AI-agent token AIA surged to a contemporary report this week, capping an in a single day surge that vaulted the brand new coin into the market’s most-traded property. Right here’s the AIA worth prediction. Will it maintain its bullish momentum?

DeAgentAI has positioned itself as a crypto infrastructure venture targeted on bringing autonomous “AI brokers” immediately on-chain. Its whitepaper frames the mission as constructing “a trusted and autonomous on-chain intelligence community.”

The venture is beginning with Sui and BNB Chain integrations, providing instruments for agent identification, reminiscence, lifecycle, and agent-to-agent communication.

Its roadmap consists of AlphaX, a signal-driven buying and selling platform the crew says already has lots of of 1000’s of each day customers, together with CorrAI, a no-code quant technique builder, and Truesights, an upcoming information-finance product.

DeAgentAI has secured backing from Web3.com Ventures, SNZ Capital, KuCoin Ventures, Vertex Capital, and Valkyrie Fund.

Technical integrations embody Binance Pockets, OKX Pockets, and Sui Community help, putting it in a rising circle of main crypto infrastructure gamers.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in October2025

What Is DeAgentAI’s Mission With the AIA Token?

As of the newest replace, the AIA worth was altering palms close to $1.50, inside a each day vary of $1.00 to $2.49. Its all-time excessive of $2.49 was recorded on October 2.

(Supply: Coingecko)

Spot buying and selling quantity reached about $200.8 million, with a market cap of roughly $149.7 million and a totally diluted valuation of $1.5 billion.

CoinGecko information confirmed centralized exchanges Bitget, Gate, and MEXC as the primary venues for liquidity

In keeping with PAnewslab, AIA perpetual futures quantity jumped to almost $2.04 billion, briefly overtaking XRP. The spike exhibits robust speculative demand and heavy market curiosity.

Binance listed AIA spot pairs on Alpha at 08:00 UTC on Sept. 18. Thirty minutes later, it added AIAUSDT perpetuals with as much as 50x leverage.

A 24-hour Alpha airdrop window accompanied the rollout, a typical liquidity increase for brand spanking new listings.

The token set contemporary all-time highs on Oct. 2, whereas surging derivatives turnover drove sharp intraday swings into Oct. 3. The volatility attracted each systematic merchants and retail momentum gamers.

A Binance Sq. observe on tokenomics stated traders maintain 21% and the crew 18%, with a one-year cliff adopted by linear releases via 2028.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

AIA Worth Prediction: Is AIA Exhibiting Indicators of a Blow-Off Prime Sample?

DeAgentAI’s token, AIA, has drawn heavy buying and selling curiosity after a pointy worth rally and equally quick correction.

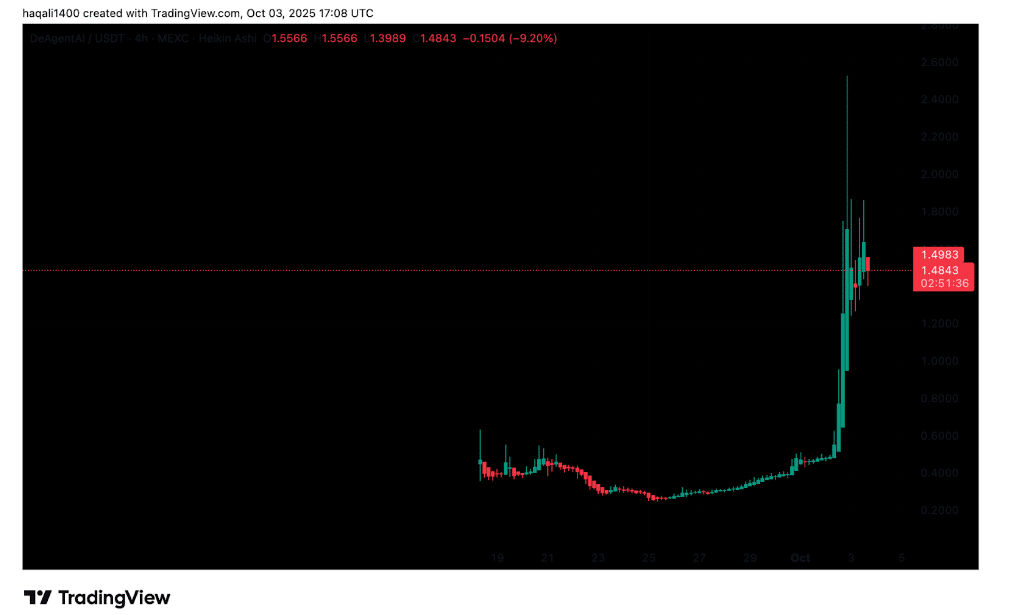

On the 4-hour USDT chart, AIA broke out from a base between $0.20 and $0.40 in late September.

(Supply: AIA USDT, TradingView)

The transfer accelerated into October, lifting the token above $1 and peaking at greater than $2.60 on October 2. At its highest level, it printed an all-time excessive of $2.49 earlier than sliding again.

By the most recent replace, AIA was altering palms close to $1.48, down 9.2% on the session.

The sample on the chart resembles a basic “blow-off high.” Robust inexperienced Heikin Ashi candles confirmed overbought circumstances in the course of the run-up. The next drop under $1.50 alerts profit-taking by early holders.

Even with the pullback, the bigger development nonetheless appears bullish. Clearing the long-term base round $0.40 suggests the token has shifted into a better vary.

Present resistance sits close to $1.80 to $2.00, the place sellers have stepped in a number of instances. Assist has shaped round $1.20. Holding above that degree may carry new consumers, whereas slipping under it dangers a deeper take a look at towards $0.80 to $1.00.

Buying and selling exercise exhibits momentum stays robust. Liquidity is flowing into each spot and derivatives markets, although volatility is excessive.

If bulls push previous $1.80, a retest of the $2.40–$2.60 zone is feasible. Continued promoting, then again, may drag costs nearer to $1.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish What’s DeAiAgent? AIA Worth Prediction After 190% In a single day Pump appeared first on 99Bitcoins.