Oracles are the indispensable bridge connecting off-chain knowledge (like asset costs) to on-chain good contracts in Decentralized Finance (DeFi).

Nevertheless, as DeFi matures, present Oracle options battle to satisfy the demand for quicker, cheaper, and crucially, extra correct knowledge, which we name Excessive Constancy Knowledge. Previous vulnerabilities have underscored the pressing want for a brand new commonplace.

Consequently, APRO is engineered to ascertain this commonplace. By optimizing for high-fidelity knowledge supply, APRO guarantees a brand new degree of security and effectivity for the subsequent technology of DeFi functions.

What Is APRO?

APRO will not be merely an information supplier. As an alternative, it’s a decentralized oracle structure designed to deal with the oracle trilemma: methods to concurrently obtain pace, low price, and absolute constancy (accuracy).

If the primary technology of Oracles targeted on creating primary knowledge bridges and the second technology centered on rising decentralization, APRO, because the third technology, is targeted on knowledge high quality on the degree of excessive constancy.

That is APRO’s core worth. Excessive-fidelity knowledge encompasses three essential parts:

Granularity: Extraordinarily excessive replace frequency (e.g., each second as a substitute of each minute).Timeliness: Close to-zero latency, making certain knowledge is transmitted immediately after aggregation.Manipulation Resistance: Knowledge is aggregated from a big, verified variety of sources, eliminating the opportunity of worth assaults originating from a single alternate.

In the end, by offering knowledge with unprecedented accuracy and pace, APRO unlocks the power to create novel DeFi merchandise that have been beforehand too dangerous or technologically unfeasible (e.g., quick time period spinoff contracts).

What Is APRO? Supply: APRO

Be taught extra: NFTevening High Decide: Every part about OKX Trade

APRO’s Core Expertise and Innovation

APRO’s structure is a classy layered system designed to course of complicated, unstructured knowledge and guarantee knowledge integrity throughout transmission:

The Layered System Structure

APRO separates the duties of knowledge acquisition/processing and consensus/auditing to maximise efficiency and safety.

Layer 1: AI Ingestion (Knowledge Acquisition and Processing)

This primary layer (L1) serves because the acquisition and uncooked knowledge transformation layer.

Artifact Acquisition: L1 Nodes purchase uncooked knowledge (artifacts) comparable to PDF paperwork, audio recordings, or cryptographically signed net pages (TLS fingerprints) through safe crawlers.

Multi-modal AI Pipeline: The Node runs a posh AI processing chain: L1 makes use of OCR/ASR to transform unstructured knowledge and NLP/LLMs to construction the textual content into schema compliant fields.

PoR Report Technology: The output is a signed PoR Report, containing proof hashes, structured payloads, and per area confidence ranges, which is prepared for submission to L2.

Layer 2: Audit & Consensus (Auditing and Finalization)

In the meantime, Layer 2 (L2) is the validation and dispute decision layer, which ensures the integrity of L1 knowledge.

Watchdogs and Impartial Auditing: Watchdog Nodes constantly pattern submitted experiences and independently recompute them utilizing completely different fashions or parameters.Dispute Decision and Proportional Slashing: The mechanism permits any staked participant to dispute an information area. If the dispute succeeds, the offending reporting Node is slashed proportional to the influence of the error, creating a sturdy, self correcting financial system.

Twin Knowledge Transport Mannequin and Knowledge Integrity Mechanisms

APRO combines its Layered Structure with a twin transport mannequin to optimize efficiency on EVM chains.

Knowledge Push: Delivers finalized knowledge from Layer 2. Following PBFT consensus and dispute decision, Nodes execute a transaction to push the ultimate knowledge onto the good contract. Appropriate for dApps requiring foundational on chain knowledge availability.Knowledge Pull: Exploits the extremely excessive frequency efficiency of Layer 1. L1 permits Nodes to signal excessive accuracy worth and PoR experiences off chain at extraordinarily excessive frequencies. Knowledge Pull is the user-initiated strategy of fetching and verifying that signed proof on chain, successfully decoupling fuel price from knowledge frequency.

Core Value Discovery and Anti-Manipulation

Knowledge high quality is ensured by way of strong algorithms and consensus mechanisms:

TVWAP Pricing: APRO makes use of the TVWAP (Time Quantity Weighted Common Value) to calculate costs weighted by each quantity and time, thereby actively mitigating small-scale worth manipulation makes an attempt.

PBFT Consensus and Status System: Moreover, the quick PBFT consensus mechanism is mixed with the Validator Status Scoring System to make sure Nodes are topic to financial penalties (slashing) if they supply stale or malicious knowledge. Consequently, this strategy maintains a robust financial barrier to entry for dishonest actors.

APRO’s Core Expertise and Innovation – Supply: APRO

Non Customary Oracle Capabilities

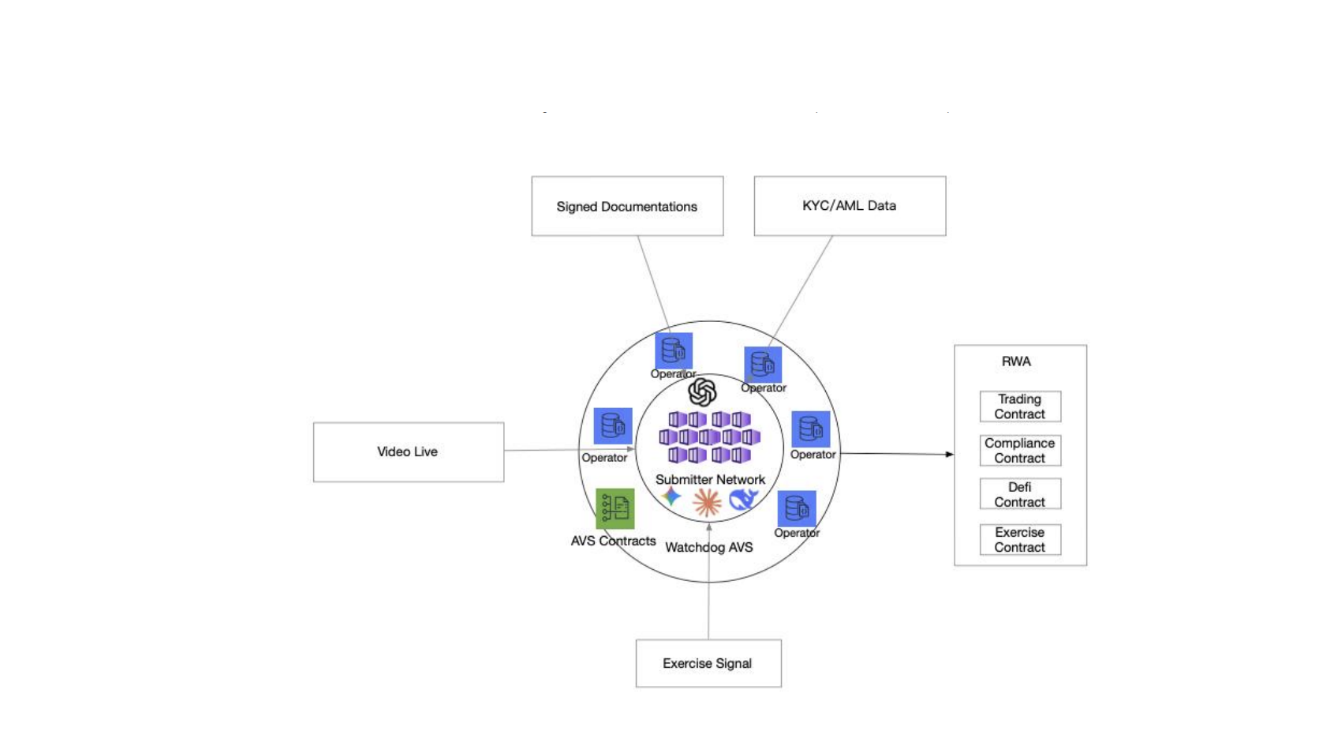

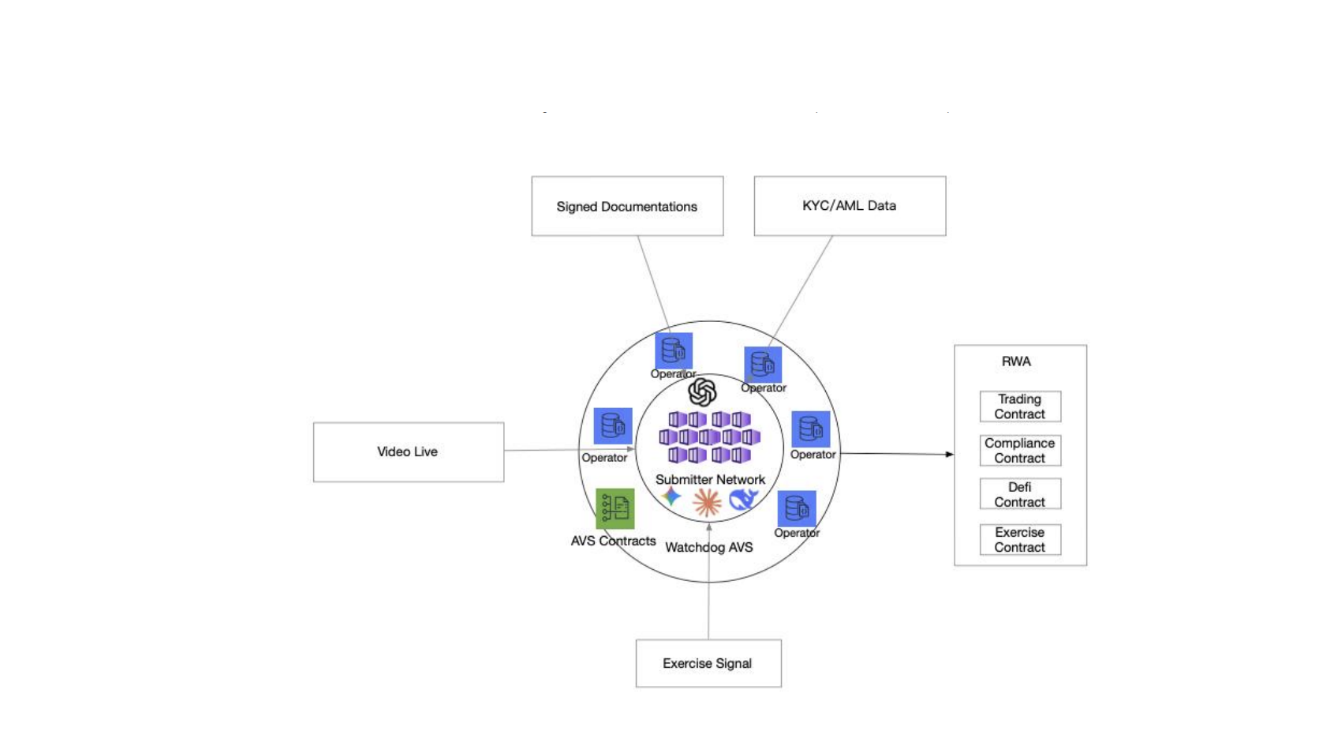

APRO’s analytical capabilities prolong far past standard crypto Value Feeds, specializing in complicated RWA/PoR verticals:

Proof of Reserve (PoR) and Automated Auditing

APRO elevates PoR to an automated auditing operate:

Multi modal Supply Processing: The L1 AI Pipeline analyzes complicated proof like financial institution letters or regulatory filings through OCR/LLM.

Authorized Consistency: Consequently, L2 performs Reconciliation Guidelines to make sure totals throughout paperwork match (e.g., verifying asset legal responsibility summaries), thereby drastically decreasing human error and manipulation dangers in reserve reporting.

RWA and Area of interest Situations

APRO supplies an in depth Oracle Functionality Matrix for complicated RWA fields, remodeling the Oracle into a classy verification instrument:

Pre IPO Shares: L2 performs cap desk reconciliation, making certain share counts align with the overall licensed shares. Outputs embrace final spherical valuation and a provenance index.Authorized/Agreements: The Oracle analyzes contracts, extracting obligations and enforceability indicators. L2 verifies digital signatures and cross references public courtroom dockets, permitting good contracts to implement complicated authorized phrases.Actual Property: APRO processes paperwork like land registry PDFs and appraisal experiences, extracting title/encumbrance details. L2 can mirror registry snapshots for verification, addressing a core drawback of actual property tokenization.

The convergence of the Layered Structure and the Multi modal AI Pipeline permits APRO to not solely ship quicker worth knowledge but additionally to make sure contextual accuracy and institutional grade auditability for probably the most complicated belongings.

APRO Tokenomics

APRO’s native utility token is $AT, with a Most Provide of 1,000,000,000 tokens.

The $AT token features because the financial core, driving community safety by way of staking and facilitating knowledge service funds, in the end selling platform sustainability.

Be taught extra: APRO (AT) Will Be Listed on Binance HODLer Airdrops!

Token Allocation

The $AT token allocation construction is designed to stability ecosystem growth, safety, and preliminary capital distribution:

Token Allocation – Supply: APRO

Ecosystem: 25percentStaking: 20% Investor: 20percentPublic Distribution: 15percentTeam: 10percentFoundation: 5percentLiquidity: 3percentOperation Occasion: 2%

The mixed allocation of 45% to Ecosystem and Staking underscores APRO’s highest precedence: enhancing community safety and constructing a sturdy group of Validator Nodes, which is a prerequisite for a profitable subsequent technology Oracle platform.

FAQ

What’s APRO?

APRO is a 3rd technology Decentralized Oracle Structure designed to ship Excessive Constancy Knowledge (excessive accuracy and timeliness). It solves the Oracle Trilemma. Its core innovation is a Layered System. This method makes use of an AI Pipeline (OCR/LLM) in Layer 1 to remodel complicated, unstructured knowledge into auditable data. Crucially, APRO makes a speciality of non commonplace verticals like RWA and Proof of Reserve (PoR).

What’s the main distinction between APRO and established Oracle platforms?

The elemental distinction lies within the Layered Structure and Knowledge Pull. APRO focuses on Excessive Constancy Knowledge through the L1 AI Pipeline and makes use of Knowledge Pull to ship extremely excessive frequency knowledge cheaply on EVM chains.

How does APRO guarantee RWA knowledge reliability?

RWA knowledge is processed by the Multi modal AI Pipeline in L1. RWA knowledge is processed by the Multi modal AI Pipeline in L1. However, it should cross L2’s rigorous auditing course of. Particularly, this course of contains outlier filtering and reaching PBFT consensus from the varied Node community. Moreover, L2 additionally performs Reconciliation Guidelines for complicated monetary paperwork.

What mechanisms defend APRO from worth manipulation assaults?

APRO makes use of a mix of defenses: TVWAP and outlier rejection algorithms for technical knowledge cleansing, together with the proportional slashing system based mostly on status scores to implement financial honesty.

How does Knowledge Pull stay price environment friendly regardless of frequent updates?

Knowledge Pull shifts the continual replace burden from the Nodes to the end-user. Nodes signal recent worth proofs off chain (fuel free). The person solely pays a single fuel charge for his or her transaction, once they pull the signed proof onto the good contract for verification.