Key Takeaways:

Bhutan transferred over $38.5 million in Bitcoin to Binance, strategically promoting 350.74 BTC throughout 10 days as costs hit all-time highs.With 11,711 BTC price $1.3 billion nonetheless in reserve, Bhutan stays one of many largest sovereign holders of Bitcoin, signaling long-term dedication.Backed by clear power and coverage foresight, Bhutan’s Bitcoin strikes replicate profit-taking and treasury optimization, not panic.

As Bitcoin crossed the $112,000 mark for the primary time in historical past, the Kingdom of Bhutan made a daring transfer. Its sovereign wealth fund quietly transferred tons of of Bitcoin to Binance, sparking international debate. Is that this a sell-off or a masterclass in digital asset technique?

Bitcoin in Bhutan: How A lot Does This Nation Maintain?

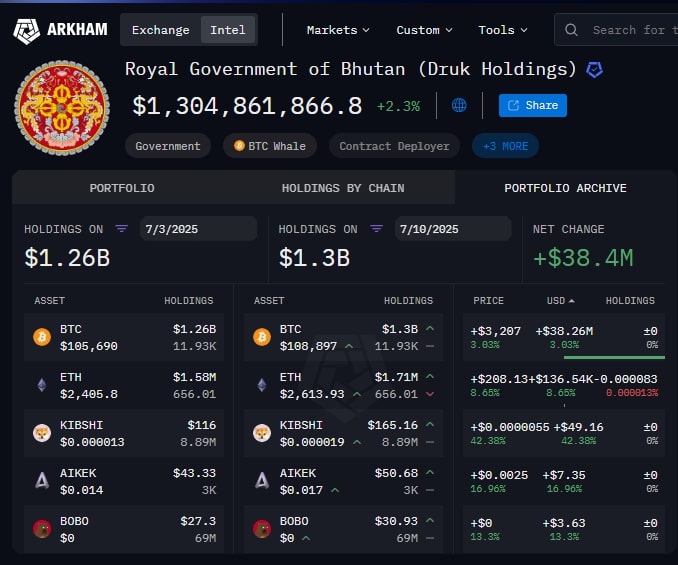

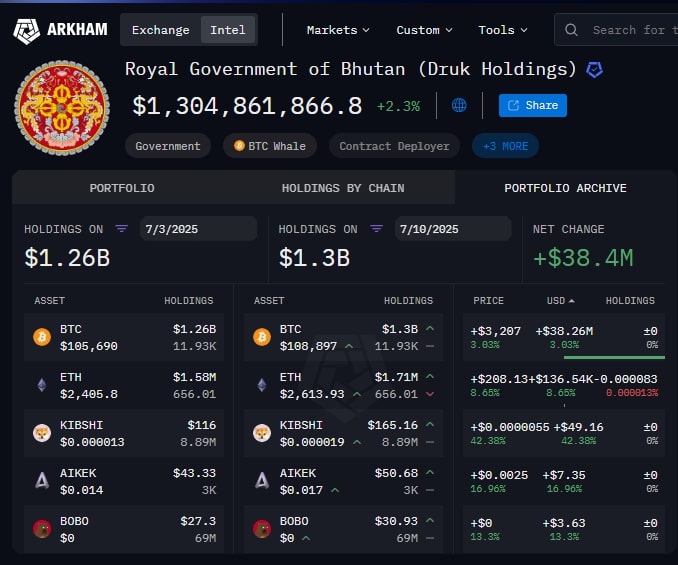

Whereas most governments are nonetheless debating crypto regulation, Bhutan has already constructed one of many world’s largest sovereign Bitcoin portfolios, now price over $1.3 billion. In keeping with Arkham Intelligence, the Royal Authorities of Bhutan, by Druk Holding & Investments (DHI), holds about 12,000 BTC, in addition to smaller reserves of Ethereum, BNB and Polygon.

Since 2019, the nation has mined or in any other case acquired greater than 13,000 BTC, thanks partly to the nation’s ample hydroelectric energy, which it has used to run power-efficient mining operations. Whereas for different nations mining is both banned or closely restricted and controlled due to environmental issues, Bhutan took crypto on board as one of many pillars of a inexperienced improvement technique.

The turning level got here in 2023 when Bhutan teamed up with Singapore’s Bitdeer to create a 600-megawatt mining middle in Gedu to offset a failed $1 billion infrastructure scheme. At the moment the positioning is a big contributor to Bhutan’s nationwide crypto reserves and in addition exports hash energy to the worldwide market.

From Secrecy to Technique

For years, Bhutan’s Bitcoin involvement flew beneath the radar. However latest on-chain knowledge reveals the dominion is just not solely holding however actively managing its crypto portfolio, adjusting to market circumstances like all seasoned investor.

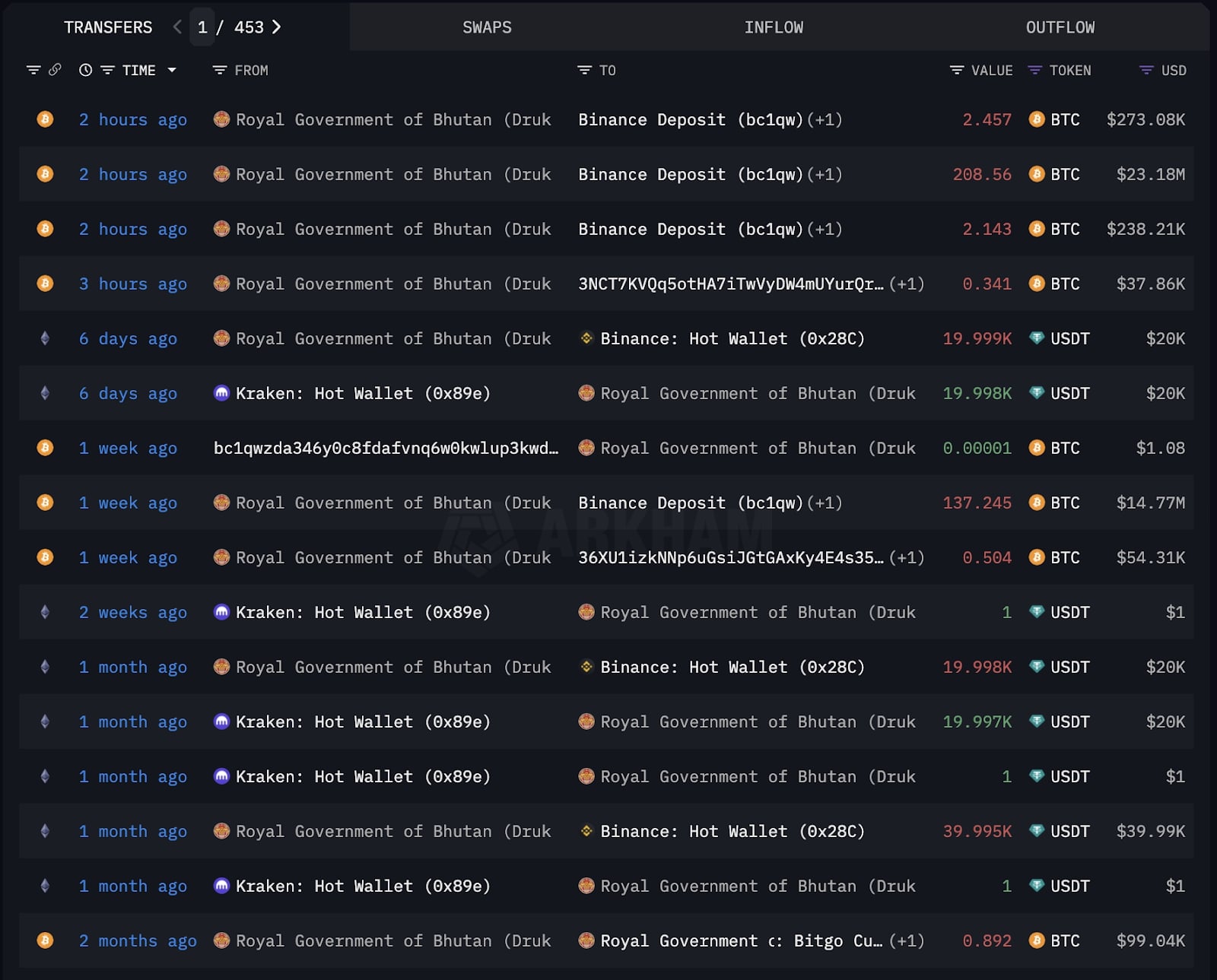

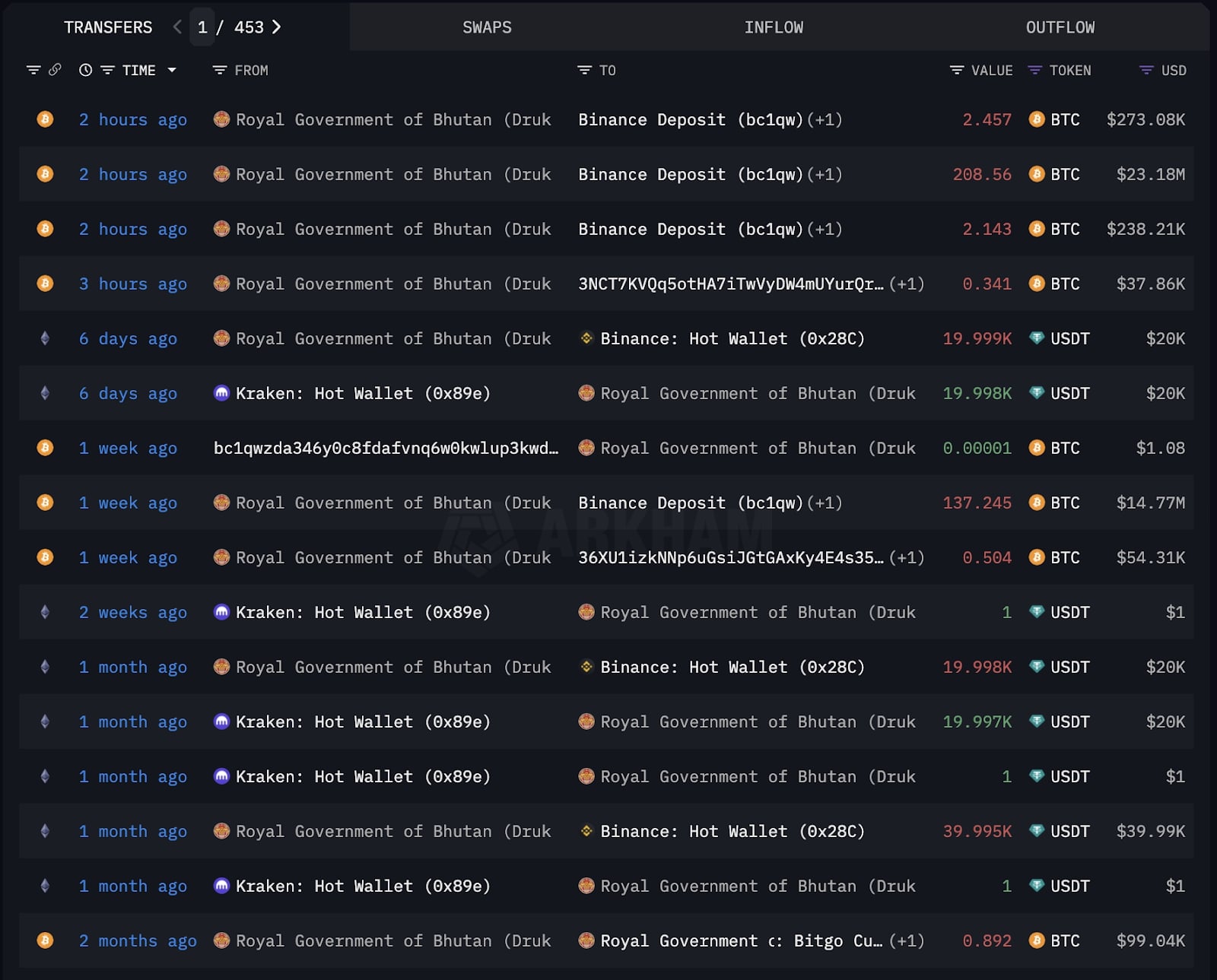

Between July 3 and July 10, 2025, Bhutan’s total portfolio worth jumped from $1.26B to $1.304B, pushed by Bitcoin’s rally. Regardless of transferring over 213 BTC price $23.73M to Binance throughout that interval, the overall holding remained the identical, indicating inner pockets reshuffling or freshly mined property.

Why Did Bhutan’s Authorities Determine to Promote Bitcoin?

Bhutan’s actions might look abrupt, however they align with 4 clearly identifiable motives:

1. Bitcoin Hits an All-Time Excessive

When Bitcoin climbed to greater than $112,000, Bhutan cashed in. Giant volumes moved to the hub and the stress they triggered, are indicative of panic taking income, not dumping. That’s a far cry from the final time Germany bought BTC at $53,000, an quantity that their treasury now is aware of it missed out on $2 billion price of good points.

Bhutan, in contrast, bought on the prime. Opportunism like this isn’t simply the results of good luck, however of market intelligence and strategizing.

2. Funding Nationwide Tasks

Bhutan’s digital gold isn’t hoarded, it’s reinvested. Proceeds from latest gross sales are possible being redirected to infrastructure, schooling, and healthcare initiatives. This follows a sample seen in previous transfers, the place BTC liquidations coincided with funds cycles and native undertaking launches.

This mannequin, convert BTC good points into tangible public worth, makes Bhutan one of many few nations utilizing cryptocurrency as an operational asset, not only a speculative one.

3. Treasury Diversification and Liquidity

Shifting BTC on to Binance implies that Bhutan is hedging itself. It might probably reallocate into BTC or make a stablecoin or fiat hedge with perpetual contracts to take away the chance of market fluctuations. Now that crypto accounts for greater than 40% of the scale of Bhutan’s GDP, managing danger is essential.

Learn Extra: Bhutan Secretly Mines $1.3B in Bitcoin—Now Holds Practically 40% of Its GDP in BTC

These are the actions that recommend the presence of a well-tailored treasury administration system (as giant monetary establishments do, however being employed in a nationwide context in Bhutan).

4. Making ready for Blockchain Ecosystem Improvement

The nation is just not solely storing or promoting crypto, it’s constructing an ecosystem round it. Bhutan has launched crypto tourism pilot applications by partnerships with Binance Pay and DK Financial institution, permitting over 100 native retailers to simply accept digital funds.

Learn Extra: Crypto Journey Skyrockets: 80% of $100M+ Bookings on Travala Paid with Digital Belongings

As well as, Gelephu Mindfulness Metropolis, a brand new financial zone, is incorporating BTC, ETH, and BNB into its official reserves. Bhutan’s crypto gross sales could possibly be fueling the foundational infrastructure for this next-gen good area.

How the Sale Was Executed

Fairly than a bulk offload, Bhutan’s BTC was moved to Binance in 1price $23.73 million, had been transferred in a number of transactions. The biggest, $23.18 million, landed simply two hours earlier than the market’s each day shut.

Arkham Intelligence confirms that that is a part of a multi-week sample. Since June, Bhutan has bought no less than 1,696 BTC at a mean of $81,999, capitalizing on rallies and changing good points.

Critically, even after these gross sales, Bhutan nonetheless holds 11,711 BTC, putting it simply behind the U.S., China, and the U.Okay. in sovereign crypto rankings. This retention confirms that Bhutan is just not exiting crypto, it’s evolving the way it makes use of it.

Bhutan’s Sensible Cash Technique vs. Different Nations

Whereas Bhutan is praised for its precision, not all governments are managing crypto this properly.

Germany bought almost 49,858 BTC at $53,000, incurring a $2B alternative loss.El Salvador, alternatively, has pledged by no means to promote. Whereas noble in intent, its buy-and-hold-only coverage lacks flexibility.

Bhutan sits between these extremes. It mines, holds, and sells selectively, treating Bitcoin as each a long-term reserve and an lively funding instrument. This mannequin might change into a blueprint for smaller nations trying to enter the digital financial system with out risking monetary stability.

What’s Subsequent for Bhutan’s Bitcoin Coverage?

Bhutan’s technique is removed from over. As market observers await the following transfer, a number of prospects emerge:

Continued promoting at worth peaks, particularly if BTC approaches the $120K–150K vary forecasted by analysts.Growth of blockchain-powered providers like tourism funds, digital id, and authorities finance.World collaboration with crypto corporations searching for inexperienced mining companions or regulatory sandboxes.

Bhutan might quickly change into a regional crypto hub, providing a uncommon mix of regulatory stability, clear power, and forward-looking coverage.