Gold ($GOLD) has at all times been a logo of wealth and stability, however its current efficiency has captured the eye of traders worldwide. The valuable steel has surged to a historic excessive of $3,000 per ounce, marking a powerful 50% enhance over the previous 12 months. This outstanding rally has left many questioning: what’s driving this surge, and may traders think about including gold to their portfolios? On this article, we’ll discover the components behind gold’s rise, its function as a protected haven, the potential dangers, and the way traders can strategy this asset in at the moment’s unsure financial local weather.

Gold’s Historic Rally: Breaking Data

Gold’s ascent has been nothing wanting extraordinary. Over the previous 12 months, the worth of gold has climbed by 50%, reaching an all-time excessive of $3,000 per ounce. This surge has defied conventional financial indicators that may usually weigh on gold costs, equivalent to declining inflation, a powerful U.S. greenback, and elevated rates of interest. So, what’s behind this unprecedented rally?

Why Gold is Rising Towards the Odds?

Gold’s current efficiency is especially intriguing as a result of it contradicts a number of financial developments that often suppress its value. Let’s break down the important thing components driving this surge:

Uncertainty as a Catalyst

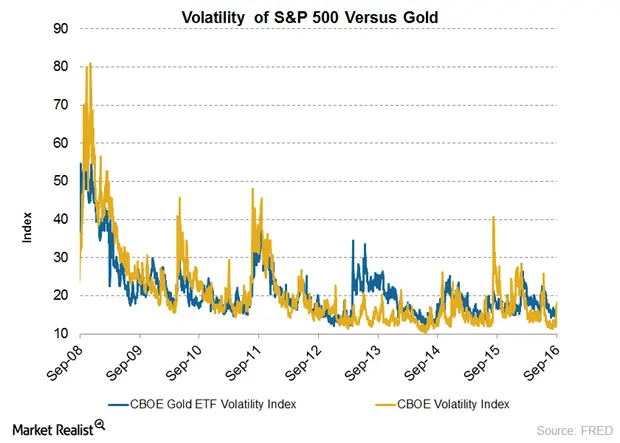

Gold has lengthy been thought of a “protected haven” asset, which means traders flock to it throughout occasions of uncertainty. At this time, the world is grappling with an ideal storm of political, geopolitical, and financial instability. From escalating commerce tensions to unpredictable coverage shifts, the worldwide panorama is rife with dangers. In such an setting, gold turns into a dependable retailer of worth, providing safety towards volatility in different asset courses like shares and bonds.

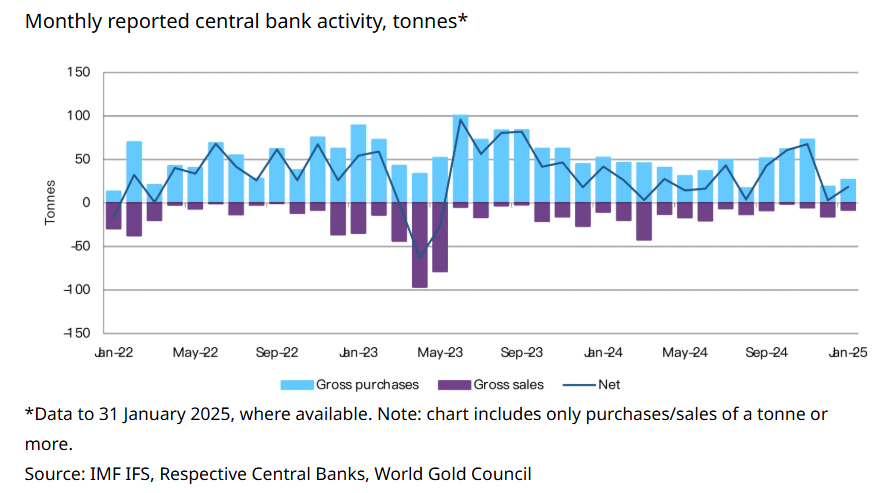

Central Banks’ Gold Rush

One other main driver of gold’s rise is the aggressive accumulation of gold reserves by central banks worldwide. Nations like China, Russia, and Iran have been stockpiling gold at an unprecedented fee. This development has intensified in response to the specter of U.S. sanctions, which regularly leverage the dominance of the U.S. greenback in world commerce and finance. By rising their gold reserves, these nations intention to cut back their reliance on the greenback and insulate themselves from potential monetary or commerce wars.

Contradictory Financial Indicators

What makes gold’s rally much more fascinating is that it’s occurring regardless of a number of financial circumstances that may usually dampen its enchantment:

– Falling Inflation: Gold is historically seen as a hedge towards inflation. Nonetheless, inflation charges have been declining in lots of elements of the world, but gold continues to rise.

– Sturdy Greenback: Traditionally, gold tends to carry out properly when the U.S. greenback weakens. This time, nonetheless, gold is climbing even because the greenback stays robust.

–Excessive Curiosity Charges: Gold doesn’t generate yield, making it much less enticing in a high-interest-rate setting. But, demand for gold stays strong regardless of elevated charges.

These contradictions spotlight gold’s distinctive function as a monetary asset. Whereas it might not at all times observe standard financial logic, its worth as a protected haven and retailer of wealth continues to resonate with traders.

The Dangers of Investing in Gold

Whereas gold’s current efficiency has been spectacular, it’s essential for traders to know the potential dangers related to this asset. Gold shouldn’t be with out its drawbacks, and its value could be influenced by quite a lot of components that will result in volatility or losses.

Worth Volatility

Gold costs could be extremely risky, experiencing sharp fluctuations over quick intervals. Whereas it’s usually seen as a secure asset, exterior components equivalent to modifications in rates of interest, foreign money actions, or shifts in investor sentiment can result in important value swings. Buyers needs to be ready for the potential of sudden declines, particularly if financial circumstances stabilize or enhance.

No Yield or Earnings

In contrast to shares or bonds, gold doesn’t generate any revenue, dividends, or curiosity. Its worth is solely primarily based on value appreciation, which implies traders rely totally on market demand to comprehend features. In a high-interest-rate setting, this will make gold much less enticing in comparison with yield-generating property.

Geopolitical and Market Dangers

Whereas gold is usually seen as a hedge towards geopolitical dangers, these identical dangers can even influence its value unpredictably. For instance, if tensions ease or world markets stabilize, demand for gold as a protected haven could decline, main to cost corrections. Moreover, modifications in central financial institution insurance policies or large-scale promoting of gold reserves by establishments can even have an effect on its worth.

Storage and Liquidity Issues

For these investing in bodily gold, storage and liquidity could be important challenges. Storing gold securely usually incurs further prices, and promoting bodily gold could be much less handy than buying and selling different property like shares or ETFs. Furthermore, bodily gold could carry premiums or reductions relying on market circumstances, which may influence returns.

Speculative Nature

Gold is usually topic to speculative buying and selling, which may amplify value actions. Whereas this will result in important features, it additionally will increase the chance of losses, notably for short-term traders. Lengthy-term traders ought to rigorously think about whether or not gold aligns with their total monetary targets and threat tolerance.

Ought to You Put money into Gold?

Given gold’s spectacular efficiency, many traders are questioning whether or not they need to add it to their portfolios. The reply depends upon your monetary targets, threat tolerance, and funding technique.

Gold as a Monetary Anxiolytic

For some traders, gold serves as a type of monetary insurance coverage. If holding gold gives you with peace of thoughts throughout turbulent occasions, consultants advocate allocating a small portion of your portfolio usually 2-3% to the dear steel. This modest allocation can act as a hedge towards market volatility and financial uncertainty.

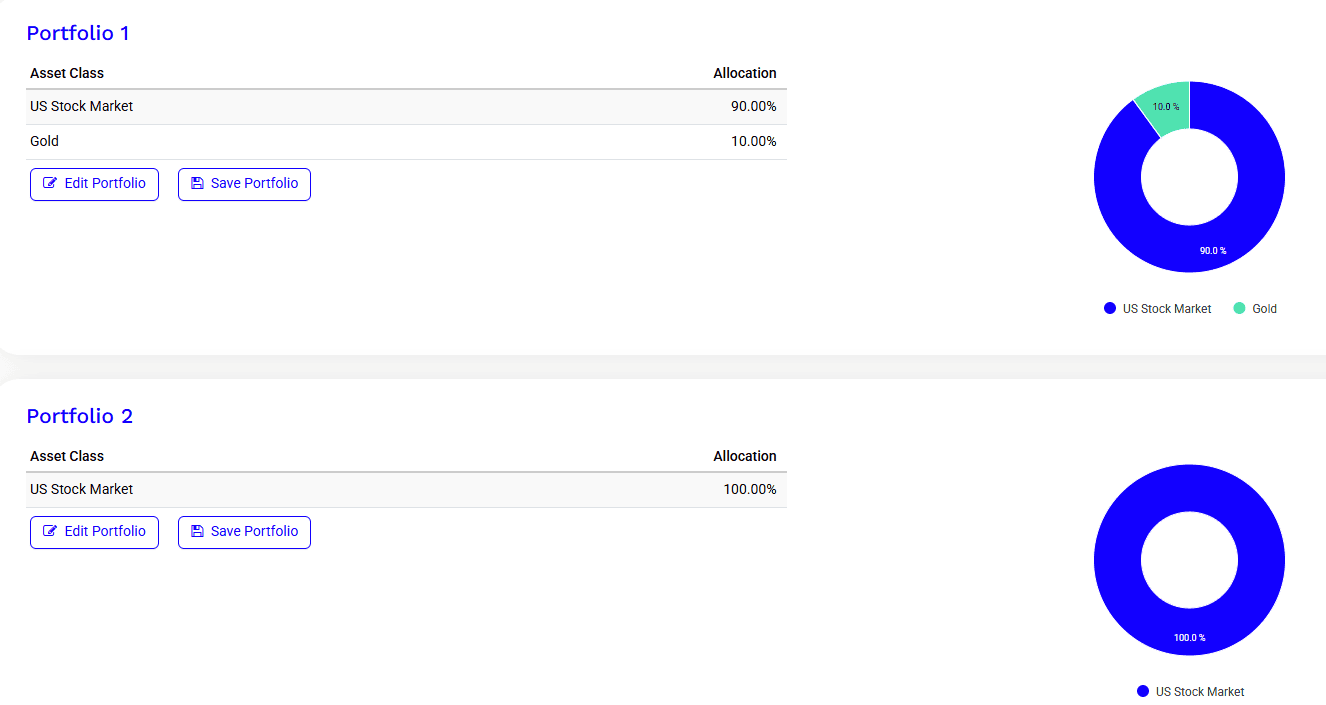

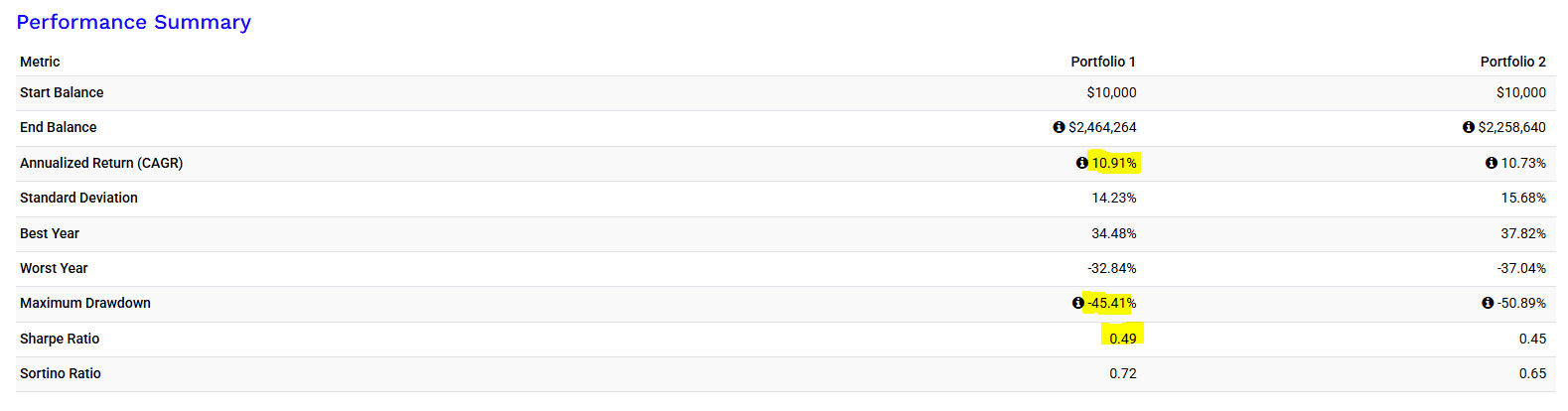

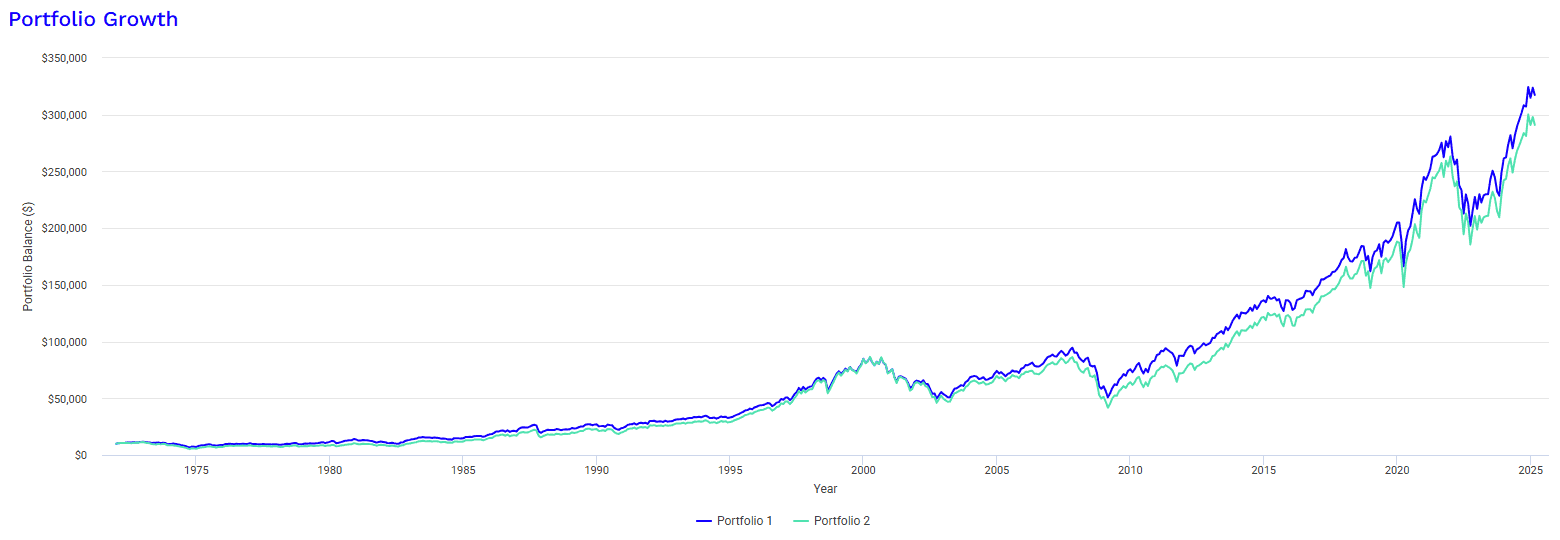

As an instance this, let’s examine two portfolios: one with 100% U.S. shares and one other with 90% U.S. shares and 10% gold. Since 1972, the portfolio with 10% gold has outperformed the all-stock portfolio, delivering an annual return of 10.91% in comparison with 10.73%. Furthermore, the gold-included portfolio has proven decrease threat, with a most drawdown of 45.41% versus 50.89% for the all-stock portfolio. This demonstrates how including gold can improve returns whereas lowering threat over the long run.

Warning Suggested

Whereas gold has its deserves, it’s essential to strategy it with warning. Gold is a speculative asset, and its value can expertise sharp corrections. In contrast to shares or bonds, gold doesn’t generate revenue or dividends, making it purely a play on value appreciation. As such, it’s greatest suited to traders who perceive its dangers and are comfy with its volatility.

Tips on how to Put money into Gold

For those who’re contemplating including gold to your portfolio, there are a number of methods to take action. Every methodology has its execs and cons, so it’s essential to decide on the one which aligns along with your funding targets and preferences.

Bodily Gold

Bodily gold consists of gold bars and cash, which could be bought from banks, specialised sellers, or numismatists. Whereas proudly owning bodily gold could be satisfying, it comes with some challenges:

– Storage: Bodily gold requires safe storage, which could be pricey and inconvenient.

– Liquidity: Promoting bodily gold could be extra cumbersome than promoting different forms of investments.

– Premiums: Cash, particularly, usually carry premiums on account of their collectible worth, making them much less correlated with the worth of gold itself.

Paper Gold

For many traders, paper gold is a extra sensible and cost-effective choice. This class consists of:

– ETFs (Trade-Traded Funds): Gold ETFs ($GLD) monitor the worth of gold and could be purchased and offered like shares. They provide excessive liquidity and low prices.

– Certificates: These signify possession of a certain amount of gold saved by a monetary establishment.

– Gold spot foreign exchange like right here on Etoro ($GOLD):

– Mining Shares: Investing in corporations that mine gold can present publicity to the steel, however these shares are additionally influenced by company-specific components and market circumstances.

($GOLD.BARRICK)

Paper gold is mostly simpler to handle and extra accessible than bodily gold, making it a well-liked alternative for each particular person and institutional traders.

The Way forward for Gold: What to Count on

As we glance forward, gold’s outlook stays carefully tied to world financial and geopolitical developments. If uncertainty persists—whether or not on account of commerce tensions, political instability, or monetary market volatility gold is more likely to keep its enchantment as a protected haven. Moreover, the continuing accumulation of gold by central banks may present additional assist for its value.

Nonetheless, traders ought to stay vigilant. Gold’s value could be risky, and its efficiency is influenced by a fancy interaction of things. Whereas it may be a beneficial addition to a diversified portfolio, it’s not a one-size-fits-all resolution.

Conclusion: Shining Vivid in Turbulent Instances

Gold’s current surge to a document excessive of $3,000 per ounce underscores its enduring function as a protected haven in turbulent occasions. Regardless of defying conventional financial indicators, the dear steel continues to draw traders in search of stability and safety towards uncertainty. Whether or not by means of bodily gold or paper devices, gold could be a beneficial addition to a diversified portfolio nevertheless it needs to be approached with care and moderation.

Because the world navigates ongoing geopolitical and financial challenges, gold’s attract is unlikely to fade anytime quickly. For traders, the secret’s to know its distinctive traits, weigh the dangers and rewards, and make knowledgeable choices that align with their monetary targets. In an unpredictable world, gold stays a timeless asset, providing each safety and alternative for individuals who know harness its potential.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

![Best Altcoins Under $1 in 2025 [March] – Top Crypto Picks Best Altcoins Under $1 in 2025 [March] – Top Crypto Picks](https://i3.wp.com/changelly.com/blog/wp-content/uploads/2025/02/best-altcoins-under-1.png?w=350&resize=350,250&ssl=1)