Interested by stablecoins and the way they match into the crypto world? This information breaks down every thing it’s essential know — what’s a stablecoin, the way it’s used for funds, buying and selling, and extra. And if you happen to’re a newbie or simply seeking to keep knowledgeable, right here’s your crash course on crypto’s most steady asset.

What Are Stablecoins?

Stablecoins are digital belongings with a hard and fast worth. Their worth is tied to one thing steady, just like the U.S. greenback, gold, or different monetary belongings.

When Bitcoin launched in 2009, it gave folks a option to ship cash with out counting on banks. However its worth adjustments quick and infrequently. That’s an issue for anybody making an attempt to make use of it for every day spending.

Btw, right here’s what you possibly can truly purchase with Bitcoin at the moment.

Ethereum improved on Bitcoin’s mannequin. It launched sensible contracts and helped launch decentralized finance (DeFi). However its token, Ether (ETH), stays risky.

Stablecoins have been constructed to repair that. They provide a center floor: the pliability of crypto with out the instability. Briefly, stablecoins preserve worth you possibly can depend on.

How Are Stablecoins Completely different from Different Cryptocurrencies?

Stablecoins are designed for stability. They peg their worth to a steady asset, akin to a fiat forex or a commodity. This makes them much less inclined to cost swings.

Common cryptocurrencies can achieve or lose worth quick. That makes them powerful to make use of for funds or financial savings. Stablecoins present a dependable different. You may ship or maintain them with out worrying about sudden losses.

For instance, 1 USDT (Tether) is often equal to 1 USD. That’s as a result of the corporate claims to again each token with money or money equivalents. This mannequin helps it preserve a gentle worth.

Most cryptocurrencies don’t have this type of backing. Their worth is dependent upon market provide and demand. That’s why stablecoins stand out — they provide consistency in an area identified for chaos.

Do We Want Stablecoins? What Is the Level of Them?

Crypto’s unpredictability stands in stark distinction to fiat cash. You see fiat costs shifting progressively. In crypto, costs change drastically day-to-day. This fixed fluctuation impacts your potential to make use of digital currencies for every day wants.

That is the place stablecoins are available. Stablecoins intention to repair this downside by tying their worth to one thing extra predictable, like fiat forex. They carry a component of consistency to a market identified for chaos. Due to this, they’re changing into a core a part of the crypto financial system.

You’ll usually see merchants shifting into stablecoins when markets get shaky. They use them as a protected zone to keep away from worth volatility with out leaving the crypto ecosystem. In the event that they wished full stability, they’d exit into fiat. However most keep in stablecoins as a result of they plan to re-enter the market — simply at a greater time.

Stablecoins additionally open the door for extra sensible crypto use circumstances. You may pay for items, retailer worth, and even earn yield — with out worrying that your steadiness would possibly crash in a single day. That’s a giant deal for adoption.

The information backs this up. In line with a report titled The State of Stablecoins 2025: Provide, Adoption & Market Tendencies, the variety of lively stablecoin wallets jumped from 19.6 million in February 2024 to over 30 million a yr later. That’s a 53% year-over-year enhance — clear proof that demand for steady, dependable digital currencies is rising quick.

How Do Stablecoins Keep Secure?

Stablecoins keep steady by pegging their worth to one thing that doesn’t swing a lot — often fiat currencies just like the U.S. greenback or commodities like gold. This peg offers them worth stability and makes them simpler to make use of.

However stability isn’t assured. Typically, stablecoins deviate from their peg. That is referred to as depegging — when a stablecoin’s worth drops under or rises above the worth of the asset it’s supposed to trace.

Depeg occasions occur extra usually than you assume. A 2023 report recorded 609 depegging situations in a single yr. However not all of them are critical.

Some depegs final just a few minutes or hours. A 1% drift on both aspect of the peg is taken into account regular, particularly when buying and selling volumes spike or liquidity will get tight. The platform the place the stablecoin is traded additionally issues — costs on smaller exchanges could range greater than these on giant platforms.

Extra excessive circumstances do occur. In early 2024, USDC briefly fell to $0.74 on Binance throughout a market panic, earlier than recovering shortly. Even top-tier stablecoins aren’t proof against sudden shocks.

Nonetheless, depegs don’t all the time imply one thing is improper. They are often brought on by many components — from technical glitches to broader market contagion. A quick depeg doesn’t imply a stablecoin is failing. Typically, it simply means the market wants time to rebalance.

There are additionally several types of stablecoins — some backed by fiat reserves, others by crypto or algorithms. Every design comes with its personal strengths and dangers. However throughout all sorts, no stablecoin can keep completely pegged always. That’s simply a part of how markets work.

The necessary factor is how the stablecoin reacts. A fast return to the peg, robust liquidity, and clear backing are key indicators of a wholesome challenge — even within the face of non permanent instability.

How Many Stablecoins Are There?

As of 2025, there are greater than 200 stablecoins in circulation, starting from well-known belongings like USDT and USDC to regional and sector-specific tokens.

Stablecoins pie chart. Supply: DeFiLlama

Stablecoins Market Cap

As of April 2025, the full market capitalization of stablecoins has reached roughly $233.54 billion. Tether (USDT) continues to guide the sector with a dominant market share of 62%, underscoring its vital affect within the stablecoin ecosystem.

Stablecoins market cap all through the years. Supply: DeFiLlama

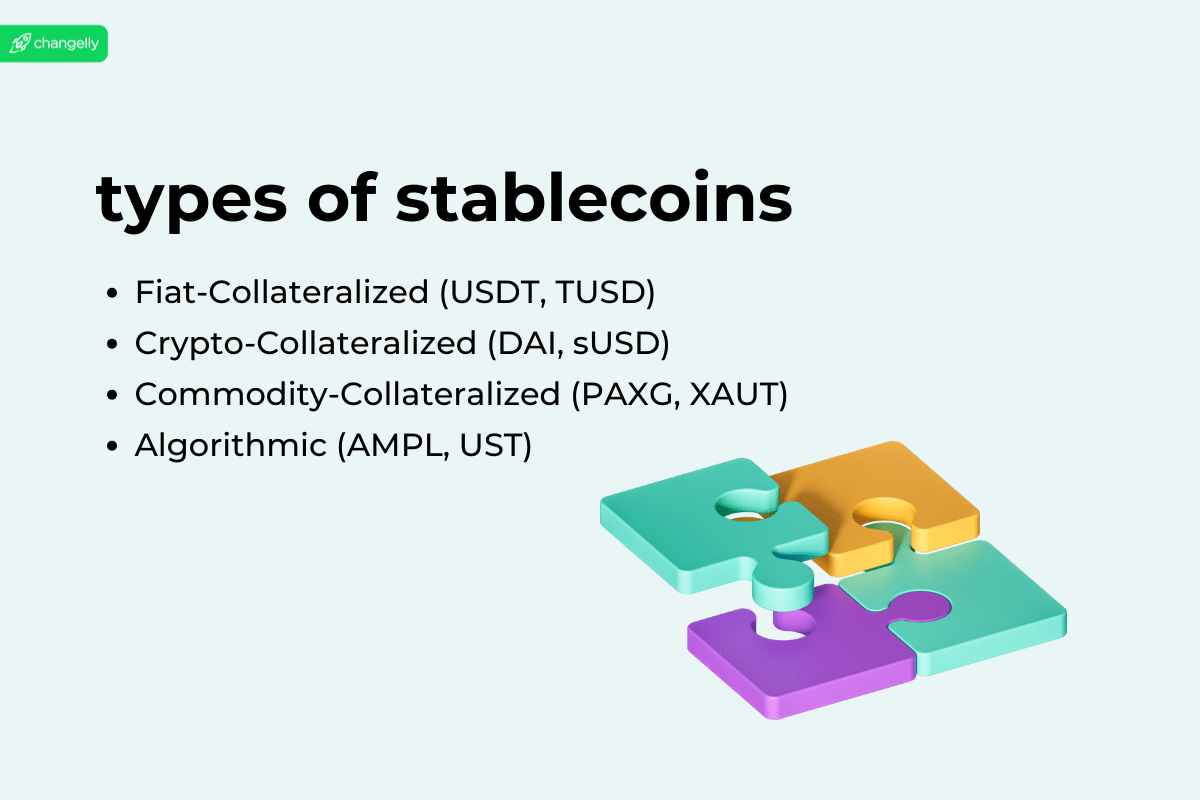

Completely different Forms of Stablecoins

Not all stablecoins work the identical means. Let’s break down the 4 primary kinds of stablecoins, every utilizing a unique technique to remain steady.

Fiat-Collateralized Stablecoins

Fiat-backed stablecoins preserve their worth by holding reserves of fiat currencies just like the U.S. greenback. These reserves are held by custodians — often banks — and are sometimes audited to make sure transparency.

This mannequin is easy and extensively used, nevertheless it depends on belief in centralized establishments to carry and handle the reserves.

Common examples embody Tether (USDT) and TrueUSD (TUSD). Each are pegged 1:1 to the U.S. greenback and backed by precise greenback reserves. As of June 2024, Tether had a market cap of over $144 billion, making it the third-largest cryptocurrency by market worth.

Understanding how fiat and crypto differ helps clarify why this mannequin exists — and why belief within the issuer issues.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins use different cryptocurrencies as collateral. As a result of crypto belongings are risky, these stablecoins are often overcollateralized to guard towards sharp worth drops.

For instance, if you wish to mint $1 million price of a stablecoin, you would possibly must lock up $2 million price of ETH. This additional cushion helps preserve the peg even when the reserve worth falls.

Dai (DAI) is a widely known instance. It’s pegged to the U.S. greenback however backed by a mixture of cryptocurrencies — primarily Ethereum — price about 155% of the full DAI provide.

Algorithmic Stablecoins

Algorithmic stablecoins, also referred to as seigniorage fashion stablecoins, don’t all the time maintain reserves. As an alternative, they depend on code. A preset algorithm adjusts the stablecoin’s provide to maintain its worth regular.

These cash use sensible contracts — self-executing applications that robotically handle the availability. When demand rises, the algorithm mints extra cash. When demand falls, it burns cash to scale back provide. No collateral is concerned.

The concept isn’t new. Central banks additionally handle cash provide with out holding a hard and fast reserve. However there’s a significant distinction — banks just like the U.S. Federal Reserve function with authorized authority and clear insurance policies. That provides them way more credibility throughout market stress.

Algorithmic stablecoins don’t have that security internet. In a disaster, belief within the system can disappear quick. That’s precisely what occurred to TerraUSD (UST) in Could 2022. The coin misplaced its peg, falling over 60% in someday, whereas its paired token Luna crashed greater than 80%. The collapse worn out over $60 billion and uncovered the dangers of relying purely on algorithms.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are tied to bodily items like gold, silver, or oil. They usually fall below the broader class of fiat-collateralized cash however are backed by tangible belongings as a substitute of currencies.

These stablecoins retailer their commodities utilizing third-party custodians or spend money on devices that characterize these commodities.

One well-known instance is Tether Gold (XAUt). It’s backed by bodily gold saved in Switzerland. Holders may even select to redeem the token for an actual gold bar, although they’ll must cowl storage and supply charges.

Common Stablecoins You Ought to Know

Let’s go over essentially the most extensively used stablecoins within the crypto area. Each follows a unique mannequin and runs on a number of blockchains.

This is without doubt one of the most necessary issues to grasp — stablecoins exist on completely different networks, and the identical token can behave otherwise relying on the place it lives. For instance, USDT exists on Ethereum (as an ERC-20 token) and Tron (as a TRC-20 token). This flexibility is nice as a result of it permits quick, low-cost transfers while you choose the correct community. Nevertheless it will also be complicated. If you happen to ship USDT from Tron to an Ethereum-only pockets, you could possibly lose entry to your funds. All the time test which model of the token you’re utilizing.

USDT (Tether)

USDT is the world’s most used stablecoin. It launched in 2014 below the identify “Realcoin,” then rebranded to Tether. You’ll discover it on virtually each trade.

Most merchants use USDT to maneuver cash shortly between platforms. It helps them benefit from worth gaps — that is referred to as arbitrage. Nevertheless it’s not only for merchants.

In Argentina, the place inflation handed 140% in 2023, folks turned to USDT to guard their financial savings. It turned a easy option to retailer worth and ship cash overseas — no banks wanted.

Tether has had its share of controversy. The corporate behind it, Tether Ltd., spent 22 months battling New York’s Legal professional Normal. They have been accused of masking an $850 million loss utilizing Bitfinex funds. In 2021, they settled, paid $18.5 million, and agreed to publish common reserve experiences.

Nonetheless, USDT stays the highest fiat-backed stablecoin by quantity. It’s quick, liquid, and accepted in every single place — even when belief in its reserves nonetheless sparks debate.

USDC (USD Coin)

USDC is the cleaner, extra clear cousin of USDT. It launched in 2018, created by Circle in partnership with Coinbase. It’s pegged 1:1 to the U.S. greenback and backed by absolutely reserved money and short-term treasuries.

You get extra transparency with USDC. It’s regulated, audited, and supported by main gamers like Goldman Sachs and Baidu. Circle points the coin and leads its growth.

Circle additionally leads with regards to regulation. In 2024, it turned the primary stablecoin issuer to adjust to MiCA, the EU’s new crypto legislation. It secured a license in France, permitting it to concern each USDC and EURC legally throughout Europe.

This transfer gave USDC a vanguard. Main exchanges like Coinbase, Kraken, and Crypto.com began eradicating stablecoins that don’t meet MiCA’s requirements, however USDC stayed — and strengthened its foothold within the area.

Learn additionally: USDT vs. USDC.

BUSD (Binance USD)

BUSD is Binance’s dollar-pegged stablecoin. It launched in 2019 by way of a partnership with Paxos. It’s absolutely backed, regulated by the NYDFS, and audited month-to-month.

Merchants cherished BUSD as a result of it labored completely inside Binance’s ecosystem. It turned the default buying and selling pair for dozens of belongings. You can apply it to Ethereum or Binance’s BNB Chain, saving on charges.

However Binance stopped minting new BUSD in early 2024. You may nonetheless commerce it, and it’s nonetheless accepted in most BNB-based apps — simply know that it’s being slowly phased out.

DAI

DAI is completely different. It’s a decentralized stablecoin created by MakerDAO. It runs on Ethereum, with no central firm controlling it. As an alternative of holding {dollars} in a financial institution, DAI makes use of sensible contracts and crypto as collateral.

Whenever you lock up ETH or different belongings in a Maker Vault, you generate DAI. The system robotically manages provide. If the value drops, it burns tokens. If it rises, it mints extra. That’s the way it holds the peg.

DAI offers you stability with out central management. It’s excellent if you wish to keep away from counting on conventional establishments. You’ll see DAI in every single place in DeFi — Aave, Compound, Curve, and extra.

And sure, you possibly can spend DAI in the true world. Monolith as soon as provided a Visa card that permit Europeans spend DAI like money. It’s a robust different if you happen to consider in decentralized cash.

Stablecoin Regulation throughout the World

Stablecoins have change into a world regulatory focus. Their fast progress and use in funds, buying and selling, and DeFi have pushed lawmakers to steadiness innovation with client safety, monetary stability, and anti-money laundering guidelines.

The European Union (EU)

The EU launched the Markets in Crypto-Belongings (MiCA) regulation to set widespread guidelines for crypto belongings, together with stablecoins. MiCA’s stablecoin guidelines got here into impact on June 30, 2024, with extra guidelines for service suppliers beginning December 20, 2024.

MiCA defines two stablecoin varieties:

E-money tokens (EMTs) – pegged to at least one fiat forex (e.g. USD, EUR), used as cost.

Asset-referenced tokens (ARTs) – tied to baskets of currencies, crypto, or commodities, used extra as a retailer of worth or trade.

Issuers of each have to be licensed, publish whitepapers, handle reserves correctly, and assure redemption rights. Bigger, “vital” stablecoins face harder oversight from the European Banking Authority (EBA).

Circle’s USDC is the primary stablecoin accredited below MiCA. Others like USDT threat being delisted from EU platforms in the event that they don’t comply.

Singapore

The Financial Authority of Singapore (MAS) finalized its stablecoin framework in 2023. It applies to single-currency stablecoins (SCS) pegged to both the Singapore Greenback or main G10 currencies. Issuers should meet strict guidelines on reserve backing, capital, redemptions, and disclosures. Compliant issuers can earn “MAS-regulated” standing.

Hong Kong

Hong Kong is constructing its personal framework for stablecoin issuers. Whereas remaining laws continues to be underway, the Hong Kong Financial Authority (HKMA) has launched a regulatory sandbox. It lets chosen initiatives take a look at their fashions and form the upcoming guidelines. Three pilot initiatives have been accepted in July 2024.

Japan

Japan was early to manage stablecoins, permitting banks and licensed corporations to concern fiat-backed tokens. Issuers should meet strict reserve necessities. Whereas companies like MUFG are exploring the area, native adoption continues to be small. Japan’s FSA is reviewing its framework to align with worldwide requirements.

United States

The U.S. continues to be debating the way to regulate stablecoins. Regardless of the recognition of USDC and USDT, there’s no federal legislation masking their issuance. Lawmakers are pushing new payments to carry readability, specializing in reserve transparency, client safety, and cash laundering safeguards. A draft stablecoin invoice handed committee evaluation in 2023, however progress has stalled.

What Are Stablecoins Used For?

Stablecoins are extra than simply digital {dollars}. Their stability makes them extremely helpful in real-world eventualities — from buying and selling and funds to supporting monetary methods in unstable economies.

Cross-Border Funds

Stablecoins enable for quick and low-cost worldwide transfers with out counting on conventional banking methods. They’re accessible 24/7, settle shortly, and don’t require approval from central authorities. Migrant employees and companies use them to ship cash throughout borders, particularly the place banking is sluggish or costly.

Hedging Towards Market Volatility

Crypto markets are identified for his or her ups and downs. Stablecoins assist customers preserve a steady worth throughout unsure instances. Merchants, buyers, and protocols usually transfer into stablecoins when volatility spikes to guard capital and keep away from sudden losses in portfolio worth.

Preserving Worth in Economically Unstable Areas

In international locations hit by hyperinflation or forex collapse, folks flip to stablecoins as a retailer of worth. With restricted entry to the worldwide monetary system, stablecoins supply an alternate. In Argentina, for instance, folks use USDT to flee peso devaluation. Stablecoins additionally enhance monetary inclusion by giving unbanked people entry to digital cash.

Buying and selling

Stablecoins play a core function in crypto buying and selling. They permit customers to shortly transfer out and in of positions with out changing again to fiat. This helps keep away from charges and delays, particularly throughout worth fluctuations. Most main exchanges use stablecoins as base pairs in spot and futures markets.

Funds

Stablecoins allow quick and cost-effective funds — irrespective of the situation. Some companies and monetary establishments now settle for stablecoins for payroll, remittances, and on-line purchases. Their stability makes them preferrred for transactions the place worth consistency issues.

Decentralised Finance (DeFi) Functions

Stablecoins are the spine of DeFi. You may lend, borrow, farm yield, or present liquidity — all with out touching risky belongings. Protocols like Aave, Compound, and Curve rely closely on stablecoins for his or her core capabilities, making the ecosystem extra predictable and environment friendly.

The Professionals and Cons of Stablecoins

Benefits

Stablecoins have various key benefits, and retaining these in thoughts may also help you make extra knowledgeable choices.

Tremendous Fast Transfers

Stablecoin transactions occur in seconds, not days. In comparison with conventional banking methods, it is a main benefit. Whether or not you’re sending cash throughout the globe or swapping belongings on an trade, stablecoins supply lightning-fast transfers. Their velocity makes them a dependable medium for every thing from remittances to real-time trades. As a medium of trade, stablecoins mix velocity with world attain.

World Accessibility

Individuals in underserved areas use stablecoins to ship and obtain cash with out counting on native banks. With only a smartphone, customers can entry crypto wallets and stablecoin platforms. This makes stablecoins globally accessible and interesting throughout financial courses.

Simple to Use on Any App

Stablecoins are straightforward to make use of and work on many platforms — centralized exchanges, DeFi apps, and wallets. You should purchase them by way of financial institution switch or perhaps a crypto bank card. They’re versatile, quick, and easy to maneuver round. This makes them preferrred for customers who desire a acquainted, liquid, and extensively accepted asset throughout a number of apps and providers.

Safer Than Conventional Funds

Stablecoins use blockchain know-how, which makes them safe and tamper-proof. Many stablecoins are backed by fiat forex, offering confidence of their worth. They’re additionally extra non-public than conventional banking choices and more durable to dam or censor.

Value-Environment friendly Transfers

Sending cash overseas by way of banks usually entails excessive charges. With stablecoins, these charges drop dramatically. The rationale? There’s no intermediary. Stablecoins use blockchain rails to course of transactions immediately, leading to considerably decrease transaction charges. That is particularly necessary for customers making frequent worldwide transfers or micropayments.

Disadvantages

It’s additionally necessary to remain conscious of some potential drawbacks. Right here’s what it’s essential know.

Reserve Danger and Transparency

Stablecoins are tied to order belongings like fiat or crypto. If these reserves are mismanaged or not correctly disclosed, the worth of the stablecoin can break. This undermines belief and defeats the purpose of utilizing a stablecoin to keep away from threat. All the time test how nicely the stablecoin is backed and whether or not it’s really tied to a fiat forex.

Lack of Decentralization

Most stablecoin issuers are non-public corporations. That provides them management over provide, reserves, and coverage. Whereas handy, this goes towards the core values of decentralized finance. If the issuer isn’t clear or solvent, customers are uncovered to dangers — together with blacklisting or frozen funds.

Peg Instability

Stablecoins are supposed to maintain a hard and fast worth — however that’s not assured. If there’s a shock to the market, issues with the underlying asset, or a lack of confidence, the stablecoin can drop under its goal. That is referred to as de-pegging. It challenges the coin’s potential to take care of worth stability, particularly in instances of stress. TerraUSD’s collapse is the clearest instance of what can go improper.

Ought to You Use Stablecoins?

Stablecoins are helpful if you wish to keep away from crypto volatility, ship cash quick, or entry DeFi instruments. They’re straightforward to make use of, usually cheaper than banks, and obtainable worldwide.

However like all asset, they carry dangers. Do your analysis and select well-regulated, clear stablecoins to remain on the protected aspect.

Methods to Purchase Stablecoins?

Shopping for stablecoins is easy — you don’t want a buying and selling background or a crypto pockets filled with cash to begin. You should purchase them with a bank card, financial institution switch, and even Apple Pay.

One of many best methods to purchase stablecoins is thru Changelly. It’s a beginner-friendly platform that permits you to buy high stablecoins like USDT, USDC, or DAI in only a few steps. No complicated buying and selling interface, no hidden charges.

Have to promote stablecoins later? You are able to do that on Changelly too — immediately swap your stablecoins for crypto or fiat, multi function place.

Last Phrases

You now perceive what stablecoins are and why they matter. They offer you a means to make use of crypto with out large worth swings. You may retailer worth, ship cash, or commerce safely. They work quick, price much less, and don’t want a financial institution. You simply want a pockets and web. Some are backed by money, others by crypto or code. All the time test how stablecoins preserve their worth. Select ones with clear guidelines and powerful backing. That helps you keep away from threat and keep protected.

FAQ

Are Stablecoins the Identical as Common Cash?

Not precisely. Stablecoins are digital currencies designed to imitate fiat cash just like the U.S. greenback. Whereas they intention for worth stability, they’re not authorized tender — which means governments don’t formally acknowledge them as forex.

How Do I Know That A Stablecoin Is Secure?

Test if it’s backed by reserves, audited repeatedly, and issued by a licensed firm. Search for transparency experiences and real-time information. Reliable stablecoins publish particulars about their holdings and operations.

Can Stablecoins Lose Their Worth?

Sure. Stablecoins can depeg if reserves are mismanaged, demand shifts, or confidence drops. Most keep near their peg, however sharp market occasions — like with TerraUSD — present that threat exists.

Do I Want a Financial institution Account to Use Stablecoins?

No. You need to use stablecoins with solely a crypto pockets. That’s why they’re so helpful for folks with out entry to banks — all you want is a smartphone and web.

What Occurs If Laws Change?

If guidelines shift, some stablecoins could also be restricted or delisted from platforms. Nonetheless, regulated issuers like Circle (USDC) are getting ready for this by aligning with world frameworks like MiCA within the EU.

Is Bitcoin a Stablecoin?

No. Bitcoin isn’t a stablecoin. It’s a decentralized digital asset with excessive worth volatility. Stablecoins are designed to remain at a hard and fast worth — Bitcoin isn’t.

Disclaimer: Please be aware that the contents of this text usually are not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.