances of exchanges getting hacked or freezing withdrawals in a single day. Use them for buying and selling, not for storage. As soon as you purchase crypto, switch it to a non-custodial pockets. Bear in mind the golden rule: not your keys, not your cash.

{Hardware} Failures, Backup Points

{Hardware} wallets are robust, however not unbreakable. Water, hearth, and even firmware glitches can brick any gadget. That’s why you at all times want a backup. Ideally, a steel seed backup that may survive the worst. Take a look at your restoration course of as soon as. For those who can restore your pockets safely, you’ll by no means panic in case your principal gadget fails.

Privateness Points

Blockchains are clear. Your public keys hyperlink to each transaction you’ve ever made. Anybody can hint funds in the event that they know your deal with. To remain personal, use a brand new receiving deal with every time or swap to wallets that generate them mechanically. Keep away from posting addresses publicly, and use privacy-focused wallets when you possibly can.

Greatest Crypto Wallets by Changelly

The crypto wallets we’ve picked under are trusted by tens of millions of customers and combine easily with Changelly, making it straightforward to purchase, promote, or swap crypto throughout a whole lot of property and networks. Whether or not you’re storing for the lengthy haul or buying and selling each day, listed below are high picks that match each model.

Last Ideas

At its core, a crypto pockets is freedom. It holds your personal keys, proving that your digital property belong to you. To not an change, to not a platform. Simply you.

The golden rule nonetheless stands: defend your digital keys, guard your seed phrase, and put your belief into math, not feelings. With a stable pockets and sensible habits, you possibly can transfer, commerce, and retailer your crypto confidently—the way in which it was at all times meant to be.

FAQ

What occurs if I lose my seed phrase?

You lose entry completely. Your seed is the one solution to restore your personal keys, so hold it backed up offline and by no means share it with anybody.

Is my crypto saved contained in the pockets?

No. Your crypto at all times lives on the blockchain community. The pockets simply shops the keys that allow you to entry and transfer it.

Can I take advantage of a number of wallets directly?

Sure. Many customers hold scorching wallets for fast trades and chilly wallets for long-term storage.

Is an change pockets secure sufficient?

It’s a handy resolution, however dangerous. Alternate wallets are custodial, that means you don’t truly maintain the keys, so if the change will get hacked or freezes funds, you might lose your entry.

Do I have to pay gasoline charges for each transaction?

Sure, most networks cost gasoline charges to course of transactions. The price depends upon community demand. Larger site visitors, greater charges.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.