Typically described as Bitcoin’s youthful sibling, Litecoin is a supply code fork that shares similarities with Bitcoin however gives some distinctive options. Whereas it lacks good contract assist and has much less visibility, LTC stays within the prime 20 cryptocurrencies by market cap. However what’s Litecoin, and the way does it handle to stay resilient amongst hundreds of competing digital property?

How is it totally different from Bitcoin, and the way precisely does it work? This complete information explores the Litecoin ecosystem, its historical past, utility, and relationship with Bitcoin that can assist you make an knowledgeable Litecoin funding resolution.

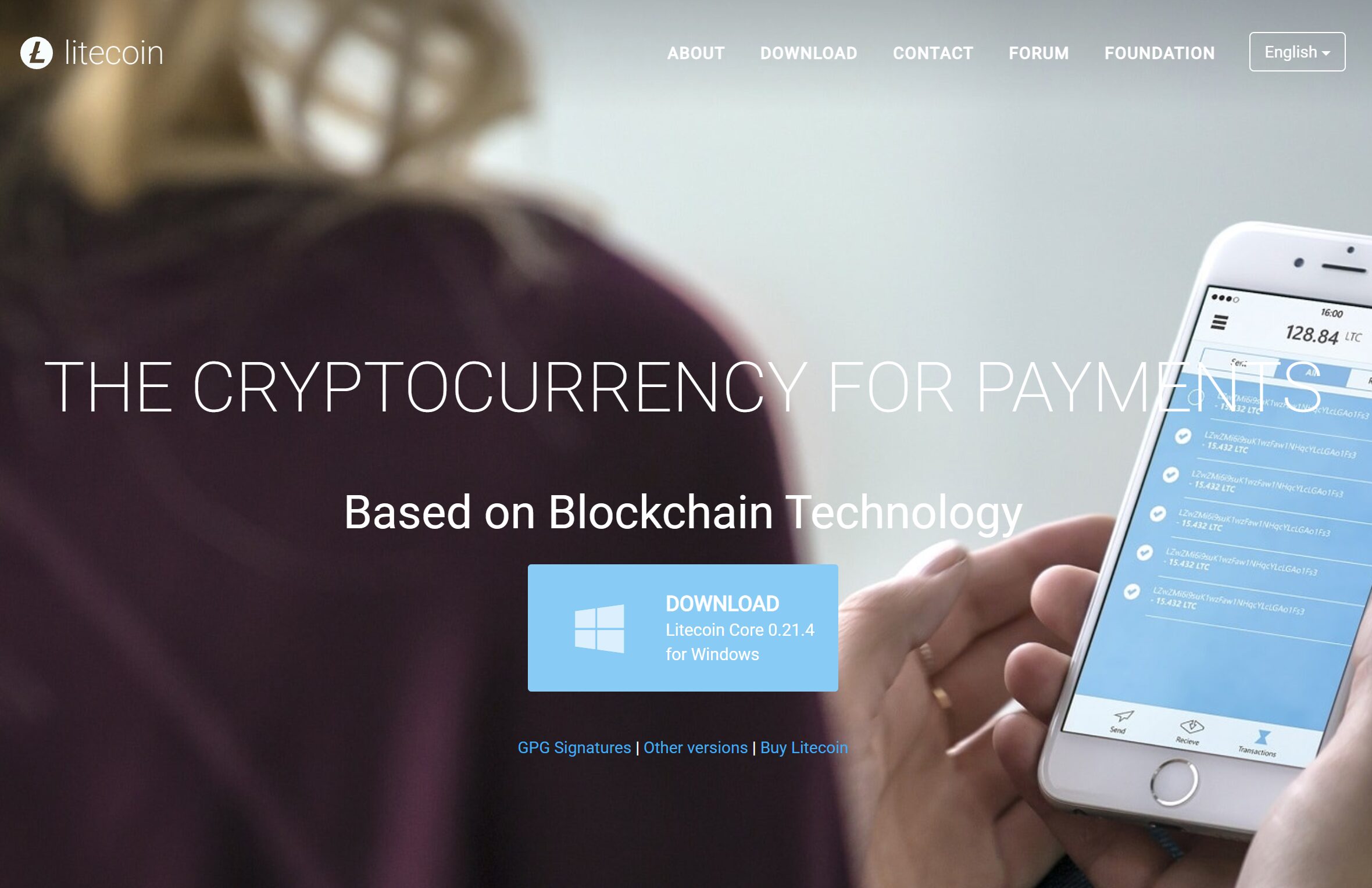

What Is Litecoin (LTC)?

Litecoin (LTC) is a decentralized digital asset that makes use of the proof-of-work consensus mechanism and was designed to function a lighter model of Bitcoin (BTC). Litecoin’s creator, Charles Lee, a former engineer at Google, aimed to handle current points like scalability with the flagship cryptocurrency, primarily specializing in facilitating decrease transaction charges and sooner transaction affirmation.

What Makes Litecoin Distinctive?

In contrast to Bitcoin, which makes use of the SHA-256 algorithm for mining, Litecoin makes use of the lighter Scrypt algorithm. This turns into one of many predominant variations between Bitcoin and Litecoin, guaranteeing that Litecoin mining may be carried out utilizing commonplace {hardware}, thus making it extra accessible to a broader viewers. A number of different elements make Litecoin a novel digital asset, together with the next:

Quicker Transaction Speeds: Among the many predominant variations between Litecoin and Bitcoin is the previous’s speedier block era time, which is 2.5 minutes in comparison with Bitcoin’s 10 minutes. In consequence, Litecoin can verify transactions a minimum of 4 occasions sooner than Bitcoin, making it an excellent selection for making real-time funds on account of utilizing Scrypt, an alternate proof-of-work algorithm.Decrease Transaction Charges: Litecoin’s transaction charges are decrease than Bitcoin’s, which means customers don’t have to fret about charges consuming into their stability when making smaller transactions.Construct Variations: Whereas they’re typically referred to as siblings, they aren’t twins. The place Bitcoin makes use of the SHA-256 algorithm, Litecoin makes use of the lighter Scrypt algorithm, which makes Litecoin mining simpler than BTC mining.Provide: Bitcoin capped its most provide at 21 million cash in comparison with Litecoin’s 84 million cash.

Historical past of Litecoin (LTC)

Since its launch in 2021, Litecoin has had an eventful journey stuffed with turns and twists which have made it probably the most standard and extensively used digital property within the cryptocurrency market. The crypto asset boasts robust group assist and devoted builders who proceed to introduce new options to boost the community’s performance. A few of the most notable milestones in Litecoin’s historical past embody:

October 2011: Litecoin is launched as an open-source undertaking, changing into a Bitcoin different that provides a sooner and lighter possibility reasonably than a alternative. 2017: Segregated Witness (SegWit) will get the nod: In 2017, Litecoin grew to become the primary main crypto community to undertake the Segregated Witness (SegWit) improve, which frees up extra space and helps blockchains sooner by separating signatures from knowledge. 2017: Lightning Community Activation: Quickly after SegWit, Litecoin joined the Lightning Community motion, a Layer 2 (L2) resolution that allows transactions to happen off-chain, leading to sooner, virtually fee-free transactions, making it superb for micro-payments.2019: Litecoin Halving Occasions: Litecoin has halving occasions much like Bitcoin’s, however for LTC, it happens each 840,000 blocks. Throughout halving occasions, the rewards miners get for confirming transactions are diminished by half, thereby decreasing the speed at which new cash are created and including extra shortage into the combination.Newest growth: MimbleWimble Improve – Litecoin’s updates are progressive, with the newest one being the MimbleWimble Growth Blocks, a privacy-focused improve that additional improves scalability whereas conserving transactions extra non-public.

Who Created Litecoin?

Supply: Happycoin

Litecoin is the brainchild of Charles Lee, formally an engineer at Google, who already had some expertise in cryptocurrency points by the point of making LTC. Apart from seeing the potential that Bitcoin had, Lee additionally found there have been nagging points, reminiscent of gradual transaction speeds and excessive transaction charges, which may have been improved.

As a substitute of competing straight with Bitcoin, Lee sought to create an alternate that might handle Bitcoin’s perceived shortcomings and introduce a digital asset that might be much less liable to centralization and extra accessible to the common person. Starting with Bitcoin’s open-source code, Lee made a number of tweaks and changes to the unique code, in the end making a sooner and extra environment friendly cryptocurrency.

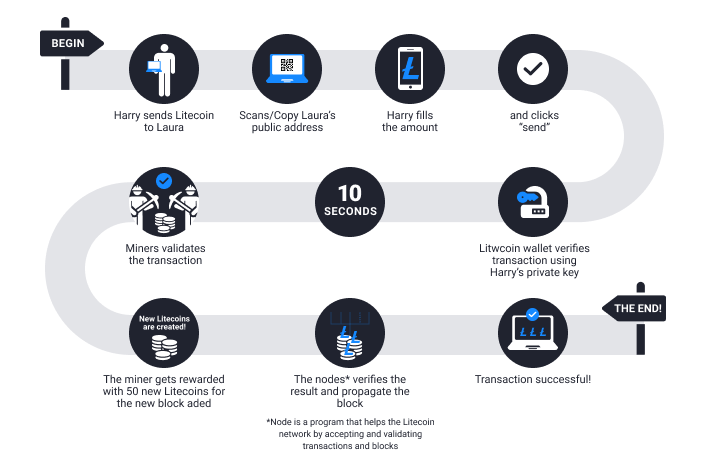

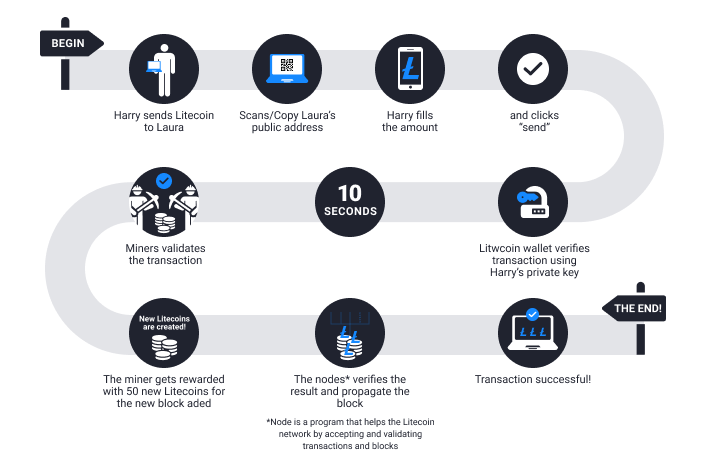

How Does Litecoin Work?

Primarily, Litecoin makes use of a distributed ledger, also called a blockchain, to trace all transactions. The blockchain is everlasting and clear, which means that each one transactions recorded can’t be erased. The community teams transactions into blocks and hyperlinks them collectively earlier than creating a series of blocks. For the reason that system is decentralized, no single entity can management it, which makes it immune to fraud.

Blockchain Fundamentals

The Decentralized Ledger: The LTC Blockchain is maintained by a community of computer systems (nodes) operating the software program worldwide, which checks and shops transaction knowledge, guaranteeing every thing stays intact throughout the community.Proof-of-Work (PoW) Consensus Mechanism: Identical to Bitcoin, Litecoin makes use of the PoW consensus mechanism to safe the blockchain. Miners compete to unravel a difficult mathematical drawback the place the primary individual to crack the code provides a brand new block to the chain and is rewarded with newly minted Litecoin tokens.The Scrypt Algorithm: Litecoin separates its operation from Bitcoin by utilizing the Scrypt algorithm as a substitute of Bitcoin’s SHA-256. The memory-intensive algorithm ensures anybody with commonplace tools can mine Litecoin, in contrast to Bitcoin mining, which requires fancy and costly ASIC miners. This makes Litecoin mining extra of a DIY operation.

Supply: Exmo

Litecoin MimbleWimble Improve

MimbleWimble is a protocol improve that introduces robust safety, privateness, and scalability options, creating a particular means of storing and structuring blockchain-based transactions. The improve presents an fascinating growth within the blockchain house, because it’s a strong standalone protocol that may seamlessly combine with different protocols.

Litecoin built-in MimbleWimble into its operations through the MimbleWimble Extension Block (MWEB) following a analysis interval into its performance till a Litecoin Enchancment Proposal (LIP) licensed it in 2019. The LIP proposed that implementing the MWEB would improve the efficiency of the Litecoin blockchain.

On account of the MimbleWimble Improve, Litecoin customers can opt-in each time they wish to make privacy-focused or nameless transactions, so long as they’ve a pockets or use an trade that helps MimbleWimble. Other than anonymity and privateness, the MimbleWimble improve additionally promotes scalability and fungibility throughout the Litecoin blockchain.

The MimbleWimble Improve positions Litecoin as a privacy-focused possibility amongst different cryptocurrencies, with the potential to draw extra customers preferring privateness and will improve its adoption for each particular person and industrial use. The elevated scalability may additionally make LTC extra environment friendly for day-to-day use, thereby strengthening the token’s utility whereas additionally providing sooner speeds and decrease transaction charges.

How Is the Litecoin Community Secured?

One of many main benefits of Litecoin’s community is using encryption to guard transactions and person knowledge. Through the use of cryptography to safe its community, the blockchain makes it impervious to fraud or hacking makes an attempt. Furthermore, the blockchain’s core know-how facilitates immutability and transparency, enabling customers to confirm transactions independently of any central authority.

Along with blockchain know-how and encryption, Litecoin additionally advantages from a devoted group of cybersecurity consultants and builders who frequently work to watch and improve the community’s security measures. The consultants can be found 24/7 to establish and resolve any vulnerability in actual time, thereby strengthening the blockchain towards cyber threats and assaults.

For the reason that blockchain makes use of the proof-of-work consensus mechanism, the Litecoin community can be secured by miners who actively take part within the block validation course of, making it extra immune to assaults reminiscent of 51% assaults or any type of fraud. Attributable to its huge group of a decentralized community of individuals enjoying totally different roles, LTC appears unlikely to turn out to be a sufferer of any malicious community assaults.

What Is the Litecoin Halving?

Previous halving value efficiency

Working like clockwork, Litecoin halving is designed to happen after each 840,000 blocks, which is roughly each 4 years, based mostly on the blockchain’s 2.5-minute block time. At any time when the halving happens, the rewards provided to miners are reduce in half, which may be in comparison with slowing down the drip of recent cash.

The first objective of Litecoin halving is to scale back the method of making cash over time, thereby mimicking the shortage of valuable property. The concept behind halving is that the less cash there are in circulation, the scarcer they turn out to be and doubtlessly the extra beneficial they turn out to be. The consequences of Litecoin halving embody:

1. Scale back Block Rewards

On the launch of Litecoin, miners obtained 50 LTC for each block they added to the chain. Nevertheless, after every halving, the reward is reduce in half, and the cycle is meant to proceed till all 84 million cash are mined. To see the way it has performed out previously halvings: in 2015, It diminished to 25 LT; in 2019, It diminished to 12.5 LTC; and in 2023, It diminished to six.25 LTC.

2. Scale back mining profitability

Miners get fewer rewards with every mining, which means that mining may get much less worthwhile if LTC’s value doesn’t improve or mining prices don’t cut back.

3. Scale back the availability of Litecoin

Halving controls the availability of LTC, resulting in shortage, which can assist assist its worth over time.

4. Bullish value pattern

Traditionally, halving occasions have persistently led to cost surges, because the discount within the provide of cash excites traders who imagine that the restricted provide may drive up costs.

For the reason that complete provide of Litecoin is capped at 84 million cash, halving occasions ensures that the token’s provide grows slowly and predictably with out ever exceeding the restrict. The managed deflationary course of lends LTC a gold-like enchantment, which in the end makes it a possible retailer of worth.

How Is Litecoin Mined?

Litecoin mining works by organizing blockchain transaction knowledge into blocks, which system individuals generally known as miners can entry at any time. Miners within the ecosystem run mining software program to confirm every block by fixing advanced mathematical puzzles. When a miner efficiently confirms a block, they add it to the blockchain and earn a reward within the type of newly generated LTC cash.

Find out how to Set Up Mining Gear

Customers serious about mining can accomplish that utilizing ASIC mining units that include pre-installed mining software program. Alternatively, you should utilize the usual CUP or GPU, however you must set up your mining software program. Nevertheless, watch out to not set up mining software program containing malware or different malicious software program.

Selection of Mining

After establishing mining tools, you need to select whether or not you’ll work solo or be a part of an current group of miners. Whereas mining alone could possibly be doubtlessly extra profitable, you threat taking a very long time with out ever discovering a block as a result of competitors from miners with stronger mining rigs. Whereas it was attainable to mine utilizing a regular CPU or GPU initially, there’s virtually no probability at present which you can make any cash. Most miners right now be a part of mining swimming pools the place they find yourself dividing the mining rewards based mostly on the hash energy everybody contributed.

Does Litecoin Have Staking?

For customers serious about incomes passive earnings by staking, the excellent news is that Litecoin staking is feasible, however this occurs not directly since LTC makes use of the proof-of-work mechanism as a substitute of the proof-of-stake mechanism related to staking. Customers can nonetheless earn staking rewards on their Litecoin tokens by utilizing third-party or Decentralized Finance (DeFi) platforms like Nexo, the place you may lend LTC and earn curiosity in your Litecoin funding.

Find out how to Stake Litecoin?

The next is a step-by-step course of for staking Litecoin:

1. Step 1: Arrange a Litecoin Pockets

Begin by establishing a pockets, reminiscent of Exodus, Ledger Dwell, or Atomic Pockets, that helps LTC and transfers some cash into it.

2. Step 2: Begin Staking

So long as you’ve got a minimum of 1 LTC in your pockets, you can begin staking by navigating to the staking part and following these steps:

Click on “Stake” and specify the quantity of LTC you wish to stakeSet the staking interval and click on “Affirm.”Watch for staking rewards to start rolling in.

3. Step 3: Monitor Your Staking Rewards

Because the interval progresses, you’ll start incomes extra LTC cash, which you’ll verify by checking your transaction historical past and pockets stability.

What Is Litecoin Used For?

1. On a regular basis Funds: Because of its low charges and quick transaction speeds, Litecoin has turn out to be the go-to different for making crypto-based funds, amongst different makes use of, because the variety of retailers accepting it grows step by step. Whether or not you’re paying for an internet service or some gadgets you purchased at a retailer, LTC gives a quick and inexpensive strategy to full your transaction. For the reason that variety of retailers and shops accepting LTC is on the rise, it’s now simpler to make use of it to finish transactions.

2. Funding Alternatives: Investing in Litecoin is now a beneficial different for these looking for to diversify their portfolio within the cryptocurrency market. Because of its robust group and superior technological basis, they more and more add LTC to their holdings in hopes of boosting returns.

3. Cross-Border Transactions: Litecoin has turn out to be a cheap and environment friendly different for cross-border cash transfers, significantly for people looking for to keep away from the prolonged ready occasions and excessive charges related to conventional strategies of sending cash overseas. With LTC, customers solely want a Litecoin pockets to ship and obtain funds worldwide inside minutes with out worrying about costly overseas trade conversions. The decrease charges make it an interesting selection for cross-border transfers.

Find out how to Use a Litecoin Pockets

After understanding Litecoin which means and its use circumstances, it’s now time to grasp methods to use Litecoin. Earlier than you may purchase LTC cash from a good cryptocurrency trade, you want a suitable Litecoin pockets the place you may retailer your cash. From there, you may simply ship and obtain LTC funds, take part in staking and DeFi actions, or retailer long-term for its worth.

There are several types of LTC wallets accessible in the marketplace, every serving a special objective. These embody {hardware}, software program, and cellular wallets. All the time select a pockets based mostly on its safety, performance, and whether or not it aligns along with your objectives and intentions for holding cryptocurrency.

{Hardware} Wallets: {Hardware} wallets, reminiscent of Ledger Nano X and Trezor, are thought-about the most secure Litecoin wallets since they retailer your non-public keys offline, which means they aren’t vulnerable to hackers. Software program Wallets: Software program wallets, reminiscent of Exodus, Electrum-LTC, and others, may be put in in your laptop computer or PC and provide larger comfort than {hardware} wallets. Nonetheless, they’re much less safe as a result of their web connection. When you select to make use of software program wallets, take additional precautions, reminiscent of utilizing a powerful password or enabling two-factor authentication (2FA).Cellular Wallets: Cellular wallets, reminiscent of Coinomi and Belief Pockets, are apps designed to retailer non-public keys on cell phones. Whereas you should utilize them on the go, they carry a comparatively larger threat since cell phones may be stolen or misplaced. You possibly can safe your cellular Litecoin pockets with a powerful password and keep away from downloading it from questionable sources.

Find out how to Purchase and Promote Litecoin

After studying methods to use Litecoin, our information now reveals you the method of shopping for and promoting LTC, so that you turn out to be geared up to navigate the crypto panorama, particularly in case you’re new to this house. The avenues for getting and promoting Litecoin could differ from apps like PayPal to centralized and decentralized cryptocurrency exchanges.

Shopping for Litecoin

Shopping for Litecoin from a centralized trade is a simple course of, as most exchanges provide intuitive and user-friendly interfaces. Whereas each trade may have a couple of nuances, the method stays largely constant.

Step 1: Create an Account: Begin by signing up for the trade – you’ll be requested to supply some crucial private particulars.Step 2: Full KYC: Subsequent, you must full a Know Your Buyer (KYC) course of to confirm your identification. Step 3: Deposit Funds: Switch cash from cryptocurrency to the trade pockets you simply created.Step 4: Seek for Litecoin: Navigate by the positioning and find the suitable Litecoin buying and selling pair (for instance, LTC/USDT) on the platform.Step 5: Place your Order: Select between shopping for instantly on the present value (Market Order) and setting a most well-liked value (Restrict Order).Step 6: Execute the Transaction: Overview your particulars, and if every thing is appropriate, proceed with executing your order to purchase Litecoin.Step 7: Safe Your Litecoin: When you obtain your LTC, think about transferring your cash to a private Litecoin pockets for added safety.

Promoting Litecoin

Step 1: Selecting Your Promoting Methodology: Resolve whether or not you wish to promote Litecoin on a P2P platform, centralized trade, or direct gross sales.Step 2: Set Up an Account: For a centralized trade, create a verified account by finishing the Know Your Buyer (KYC) course of and establishing two-factor authentication (2FA) for an added layer of safety.Step 3: Transferring LTC to the Alternate: Switch the LTC you wish to promote out of your pockets to the trade. Double-check the receiving handle to make sure there’s no mistake.Step 4: Create a Promote Order: Select between a Marker Order (greatest accessible value) and a Restrict Order (set your most well-liked value.)Step 5: Handle the Transaction: Watch for the order to be executed and wait to your money based mostly on the popular fee methodology you entered.

What to contemplate earlier than shopping for Litecoin?

Before you purchase Litecoin or every other cryptocurrency, you need to keep in mind that crypto property are a brand new type of cash and may be extremely unstable or turn out to be illiquid at any second, making them a high-risk funding. Nevertheless, they’re additionally thought-about the way forward for cash and have the potential to yield a very good return on funding.

Educate your self about Litecoin and the broader cryptocurrency business so you may successfully clarify blockchain know-how and decentralization to household and buddies. You need to be aware of the fundamentals of cryptography so you may perceive what’s taking place within the business at any given time. After getting understood the cryptocurrency business and the way its economics work, ask your self in case you genuinely imagine within the worth of digital property and select whether or not it’s the proper factor for you.

Since there’s nonetheless some degree of uncertainty surrounding crypto buying and selling, think about diversifying your portfolio to incorporate different cryptocurrencies aside from Litecoin and, as a lot as attainable, restrict your Litecoin funding to an quantity you may afford to lose. Lastly, keep in mind that crypto buying and selling is topic to capital good points tax in lots of jurisdictions.

Find out how to Retailer Litecoin

When you’re new to crypto investing, understanding methods to retailer your Litecoin safely is among the most essential steps to contemplate. You want to have a transparent understanding earlier than urgent the “Purchase” button to keep away from your funding journey ending in a setback. All the time select a safe and accessible methodology to maintain your property protected—one easy mistake can lead to the lack of your crypto holdings. There are essential elements to at all times bear in mind to safe your Litecoin.

Be Skeptical of Unsolicited Messages: By no means reply to any messages asking about your pockets info. All the time confirm the supply and by no means click on on any suspicious hyperlinks, as they could possibly be phishing makes an attempt to steal your funds. No cryptocurrency trade will ever ask you about you’re the key part of your pockets or non-public keys.Please again up your Pockets: Create a number of backups of your Litecoin pockets and retailer them in a protected, safe location. Contemplate encrypting your purse for an added layer of safety.By no means Share Your Personal Key: Your seed phrase is the grasp key to your crypto pockets. Sharing it with anybody is akin to handing over management of your crypto property to different folks. Hold your secret phrase confidential and by no means disclose it through textual content or on-line to safeguard your cryptocurrency.Hold Your Machine and Pockets Software program Up to date: Set up common updates for each your gadget and pockets, as outdated software program is vulnerable to hackers and different cybercriminals.

Litecoin vs. Bitcoin: Key variations

Supply: Bitpanda

1. Pace of Transaction: Transaction velocity stays one of many key variations between Litecoin (LTC) and Bitcoin (BTC). The place a median Bitcoin transaction takes 10 minutes, Litecoin will take 2.5 minutes.

2. Mining Algorithms: Bitcoin employs the safe and intensive SHA-256 hashing algorithm, whereas Litecoin makes use of the Scrypt algorithm, which is lighter and sooner, which means it’s attainable to mine Litecoin utilizing commonplace CPUs or GPUs.

3. Provide Limits: The whole provide of Bitcoin is capped at 21 million, whereas Litecoin is capped at 84 million.

4. Efficiency and Adoption: By way of efficiency, BTC leads in market capitalization and adoption, whereas Litecoin nonetheless struggles with adoption, though its low charges make it superb for day-to-day use.

Advantages of Utilizing Litecoin

Quicker transaction occasions: In comparison with BTC, Litecoin generates blocks extra shortly, permitting customers to verify transactions sooner and full funds with ease.Scalability: Litecoin’s bigger most provide processes extra transactions effectively. Its scalable design makes it a powerful candidate for mainstream adoption.Lively growth group: The Litecoin Basis has a group of builders consistently working to detect and repair any points as they seem, along with frequently enhancing the community’s efficiency by implementing new options.Widespread acceptance: Many new retailers are accepting LTC as a type of fee for items and companies, which make it an excellent selection for many who intend to spend cryptocurrency.

Dangers of Investing in Litecoin

Much less safe: The draw back of the sooner block time is that it makes the Litecoin community vulnerable to double spending and poses a safety threat to customers.

Market volatility: Litecoin, like all different cryptocurrencies, is topic to market fluctuations, which regularly result in vital value swings, making it a comparatively dangerous funding.Competitors: Different altcoins, reminiscent of XRP and Ethereum, are giving Litecoin stiff competitors, which may have a destructive affect on its progress potential.Restricted use circumstances: Litecoin has restricted use circumstances in comparison with different cryptocurrencies, which may hinder its widespread adoption sooner or later.Regulatory Uncertainty: Whereas constructive adjustments are rising within the crypto regulatory panorama, the present regulatory atmosphere can affect the LTC’s use and adoption.

Does Litecoin Have a Future?

Litecoin has offered itself as a sooner and extra accessible cryptocurrency, competing with Bitcoin. Regardless of the challenges, reminiscent of the dearth of good contracts and diminished relevance, that LTC at present faces, it has remained resilient as a quick and cost-effective different to extra established cryptocurrencies. Litecoin strikes a stability between effectivity and decentralization whereas selling interoperability, positioning itself as a powerful contender within the aggressive crypto market.

Fortunately, the Litecoin group and growth group stay steadfast in pushing the undertaking’s agenda of constructing cryptocurrency use sensible and accessible to everybody, along with its potential as a viable retailer of worth. Sadly, the coin’s restricted presence on decentralized finance (DeFi) and decentralized exchanges (DEXs) has restricted its utility and made it unavailable to rising functions.

Nevertheless, given the robust growth group behind the undertaking, it’s more likely to proceed innovating, doubtlessly resulting in widespread adoption of Litecoin quickly.

FAQs

Is Litecoin a very good funding?

Litecoin gives decrease transaction charges, sooner speeds, and a confirmed monitor file. Nonetheless, it scores low on adoption and distinctive options regardless of being one of many oldest altcoins. Nevertheless, many consultants imagine LTC has a powerful future within the cryptocurrency market although it could not have the ability to compete with Bitcoin.

How Many Litecoin (LTC) Cash Are There in Circulation?

Based on CoinMarketCap, as of June 28, 2025, Litecoin at present ranks twentieth and has a stay market capitalization of $6.5 billion. The token’s present circulating provide is 76.01M LTC and a most provide of 84 million LTC cash.

How a lot is $1 LTC to USD?

Based on CoinGecko, the present value of 1 LTC is LTC in June 28, 2025.

The place Can You Purchase Litecoin (LTC)?

There are a number of cryptocurrency exchanges the place you should buy, promote and commerce Litecoin. Nevertheless, you must conduct some analysis to discover a platform that fits your objectives and buying and selling preferences so you may get pleasure from a easy buying and selling expertise. Contemplate elements reminiscent of charges, strong safety, and user-friendly options when searching for a spot to purchase LTC.

Will Litecoin attain $100?

LTC has just lately closed close to the $100 resistance degree, and it seems to have rejected that value for the final two years, preferring to remain close to the $91 to $95 space that beforehand pushed the value a lot decrease. Analysts imagine the push towards the $100 stays low until the value strikes above the present order block.

Is Litecoin a Fork of Bitcoin?

Litecoin is an altcoin and a fork of Bitcoin. It’s builds on the identical underlying blockchain and verification methodology as Bitcoin, however introduces a couple of minor variations.

What Will Litecoin Be Price in 5 Years?

Based on a number of analysts and the consensus scores from Binance Alternate customers, consultants predict Litecoin may climb to a minimum of $123.29 throughout the subsequent 5 years.