Stellar Lumens hit a crucial help degree this week at $0.20, placing the token in a precarious spot. At that value, XLM sits 30% beneath its peak in Might and 60% below its 2024 excessive.

Associated Studying

Primarily based on experiences, bears have been piling on, pushing the funding price into unfavorable territory since early June. If that help provides method, merchants warn XLM may slide towards $0.15, a drop of about 35%.

Community Exercise Up

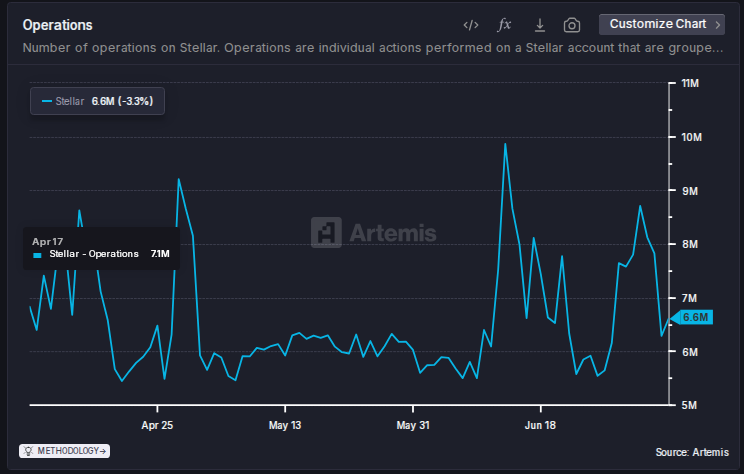

In accordance with Artemis, operations on the Stellar community surged to 197 million in June. Stablecoin provide additionally reached a report $667 million.

Over the previous 5 months, the entire worth locked in actual‑world asset tokenization grew to $487 million, helped by new choices such because the Franklin OnChain US Authorities Cash Market Fund. These figures counsel wholesome demand for on‑chain providers and asset tokenization inside Stellar’s ecosystem.

Funding Charges Down

Funding charges in perpetual futures have been unfavorable most days since Might. Meaning extra brief positions than lengthy ones, with brief merchants paying lengthy merchants to maintain their bets in place.

XLM’s funding price hit its lowest level since June 30, pointing to rising bearish sentiment. When funding charges keep deep within the purple, it usually provides promoting stress as merchants brace for steeper losses.

The picture above exhibits that XLM funding charges are down on most main exchanges, significantly for stablecoin-margined pairs, knowledge from Coinalyze exhibits.

On‑Chain Progress Clashes With Market Temper

Nansen knowledge exhibits the variety of transactions rose by 11% over the past seven days to 182 million. Energetic addresses climbed 10% to 146,700 in the identical span.

Even so, value motion has ignored these features. XLM fell beneath its 50‑day and 100‑day Exponential Transferring Averages, and momentum seems to favor sellers.

Some market watchers counsel that deep unfavorable funding may set off a brief squeeze, turning sentiment round if shorts rush to cowl.

Chart Patterns Warn Of Drop

The each day chart reveals a descending triangle sample, with $0.21 forming the decrease trendline. That degree additionally marked April’s lows when altcoins broadly bought off.

XLM has slipped beneath the 60% Fibonacci Retracement zone, the place many merchants count on a bounce. A clear break below the triangle may unleash algorithm‑pushed orders, sending value towards $0.15.

Associated Studying

In the meantime, Stellar’s fundamentals look strong, however technical alerts stay bearish. Merchants and holders ought to watch that $0.21 line. A robust rebound there may restore confidence in on‑chain power.

On the flip facet, a slide by means of help might spark quicker losses. Both method, XLM’s close to‑time period path hinges on that key degree.

Featured picture from Meta, chart from TradingView