We love predictions… What is going to occur sooner or later? Discovering the reply to this query is inherent to us as people, as we wish to keep away from uncertainty as a lot as potential.

The yield curve evaluation is an interesting topic usually used as an indicator to sign financial slowdowns. However what precisely is it, and why must you care?

Merely put, the yield curve is a chart that plots rates of interest of bonds of various maturities. When the curve inverts, short-term rates of interest turn into greater than long-term ones. This has traditionally foreshadowed financial downturns.

What Is Yield Curve Inversion?

The yield curve is a graphical illustration of rates of interest throughout totally different bond maturities. The conventional expectation is that bonds with longer maturities will obtain greater rates of interest.

This compensates traders for the totally different dangers concerned in lending out their cash. The longer the interval, the larger the dangers of inflation, financial uncertainty, and credit score default turns into.

Supply: https://corporatefinanceinstitute.com/assets/fixed-income/inverted-yield-curve/

This indicator was launched in 1986 by Professor Campbell Harvey of Duke College, as he acknowledged a constant sample: each time the yield curve inverted, a recession tended to comply with inside 12 to 18 months.

Through the years, this sample has been noticed throughout a number of financial cycles, making the yield curve inversion a key software for analysts, traders, and policymakers.

What Does Inversion Imply?

A yield curve inversion happens when short-term bonds yield greater than long-term bonds. This example can occur for varied causes, together with the next:

Investor Sentiment: When traders are unsure in regards to the future, they usually want the security of long-term bonds. This elevated demand pushes long-term yields down, which may contribute to an inversion.

Inflation Expectations: If traders anticipate decrease inflation sooner or later, they might be extra keen to lock in long-term yields, driving these yields decrease relative to short-term charges. Then again, if inflation is anticipated to rise within the close to time period, short-term charges is likely to be adjusted upward by policymakers.

Financial Outlook: A persistent inversion could sign that market members anticipate financial progress to decelerate, probably resulting in a recession.

A simple metric: 10-year vs 2-year unfold

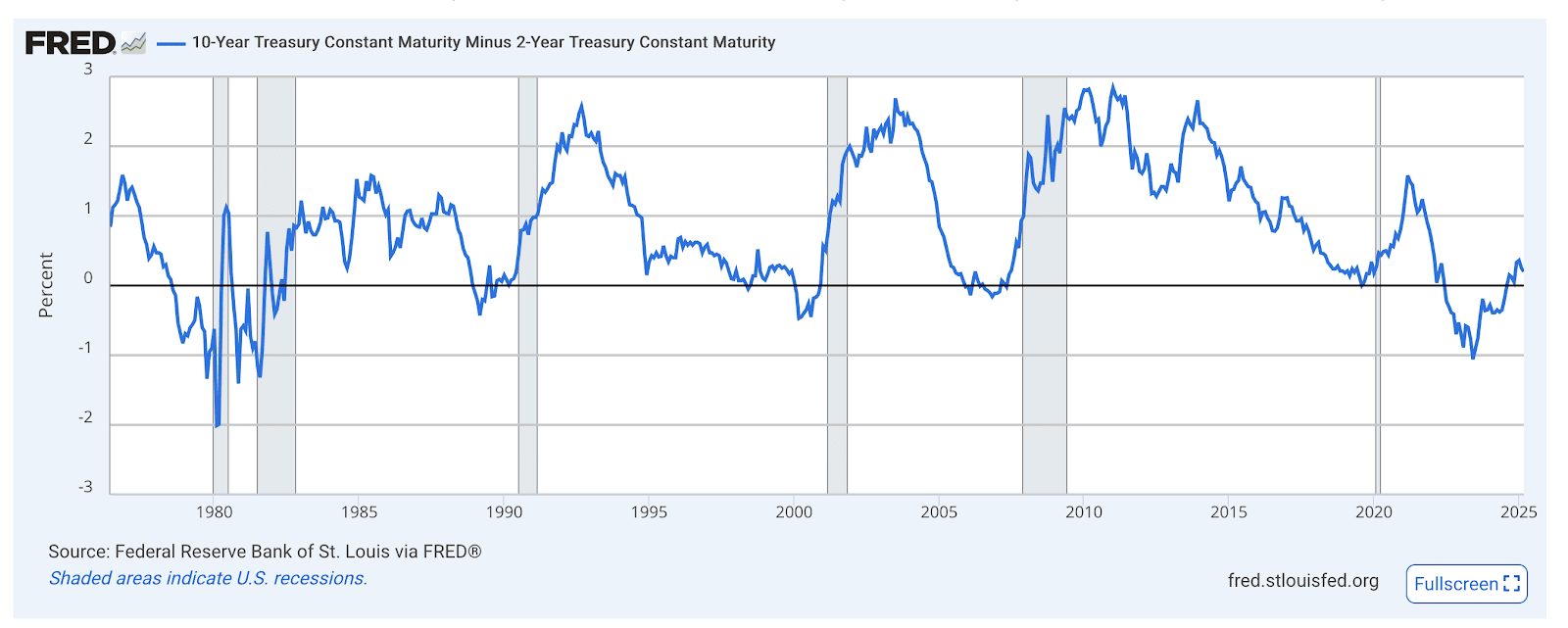

The preferred metric available in the market is the unfold between 10-year and 2-year U.S. Treasury yields, as a result of it gives a transparent snapshot of financial expectations.

The two-year yield immediately displays the Fed’s short-term rate of interest strikes, whereas the 10-year yield provides perception into long-term progress and inflation. When the 10-year yield drops under the 2-year, it indicators warning.

This straightforward metric helps traders steadiness short-term coverage impacts with long-term financial outlooks.

The blue line within the graph under represents this distinction in yields. Something under the black line indicators inversion, and gray areas point out recessions.

Supply: https://fred.stlouisfed.org/collection/T10Y2Y

Is the Yield Curve Nonetheless Related In the present day as an indicator?

Whereas the yield curve has traditionally been a dependable recession predictor, the worldwide financial panorama is consistently evolving. Elements corresponding to world commerce dynamics, technological improvements, and unconventional financial insurance policies (like quantitative easing) have added layers of complexity to monetary markets.

Regardless of these modifications, the elemental financial psychology behind the yield curve stays intact. Buyers nonetheless search safer, long-term investments throughout instances of uncertainty, making the yield curve a helpful indicator of market sentiment.

Statistical Monitor Document

Traditionally, an inverted yield curve has preceded a number of recessions with spectacular accuracy. For instance, prior inversions in previous a long time have been linked to recessions within the early 2000s and the 2008 monetary disaster. Nonetheless, whereas its observe document is spectacular, no single indicator is foolproof. The yield curve ought to ideally be thought of alongside different financial information.

The yield curve stays a related, accessible and straightforward to know software linked to market expectations, but it surely can’t be counted as the only real indicator of financial well being. There are a number of different components additionally enjoying essential roles in predicting recessions corresponding to: Unemployment Charge, Client Confidence, Inventory Market Traits, Industrial Manufacturing and Manufacturing Knowledge.

Ought to We Anticipate A Recession In The Subsequent Two Years Based mostly On Yield Curve Evaluation?

Current information signifies that the yield curve has inverted on a number of events over the previous few months. This inversion has sparked discussions amongst market analysts, as related patterns in earlier cycles have usually preceded recessions. Whereas the yield curve is a helpful sign, it’s just one piece of the puzzle.

Different indicators we must always contemplate for additional evaluation embrace:

Client Spending: There was a slight slowdown in shopper spending, which raises trigger for concern.

Financial Coverage: Central banks look like sustaining a cautious strategy, balancing between battling inflation and fostering progress. Simply take a look at the behaviour of the FED, which is at the moment on standby.

World Financial Surroundings: Worldwide markets stay unstable, and geopolitical tensions, to place it flippantly, are having a heavy affect on the world’s financial stability.

Contemplating these elements, some economists mission {that a} gentle recession might happen inside the subsequent two years. Nonetheless, it’s equally potential that proactive financial insurance policies and different mitigating elements would possibly delay and even soften the affect of a recession. The yield curve inversion serves as an early warning system, suggesting that warning is warranted, but it surely must be weighed alongside different financial indicators.

Conclusion

In right this moment’s surroundings, the yield curve’s inversion is considered one of a number of indicators that recommend warning. Whereas it’s not an infallible predictor, its historic reliability can’t be ignored. It’s important to take a balanced view—combining insights from the yield curve with different financial information—to raised perceive the place the economic system is likely to be headed.

A key takeaway I might love so that you can maintain, is that whereas the yield curve inversion does increase crimson flags, it doesn’t present a definitive timeline or assure a recession. As a substitute, it highlights potential vulnerabilities available in the market, encouraging policymakers and traders to organize for a variety of eventualities.

Do I see a possible recession? I want I might let you know. One factor is for positive, there are robust indicators telling us to be extra cautious than in earlier years. Monetary fashions want to organize for the actual chance of one thing massive coming sooner or later, as historical past tends to repeat itself. My private motto: Hope for the very best however put together for the worst.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.